|

Getting your Trinity Audio player ready...

|

Non-fungible tokens (NFTs) made a comeback in November after dipping for seven consecutive months, hitting $563 million in monthly volume as the positive momentum from the United States elections spread to the NFT market.

Since their emergence in 2021, NFTs have mirrored the overall digital asset market sentiment, with trading volume and overall activity surging during bull cycles. It was no different in November, where 427,000 unique sellers transacted $562.92 million worth of NFTs, data from CryptoSlam shows. This represented a 58% increase from October’s $356 million.

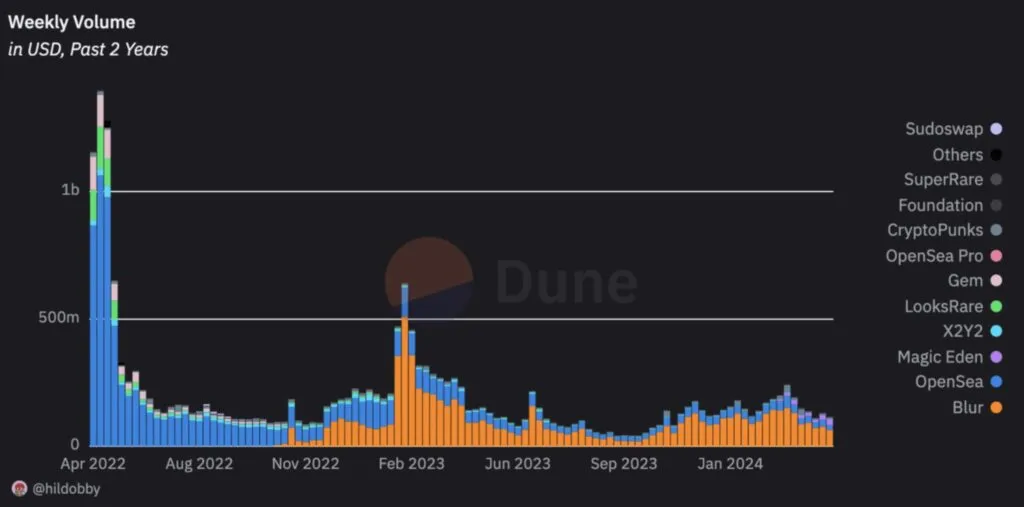

This was a reversal of a downward trend that had been ongoing since March when the sector hit a yearly high of $1.614 billion. Over the next seven months, the volume dipped every month, hitting a low of $300 million in September.

Despite the rebound, NFTs are still far from their 2021 highs. Extreme speculation led to a sustained period between August 2021 and May the following year, during which the monthly trading volume was above $3 billion. Many NFTs were just mere JPEGs, but they were going for millions of dollars. The trend spread to the mainstream market, and once celebrities aped in and began purchasing Bored Ape Yacht Club (BAYC) NFTs for millions, the market was only going in one direction.

However, the hype was unsustainable, and once ‘crypto’ stopped pumping, NFTs hit the floor. Tokens whose floor price was previously thousands of dollars were going for less than $100, and the trading platforms started drying up.

OpenSea, the market leader, laid off 50% of its employees last year. Last week, Kraken announced that it was shutting down its NFT platform just a year after its launch. The exchange claimed the shutdown was to “shift more resources into new products and services, including unannounced initiatives in development.”

While the speculative NFTs may have died out, companies that built utility into these tokens are still thriving. One of these, Rad TV, has been changing the ownership model of digital content using NFTs on all major platforms. Founder Tony Mugavero told CoinGeek that his company uses smart contracts embedded in NFTs to ensure that every stakeholder in the content value chain is fairly compensated for their effort.

Watch: Using blockchain tech to create efficiencies in Hollywood

09-13-2025

09-13-2025