|

Getting your Trinity Audio player ready...

|

The past four years have been tumultuous for the digital asset market. Major exchanges like FTX collapsed, Binance faced criminal charges with multiple U.S. agencies, and numerous blockchain projects turned out to be nothing more than vaporware. For a while, skepticism about the industry overshadowed its potential, making it easier to dwell on failures than focus on blockchain technology’s positive possibilities.

But now, we are entering a new era, and the outlook is shifting. If current trends serve as any indication, blockchain and digital assets are on the verge of significant growth; and with the United States electing a new president who has expressed explicit support for digital assets, there’s renewed optimism in the market.

How Trump’s election is fueling the rise of digital assets

The recent rise in digital asset valuations isn’t a coincidence—it’s tied directly to the outcome of the U.S. presidential election. President-elect Donald Trump has made his stance on blockchain and “cryptocurrencies” clear. Beyond his NFT launches and involvement in a recent Ethereum-based token launch, Trump has outlined a vision for the U.S. to become the global hub for digital assets.

At BTC 2024, Trump pledged to make the United States the “crypto capital of the world.” He also proposed the creation of a “Strategic Bitcoin Reserve,” where the government would hold confiscated BTC instead of auctioning it off as it has historically done. He also plans to appoint a BTC and “crypto” advisory council tasked with “designing transparent regulatory guidance to benefit the digital asset industry.” These proclamations have sparked some excitement, but Trump has also laid out more tangible policies that are likely to have an immediate impact on the industry.

Trump’s plan to reshape the SEC and revitalize blockchain innovation

One of the most impactful components of Trump’s crypto strategy lies in his plans for the U.S. Securities and Exchange Commission (SEC). Under current Chairman Gary Gensler, the SEC has taken an aggressive stance against digital asset companies, prosecuting high-profile cases and creating an environment of regulatory uncertainty. This approach stifled innovation, discouraged investment, and led many blockchain entrepreneurs to think twice before launching or operating in the U.S.

Although a sitting president cannot directly fire the SEC chair, Gensler’s term ends in July 2025, and Trump has already expressed his intent to replace him with a crypto-friendly appointee. This shift alone has invigorated the market, as investors and innovators anticipate a more favorable regulatory landscape.

As chairman, Gensler prosecuted various blockchain-related cases, making examples out of bad actors but also inciting fear among legitimate innovators. Activity in the blockchain world slowed, and innovation was practically non-existent. With Gensler gone, regulations around the digital asset industry should loosen up, leading to more activity and fewer companies facing prosecution.

The SEC isn’t the only place where change will take place that affects the digital asset industry. The Department of Justice (DoJ) has also indicated a shift in focus. Officers have stated that once Trump takes office, resources will be reallocated from prosecuting “crypto” cases to other priorities, such as immigration. This shift could reduce scrutiny on blockchain businesses and provide room for industry growth and experimentation.

The Trump Bump: BTC’s Rebound and the Market Shift

The signs of a rebound taking place in the market are clear.

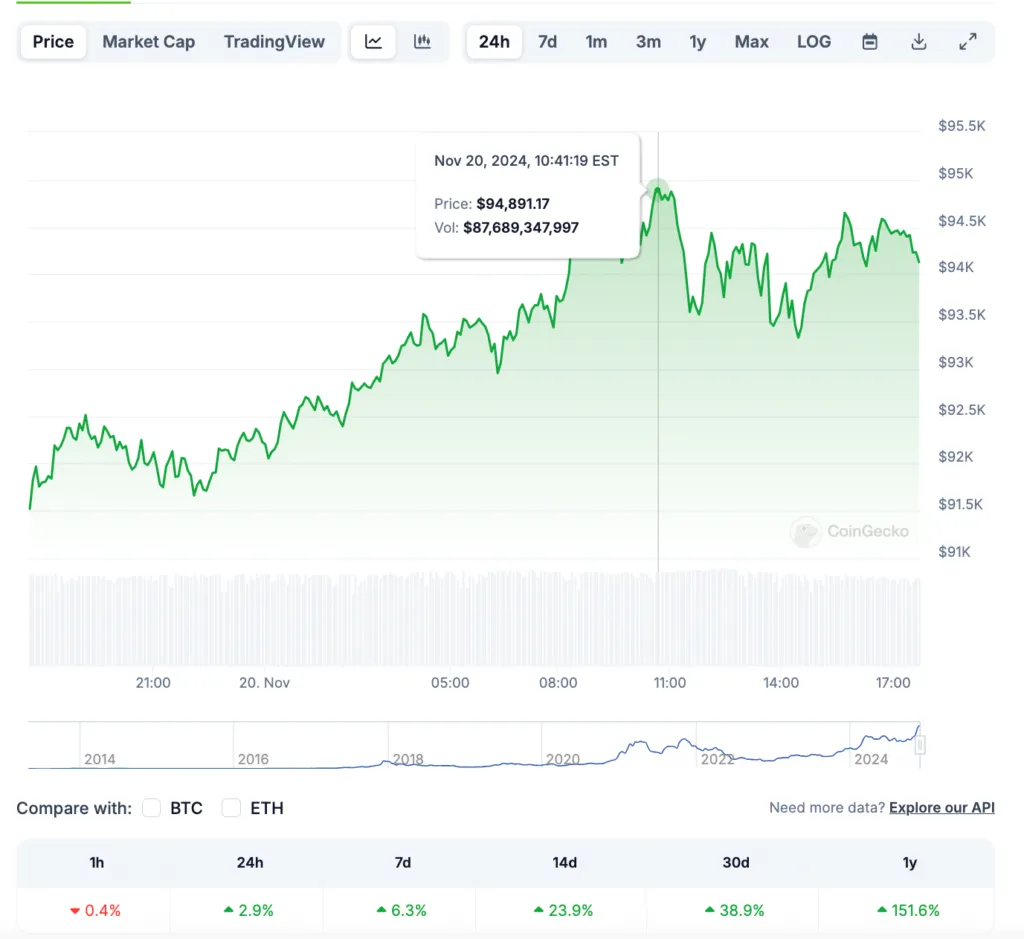

Using BTC as a benchmark, the market hit its last peak in November 2021, followed by a steep decline that bottomed out in November 2022.

Over the next two and a half years, the price recovered to its 2021 highs (March 2024), and just seven months later (November 2024), it reached a new all-time of $94,891.17

Empirically, the tides have turned in the market for blockchain technology and digital assets. Coupled with Trump’s election, this rebound signals a shift in sentiment. Given the economic forecast and foreshadowed regulatory optimism, it’s safe to say the market is poised for continued growth.

How a ‘crypto-friendly’ administration fuels a blockchain boom

Several factors are converging to create what might be the ideal environment for the blockchain industry to flourish. Beyond the anticipated regulatory changes, Trump’s well-established relationships with influential ‘crypto’ supporters like Elon Musk signal further backing for the digital asset space.

Additionally, the millions of dollars in crypto-based campaign contributions Trump received suggest that key industry stakeholders will have his ear. This financial support has created expectations that the administration will reciprocate by implementing policies favorable to blockchain and digital assets.

A crypto-friendly administration will revitalize the industry. Entrepreneurs will feel more confident about launching blockchain projects without fearing legal repercussions. Institutional and retail investors are likely—and have already begun—to re-enter the market. Reducing regulatory uncertainty will lower the perceived risk of investing in digital assets, encouraging more capital to flow into the space.

For the first time in nearly four years, the future of blockchain and digital assets feels bright. The combination of a supportive administration, upcoming regulatory clarity, and renewed market enthusiasm is setting the stage for a period of growth and innovation.

Watch: Blockchain & Metanet’s role in combating fake news

07-14-2025

07-14-2025