|

Getting your Trinity Audio player ready...

|

99% of Turkish investors are familiar with digital assets, a spectacular rise from 16% in 2020, a new survey by a local exchange has found.

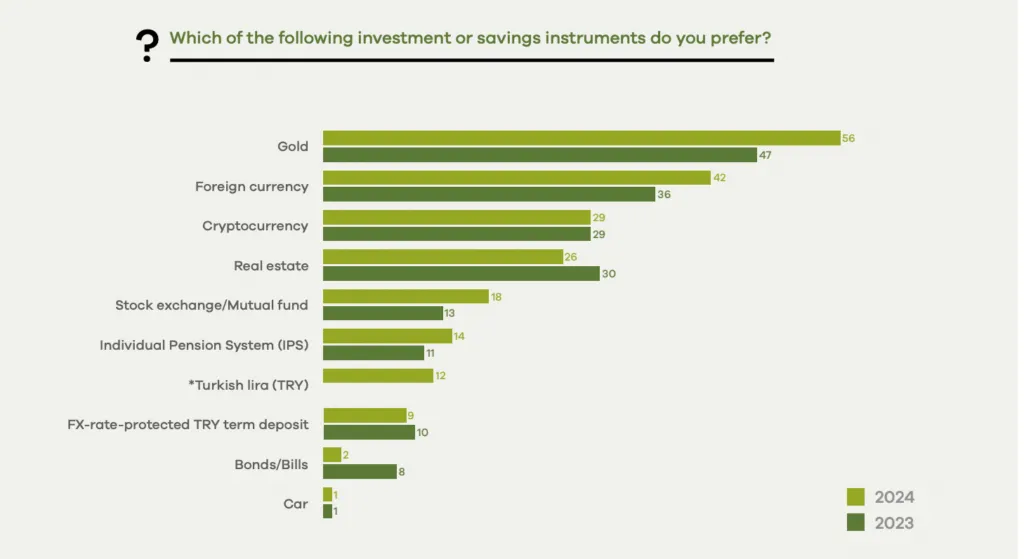

The survey by Paribu exchange revealed that digital assets have now become the third-most favored investment in Turkey, toppling real estate from last year’s survey. Investors are now nearly twice as likely to invest in digital assets as in stocks and mutual funds.

The trend is consistent with other nations in Asia, where digital assets are replacing stocks and mutual funds, especially among younger investors. In Indonesia, digital asset investors hit 20 million this year, far outweighing the 12 million who invest in the country’s stock exchange. A Bank of America survey in June also found that younger investors in the U.S. are shifting away from stocks and bonds for digital assets.

While they cited fast transactions as one of the top advantages of digital assets, Turks mainly invest in digital assets for their high return potential, the survey found. A sizable number is in it because it believes its use will increase in the future, while others cited trends and censorship resistance as their reasons for investing.

Commenting on the survey, Paribu’s Nergis Nurcan Karababa noted, “Compared to traditional financial products, crypto assets may experience much higher rates of adoption. Individuals are motivated to step into this world now, anticipating more widespread use in the future.”

The survey, which polled just over 2,000 residents and 541 active traders, found that Turkish investors’ primary demand from their trading platforms is the presence of a robust security system.

Hackers have regularly targeted Turkish exchanges. In June, the largest local exchange, BtcTurk, was reportedly infiltrated, and over $55 million was stolen from half a dozen hot wallets. Thodex, however, still holds the record in the local exchange scene after it collapsed with $2.6 billion (according to Chainalysis, although local prosecutors say the figure was much lower) in investor funds in 2021. The founder was sentenced to 11,000 years in prison.

Despite these struggles, Turks still prefer local exchanges. In 2023, 63% of traders said they preferred a Turkey-based exchange; this has risen to 78% this year. It aligns with global trends, where traders now prefer local platforms as they are regulated mainly by local authorities, and legal redress would be more accessible if they failed. The collapse of global giants like FTX has only strengthened this resolve, with countries like Nigeria, India, and Indonesia banning foreign exchanges and issuing new licenses for local platforms.

Turkey remains the largest digital asset market in the Middle East and North Africa (MENA) region, ranking 11th for adoption globally, according to Chainalysis. In the year ending June 2024, the country received $137 billion in digital assets, the seventh highest globally.

Kazakhstan’s CBDC pilot reduces VAT reimbursement time by 80%

In Kazakhstan, the central bank has launched a pilot that leverages the programmability of the country’s CBDC, cutting the time it takes for businesses to get reimbursements by up to 80%.

Binur Zhalenov, the Chief Digital Officer at the National Bank of Kazakhstan (NBK), announced the new pilot at a recent industry event. The central bank has partnered with the State Revenue Committee on the initiative to improve the efficiency of VAT reimbursements for exporters.

In the pilot, NBK automatically marks VAT in B2B transactions for the participating businesses, leveraging the programmability of the digital tenge. “By doing so, we eliminate the need for manual checks by tax authorities, significantly streamlining the reimbursement process,” Zhalenov noted.

NBK claims to have cut down the reimbursement time from a maximum of 75 days to between 10 and 15 days. It intends to continue improving the process to achieve instant reimbursement in the future.

“This enhancement is highly sought after by exporters, and we’re eager to scale this project to benefit more businesses,” Zhalenov stated.

Kazakhstan launched the digital tenge last November, offering users essential services, such as online and offline transfers. The Central Asian nation views the central bank digital currency (CBDC) as a major tool for supervising public funds and introducing accountability and transparency to a government that barely cracked the top 100 countries in this year’s Corruption Perception Index.

Speaking two weeks ago, Assel Marchenko, the CTO of the National Payment Corporation of NBK, noted, “The first priority for us is public funds spending. We want to see how we can actually bring clear benefits to our public, to our citizens, and show how digital thinking could help make it more efficient and transparent and decrease this potential for corruption.”

Beyond the basic services, NBK has been exploring additional applications of the digital tenge, and programmability has been key. According to Zhalenov, it allows the CBDC to be used in public procurement, investment subsidies administration, and targeted financing from the country’s sovereign wealth fund, whose assets under management are estimated at $81 billion.

“These initiatives demonstrate the versatile applications of programmable money in enhancing government processes and financial operations,” noted Zhalenov.

Watch: Developers can propel the BSV blockchain forward

09-18-2025

09-18-2025