|

Getting your Trinity Audio player ready...

|

The United Arab Emirates recorded the highest growth in digital asset activity, leading the rise of the Middle East and North Africa (MENA) as a digital asset hub, a new report has revealed.

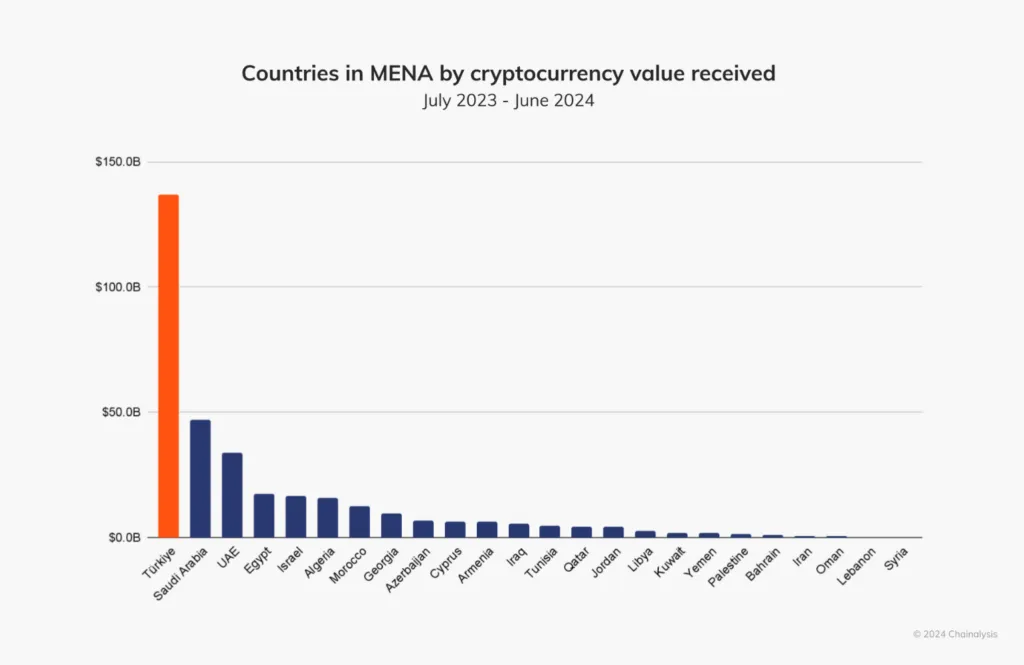

The 2023 Geography of Cryptocurrency Report by Chainalysis disclosed that the UAE’s longstanding enabling digital asset regulations are bearing fruit. In the year ending June 2024, the country received $30 billion in digital assets, making it MENA’s third-largest digital asset destination after Turkey and Saudi Arabia. This equated to 42% growth, nearly four times higher than the region’s average of 11.7%.

Unlike most of its neighbors, the UAE has recorded growth across all blockchain and digital asset sectors, including in decentralized finance (DeFi) and decentralized exchanges—the latter recorded an 87% rise in value received to hit $11.3 billion. The explosion was also across all transaction sizes, from retail users transferring less than $1,000 to professional users sending up to $1 million and institutions with up to $10 million per transaction.

The surge in adoption has attracted global and regional venture capitalists (VCs), local banks and other financial industry players, noted Chainalysis’ Head of Policy of MENA, Arushi Goel.

“Traditional financial institutions such as banks are actively exploring their roles within the crypto ecosystem, showcasing the growth of a crypto-TradFi nexus. This engagement is further supported by a robust and evolving regulatory framework,” she commented.

UAE champions digital asset regulations

The biggest tailwind for UAE’s digital asset sector is enabling regulations. Dubai, the country’s largest city, first launched a blockchain strategy in 2016, and two years later, Abu Dhabi established one of the world’s first digital asset regulatory frameworks. The Securities and Commodities Authority has since taken to regulating digital asset services while the central bank oversees payment token services.

However, it was the establishment of the Virtual Asset Regulatory Authority (VARA) in Dubai in 2022 that changed the game. VARA is the world’s first standalone regulator for virtual assets, and since it launched, it has worked with over a thousand virtual asset service providers (VASPs) to transition to a new regulatory framework, says Deepa Raja Carbon, the vice chair of VARA.

The secret has been cooperation from all quarters, she noted.

“Both the industry and regulators come to the table with that perspective — to learn together and evolve.”

While it seeks to promote innovation, VARA takes its role of protecting investors seriously. Last week, it announced that all VASPs in the UAE must prominently display a disclaimer stating: “Virtual assets may lose their value in full or in part and are subject to extreme volatility.”

Additionally, VASPs that intend to offer incentives for digital asset investment, such as lower fees, bonuses or referral rewards, must first receive VARA’s nod. This, says CEO Matthew White, will ensure that VASPs don’t use incentives to blind customers from the risk of their investments.

VARA was initially launched to regulate digital assets within Dubai. In September, the agency partnered with the Securities and Commodities Authority (SCA), allowing VARA-licensed firms to serve the rest of the country.

In stark contrast to the United States and Europe, where VASPs have complained for years about ‘regulation by enforcement,’ VARA licensees have nothing but praise for its approach.

Speaking to Chainalysis, Akos Erzse, a senior manager at Dubai-based BitOasis exchange, said that the agency has introduced “new momentum for forward-looking regulatory clarity in the region,” and it’s luring major global players.

One of the unique approaches of VARA is its specificity, he added.

“There are distinct rulebooks for staking, broker-dealers, advisory services, custodians — this makes it easier for businesses to understand what the specific regulatory requirements are for providing certain services.”

Turkey leads MENA in adoption as stablecoins soar

While the UAE had the highest adoption growth, Turkey is still the biggest digital asset market in the MENA region. The country ranked 11th globally for adoption last year and has ranked in the top 20 for the past three years.

In the year ending June 2024, Turkey received $170 billion in raw digital asset transaction volume, the fourth highest figure globally after the U.S., India and the United Kingdom.

A thriving local exchange ecosystem is among the factors behind Turkey’s continued high ranking. Under a new regulatory framework introduced in February this year, over 70 VASPs have applied for a license. The collapse of Thodex, a local exchange that went under with over $2 billion in investor funds, has not dampened the digital asset enthusiasm in Europe’s sixth-largest economy.

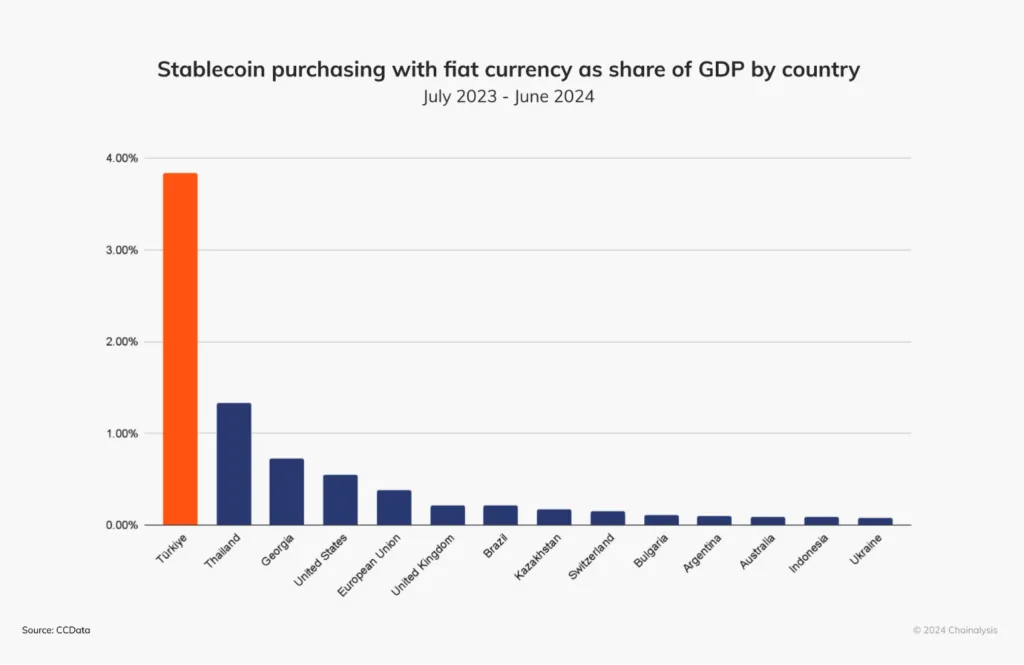

High inflation and devaluation of the Lira currency have also pushed Turk investors to digital assets, with stablecoins emerging as the most popular alternative.

Globally, Turkey is the runaway leader in stablecoin trading volume as a percentage of gross domestic product (GDP), by a large margin. In March of this year alone, Turks bought nearly $6 billion worth of stablecoins with the Lira.

Watch: Adopting enterprise blockchain brings benefits

07-06-2025

07-06-2025