|

Getting your Trinity Audio player ready...

|

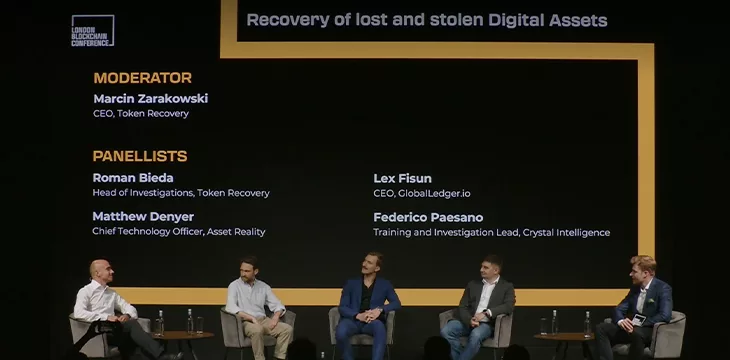

London Blockchain Conference 2024’s Day 2 brought together leading experts in the fields of blockchain and asset recovery to tackle the challenges, methodologies, and opportunities for the recovery of lost or stolen digital assets, including the most common scams to be aware of, and what to do when you fall victim.

The ExCel centre in London was the venue for this timely discussion, which took place—appropriately—in the context of the United Kingdom, where new regulation allowing for digital asset confiscation and recovery recently became official—the Economic Crime and Corporate Transparency Act 2023, which came into force on April 26.

The fact that regulators are clearly aware of the issue and actively looking for solutions must have formed part of the impetus behind the London Blockchain Conference panel.

The lively discussion centered on the proposition that the legitimacy and mass adoption of blockchain technology hinges on the industry’s compliance with regulators, which includes acknowledging property rights. In other words, companies must respect and assist the work of regulators in the digital asset recovery space.

One such company is Token Recovery, which operates within the BSV blockchain ecosystem and aims to “give confidence in tokenization of financial instruments and real-life assets and enable the enforcement of legal and regulatory compliance within the industry that can be trusted.”

The company’s CEO, Marcin Zarakowski, and Head of Investigations, Roman Bieda, made up two fifths of the panel and discussed their mission to “empower digital asset owners” with several other experts in the space.

Zarakowski, who hosted the panel, began by asking the speakers to outline the problem at hand.

Scams, fraud, and romance

In terms of how digital assets are commonly ‘lost,’ the most popular reasons the panel came up with seemed to be fishing, address hijacking, and ‘romance scams,’ where scammers inveigle themselves into a victim’s personal life in the hopes of persuading them to send digital assets or blackmail them at a later date.

“It can happen to anyone,” said Federico Paesano, former investigator with the Italian financial police and now the training and Investigation lead at Crystal Intelligence, a company that provides blockchain intelligence and compliance solutions for financial institutions, governments and regulators.

He went on to outline the first hurdle to recovery, specifically “the lack of knowledge that is there in law enforcement. It’s a problem.”

Despite a lack of expertise in many law enforcement agencies, Paesano suggested that victims should still seek out police and report losses “because even if you trace the funds, there’s nothing you can do without having reported the funds stolen.”

The next step in the process, said Paesano, is to “seek the assistance of blockchain analytics providers. One of the reasons law enforcement isn’t working is not because they are lazy; it’s because they lack the tools. Analytics providers can trace the funds and help law enforcement recover the assets.”

Bieda concurred, suggesting that “the problem is in most cases law enforcement is not well equipped technically… the main goal of law enforcement is finding the perpetrator, not recovering the assets, so analytics companies can step in and help recover the assets while law enforcement deals with the perpetrator.”

This, he said, is where companies like Token Recovery come into play.

The recovery process

Once contacted, companies such as Token Recovery, Crystal Intelligence and GlobalLedger.io can step in and provide the expertise that law enforcement is currently lacking, which includes tracking the assets and then having them frozen.

“If it’s on an exchange you can freeze the accounts and reposes the assets,” explained Paesano. This is particularly true for centralized stablecoins.

“In the case of centralized stablecoins, the funds can be frozen. The difference is huge when it comes to recovery and what can be done,” said Paesano.

Bieda agreed, saying, “With the proper action, we can request the freezing of stablecoin. There is a legal process that needs to be done, involving a forensic report, but it can be done.”

Another panelist, Lex Fisun, CEO of GlobalLedger.io, also agreed that “stablecoins can be blocked at any wallet,” but explained that in some cases recovery is made more complicated by other services.

“One of the biggest obstacles is mixing,” said Fisun, who provides advice to victims and law enforcement when expertise is lacking.

Digital asset mixers are platforms that obfuscate the origin of digital assets, ostensibly for privacy purposes, but more often than not for criminal money laundering.

Fisun pointed an accusing finger at the “privacy activists” in the digital asset space, who advocate for the existence of such services, saying, “I would encourage the crypto community not to create obstacles for itself.”

However, on a more optimistic note, he did highlight other routes to recovering assets, even those on decentralized blockchains.

“Another thing is miners acting on the user’s side, not the hackers’ side,” said Fisun. “It’s not common, but we saw it in the case of the DAO, where miners rolled back the DAO hack, they were actively on the victims side.”

The DAO (Decentralized Autonomous Organization) was a smart contract platform built on Ethereum, essentially a venture capital fund in the form of a smart contract. In 2016, a hack resulting in the theft of approximately $50 million worth of ETH.

In response, the Ethereum community chose to, somewhat controversially, reverse the transactions associated with the hack, which led to the creation of two separate blockchains: Ethereum (ETH) and Ethereum Classic (ETC). Ethereum continued with the hard fork, undoing the hack and returning the stolen funds, while Ethereum Classic remained on the original blockchain.

So, as Fusan says, it is possible. However, he also noted that “we had two billion of DeFi hacks last year, and miners did not act.”

He went on to predict that laws and regulations may begin to mandate miners to take such measures, which it’s been shown they can do but are reluctant to do out of goodwill alone.

Looking forward

Drawing the panel to a close, Zarakowski asked the speakers to reflect on future measures and directions of travel in asset recovery.

To which Matthew Denyer, Chief Technology Officer at Asset Reality—a firm that describes itself as, “introducing the world’s first platform to seize, manage and liquidate assets”—suggested that the focus must remain on “taking the assets, not just the criminals, we need to make it less valuable to do these crimes.”

He also said “the way people interact with crypto is different to how they act with things such as banks,” this goes for consumers as much as law enforcement. This is a mindset that might need to chance in order to progress digital asset recovery.

Providing something positive for the—perhaps unsurprisingly—packed auditorium to go away with, Paesano suggested that the digital asset recovery situation is slowly changing and for the better:

“The entire ecosystem is working towards this goal. Awareness in users and law enforcement is increasing. Apps are getting better, and from a regulatory point of view there are frameworks and international cooperation… the percentage of illicit activity on the blockchain is decreasing, we’re getting better.”

The message is, don’t give up hope, but stay vigilant. And in case of an emergency, call the professionals.

Watch: Showcasing power of blockchain tech with nChain Web3 event app

04-04-2025

04-04-2025