|

Getting your Trinity Audio player ready...

|

We need to think about solving challenges around global remittances, and how the Bitcoin network can help. Dr. Craig S. Wright presents the sixth edition of the Bitcoin Masterclasses this week, looking at the ways an improved digital monetary system—with almost no-cost micropayments—can improve the lives of the world’s migrant workers.

You can watch the latest Bitcoin Masterclasses series here, and see all past seasons on the CoinGeek YouTube channel.

While The Bitcoin Masterclasses series has had a technical and business-process focus so far, this one takes a dive into economics and socioeconomics. The topic of remittances is almost “old school” as far as Bitcoin goes. Before BTC’s notorious block size limits drove transaction fees higher than many of the world’s people make in a day, remittances were touted as a major use case.

Dr. Wright even hauls Western Union back to the front of the stage. For those of us who’ve worked in Bitcoin for a decade or more, that’s a name we’ve not heard in a long time.

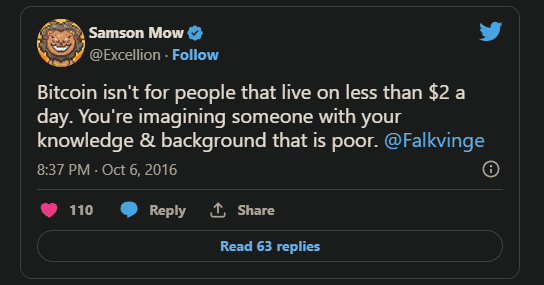

But then, as hardcore “small-blocker” and BTC proponent Samson Mow said in 2016, Bitcoin isn’t for low-income earners after all:

Mow’s statements, as Dr. Wright points out, highlight what’s wrong with the way Bitcoin (or at least, BTC) is perceived these days compared to when it first appeared.

“The promise of Bitcoin, like many seem to think, isn’t ‘be your own bank’… It’s a better monetary system, but it doesn’t give you home loans, it doesn’t give you anything else. Banks are needed for that, and micro-banking becomes a solution only when you have a whole lot of other problems solved.”

This is all about creating new opportunities. We’re not always talking about people on US$2 a day or less—migrant workers in Asia and the Middle East may earn $8-10,000 a year, sending $100 to families in their home countries a week and paying ~$10 each time for the privilege.

“How many migrant workers don’t at least have a cheap phone?” he asks.

He notes that it’s empowering women that appears to have the biggest impact in lifting whole populations out of poverty. When you educate women and give them the power to manage household finances—as well as earn a living themselves—families’ financial situations tend to improve.

With this in mind, what should be Bitcoin’s main focus? Probably not speculative trading, even though that grab’s the lion’s share of mass media attention. Dr. Wright points out that BTC amounts shuffling around exchanges can’t even be considered real. There probably aren’t even a million individuals actually using Bitcoin today, despite all the hype.

“If you had a million people using BTC or Ethereum, you’d have fees around $20,000,” he says. “So they’re not doing it. It’s fairly simple.” At this point, it’s handy to remind everyone the BSV network handles many millions of transactions a day, each charging a fee of around 1/1000 of a U.S. cent.

The blockchain infrastructure to handle a cheap, fast and effective remittance system needs a few things besides payments. It needs a trustworthy digital ID management system to keep KYC/AML costs down. Atomic swaps would be handy for dealing with different assets and tokens.

“Our job is to imagine a completely new world.” Current remittance users may not even know what they need, as they only know what they’ve used in the past. Most people never even think about micropayments, because it’s not something they’ve ever encountered.

With BSV blockchain, micropayments are now possible. We can pay use-by-use for anything. This will change behaviors, creating an economy where money is constantly moving rather than one where people save (or take high-interest loans), then spend in bulk.

The other sessions in this series will look at individual aspects of the remittance economy in more detail. It’s not just for migrant workers, either. Ordinary travelers still need to pay bills or for emergencies, and currency conversions are still an issue for international payments. Bitcoin can solve all these problems, so as always, we recommend watching the complete Bitcoin Masterclasses series to get some new ideas.

Watch The Bitcoin Masterclasses #5 highlights: EDI logistics & tracing goods

08-09-2025

08-09-2025