|

Getting your Trinity Audio player ready...

|

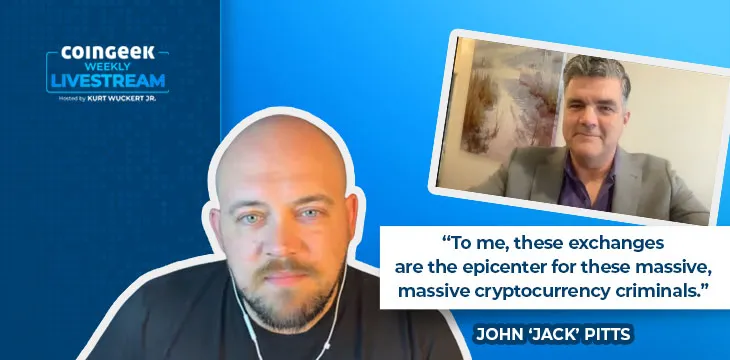

On this CoinGeek Weekly Livestream episode, Kurt Wuckert Jr. talked to SLictionary CEO John’ Jack’ Pitts about new SLictionary features, the growing Bitcoin SV (BSV) ecosystem, the recent action by regulators and how it will impact the industry, and a whole lot more.

Introducing Jack Pitts

For those who don’t know him, John Pitts is a leading entrepreneur in the BSV ecosystem. He co-founded and is the CEO of SLictionary, a self-learning dictionary funded by Bitcoin micropayments.

Pitts has a long history in the world of investing, having had a front-row seat to the Dotcom bubble and subsequent crash. He called Google (NASDAQ: GOOGL) and Amazon (NASDAQ: AMZN) early and believes BSV is the next big thing.

SLictionarys’ new feature – SLebrity definitions

Wuckert asks Pitts to tell us more about SLictionarys’ new feature – SLebrity word auctions. “Imagine if you could own the definition of basketball written by Michael Jordan,” Pitts says. Regardless of whether it’s successful, you’ll own the definition etched on Bitcoin—it’s much better than an autograph. Better yet, it will outlast everything when the world burns someday, Pitts chuckles.

“What would you pay to own that and be able to flash it the way you flash pictures of your kids at a party?” Wuckert likens it to busting out a Babe Ruth baseball – there aren’t too many of those around.

Unlike NBA Top Shots, which were 1 of 99, and buyers didn’t actually own the video clips or have any licensing rights over them, SLebrity definitions are truly unique. You can buy and sell them, and they sit on satoshis, so they can be moved on the Bitcoin ledger easily. SLictionary doesn’t even have to touch it or be involved at all.

“One of the cool things that makes us different from Wikipedia is our signature. When you define something, it’s yours,” Pitts says. On Wikipedia, you don’t know who wrote the definitions or whether the information is even accurate. “That’s what makes us special,” Pitts reiterates. These definitions will be crafted by true experts who are at the top of their fields.

How SLebrity definitions work

How does SLictionary verify the celebs themselves are the ones defining the word? Pitts says it’s via handshake agreement after direct contact with the celeb in question. Users can nominate a celebrity to define a word, and SLictionary will attempt to contact them.

Of course, this being Bitcoin, nominations and votes for a nomination will cost money, so while people can game the system to bump their nomination to the top, it will cost them to do so. Pitts also shows how this works on the screen—the non-fungible tokens (NFTs) are auctioned in eBay style, and nominations can be made quickly and easily for anything from a few pennies.

What does SLictionary do with the money? There are two parts: the nomination amount, which SLitionary will use for bounties to define the celeb in question, and the actual payment for the definition NFT, which will also be used as a bounty for users to describe the same word and compete with the celeb. This could lead to some seriously huge bounties in SLictionary, which average users can win. Celebrities will also have a choice to donate some of the amount paid for their definition to charity.

Another feature of SLictionary auctions is the leaderboard. Whereas follower counts on platforms like Twitter can be manipulated, this will give us a real insight into who is most popular via monetary means. It’s also a great way to drum up interest in the dictionary.

The criminality in the digital currency industry

Aware of Pitts’ background in investing over the decades, Wuckert says that he always thinks of him first when he sees documentaries about boiler rooms. Pitts laughs, saying he seen some of those rooms.

Wuckert and Pitts often talk about all the nonsense and shenanigans in the digital currency industry. Wuckert reiterates his suspicion that many people in charge of the exchanges and platforms are mid-level Wall Street guys who have seized the opportunity and easy money the “sick and twisted” industry presents.

Pitts says that some of the criminals in the industry are some of the richest people in the world. In fact, one of them may be the wealthiest person in the world, period. He says that Sam Bankman-Fried and the shenanigans at FTX prove that exchanges are the epicenters of the crime. He also says the industry has almost a ‘caste system’ with insider cronies’ trading screwing everybody over.

Many of these same criminals are stealing capital and liquidity from the BSV ecosystem. Pitts has said many times that he believes naked shorting is occurring, and he has personally seen rich investors walk away from building on BSV because they saw Solana pumping and the allegedly attempted double-spend attacks. In many cases, the mask is slipping, such as when one of the Silbert brothers literally directed one of his journalists at CoinDesk to retract an article that painted Dr. Craig Wright in a semi-favorable light.

Later in the podcast, Wuckert says he has personally experienced being offered to participate in pump and dumps by exchanges. They offered him and his friend the chance to know in advance what coins would be listed if he used his influence to promote them.

Why Bitcoin will survive the era of regulation and why price matters

What are we to do about all of this criminality? Pitts says it is simple; Bitcoin has an issuer, and that is Dr. Craig Wright. He made no promises about price (unlike Vitalik Buterin and others), which is why it will pass the Howey test and survive the onslaught of regulators.

“All Bitcoin is is an informational, computational commodity. It doesn’t have to be traded for fiat or anything else,” Pitts says.

All that said, Pitts maintains that in the short term, price matters a lot. He personally experienced Wall Street investors promising to come visit him and talk about investing tens of millions into BSV startups and then go away when they saw the price plummet while some other coins like Solana were pumping. Even though Pitts knows it’s rigged, the investors don’t, as most haven’t done the work to understand the fundamentals.

“You need capital to build this and make it work,” he says, noting that price matters when you want to raise money.

Is it all a bubble? Absolutely, but everything new experiences a bubble, Pitts says. The railroads experienced a bubble back in the day, as did the Dotcoms. Bubbles also serve a purpose—they funnel capital “at the cool thing” so that someone can win. The capital wasted on speculation is the price we pay for having it happen in our lifetimes.

Pivoting back to the criminality in the industry, Pitts says, “the day of reckoning is coming.” He likens the criminals in the industry to Colombian drug lord Pablo Escobar—he got money quickly, but he paid the ultimate price for that. Even after the criminal cases are finished, the civil cases will keep the cryptocurrency criminals in court for years.

Watch: English speakers are the real keepers of English lexicon

09-06-2025

09-06-2025