|

Getting your Trinity Audio player ready...

|

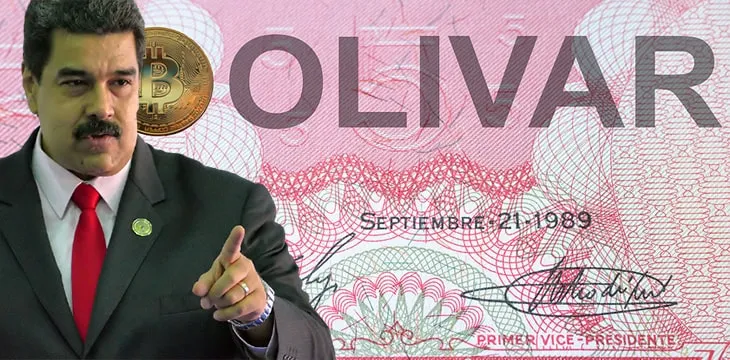

Venezuela’s president is planning a “surprise” for the South American nation regarding the future of their financial systems. Nicolas Maduro recently told Venezuelans that his government is working on a digital bolivar, promising a big surprise announcement soon.

In a live TV address, Maduro mentioned a digital bolivar as one of the economic actions his government is undertaking to rebuild the economy. He added that his government was also working on a big surprise that he will reveal in the future.

Maduro is no stranger to digital currencies. He has been behind Petro; a digital currency he claims is backed by Venezuela’s rich oil reserves. However, the currency hasn’t turned out as he would have wished, becoming a joke in the digital currency circles and being shunned by most Venezuelans. This is despite his valiant efforts to force Venezuelans to use the currency.

The Venezuelan digital currency ecosystem is eagerly anticipating the so-called “big surprise.” For some, it will be the announcement of a full-fledged CBDC. While Petro has been around for years, it’s still not legal tender. The Venezuelan constitution still only recognizes the bolivar as the sovereign currency. This has hindered Petro from international recognition and consequently, the locals have shunned it.

Local blockchain expert Fernando Medina is one of those that expect a full-fledged CBDC. Speaking to Decrypt, he stated, “At a constitutional level, the bolivar is the legal tender, I see the digital bolivar as an evolution of that monetary cone that has had so many problems at the level of cash issuance.”

The ‘big surprise’ comes at a time when President Maduro has allowed the citizens to open dollar accounts for the first time in a long time. The banks still process the transactions in bolivars, but it allows Venezuelans to acquire dollars, critical in a country whose local currency has seen unprecedented hyperinflation. Maduro might end up allowing those that hold the dollars to easily convert them to digital bolivars to make payments. In the first month of approval, banks opened 20,000 foreign currency accounts, the president said.

Maduro is confident that Venezuela’s financial system will become fully digitalized by the end of the year. He claimed that in 2020, it achieved a 77% level of digitalization.

To learn more about central bank digital currencies and some of the design decisions that need to be considered when creating and launching it, read nChain’s CBDC playbook.

See also: CoinGeek Live panel, The Future of Banking, Financial Products & Blockchain

08-08-2025

08-08-2025