|

Getting your Trinity Audio player ready...

|

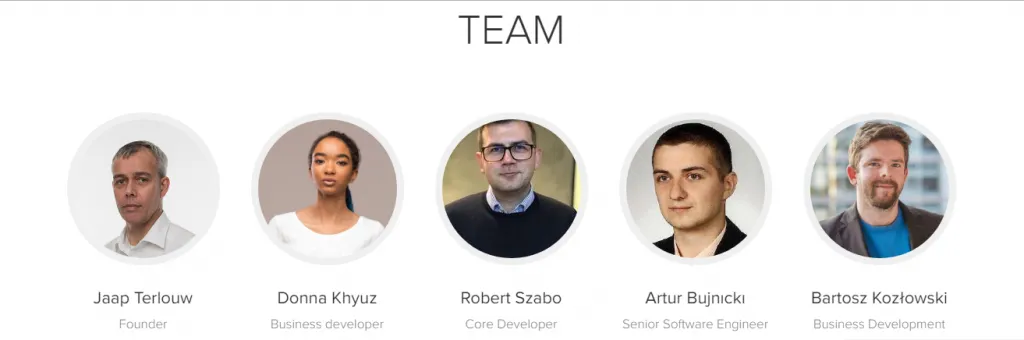

The first lead developer they listed was taken off the site after he denied any involvement in the project.

Originally scheduled to initiate a hard fork on block 494,784, proponents of the second phase of the New York Agreement (NYA) known as SegWit2x ultimately ditched the supposed 2Mb block size increase for the legacy chain at the last minute.

Before the November 15 scheduled hard fork, its lead developer Jeff Garzik abandoned the project, announcing that he has been working on another cryptocurrency—one that could switch between blockchains should one implode. Consequently, the ethical issues stemming from the glaring conflict of interest did not escape the news, and after losing a huge amount of support from the community, proponents decided to back out.

Needless to say, SegWit2x has had a bad history. And it seems its recent “revival” fails to rewrite that record. If anything, it just piled on to the whole mess.

On November 9, a group of nameless entities simply going by the name BitPico released a not-very-professional message saying they are reviving SegWit2x. It was signed as “sent from my spaceship.” And on December 16, they announced that they will be pushing through with the SegWit2x fork anyway on block 501,451 which falls on December 28, complete with a new website listing several big promises—far more ambitious than the original SegWit2x roadmap, especially considering the last minute announcement.

It seems too good to be true, because it very well is. The SegWit2x revival had nothing to do with the original, but took advantage of the name nonetheless. Read this disturbing post on why the whole project reeks of a scam. First was the switch from one lead developer to another. A man named Sairam Jetty was initially listed as the “Team Lead Developer,” but his profile was allegedly taken down from the website after he denied having anything to do with the project.

Additionally, such a serious and massive undertaking warrants certain expectations, particularly with the credentials of its developers. The people supposedly working on the project barely have any online presence.

The developer who took up the project after being dumped in the bin is relatively unknown in the blockchain sphere. Jaap Terlouw, supposed founder of this SegWit2x, only lists three jobs on LinkedIn with “.” as the company for his last two jobs, and had a twenty year gap between the first and the second job. His profile also appeared with conflicting background information online—one says he’s from Ukraine, while the others say he’s from the Netherlands—which makes more sense based on his name.

Their business developer Donna Khyuz’s LinkedIn profile is not available, and her Instagram profile revealed that while she lists herself now as “crypto developer, ICO & blockchain expert,” that her profile was recently changed from the previous description saying she’s a “model, dancer, actress, business woman.”

Meanwhile its supposed core developer Robert Szabo’s work background seems irrelevant to what is required of a core developer, especially one dealing with a fork of the Bitcoin blockchain nonetheless—he worked as a “sale manager” and a call operator at one point.

Despite their promise of rewarding holders a cut of “Satoshi Nakamoto’s Bitcoins,” depositors should tread lightly. Several users have been calling out on a possible pump-and-dump scam ever since the “revival” was announced. True enough, 2 million coins were pre-mined, which makes up 9.5% of the total coins that would supposedly ever exist. And then comes the pump-and-dump sting: from a high of $1,205 on December 27, the day before their scheduled hard fork, B2X has now dropped to around $240 as of writing. And as expected, support for this fork is embarrassingly minute—with only a measly 3.2% of the mining pool signalling support (as of 7:37am GMT).

Although cryptocurrencies are overall risky due to their volatility, there is far more uncertainty in this case until the team members’ identities are actually confirmed—that they are who they say they are first of all and that they are even capable of delivering as promised. Legal accountability in itself is already a big problem in the emerging blockchain industry, much more in an era of easily faked profiles.

09-18-2025

09-18-2025