|

Getting your Trinity Audio player ready...

|

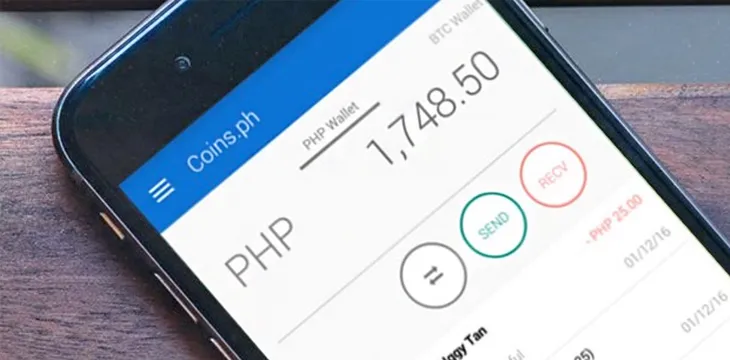

Fintech startup Coins has more than tripled its user number to 5 million in under 12 months, after a whirlwind year for the company and its cryptocurrency payments app. The firm specialises in peer-to-peer remittances, allowing users to send payments instantly and for free through its platform.

In an interview with Tech in Asia, Coins CEO and co-founder Ron Hose said that sending money shouldn’t cost more than using any other mobile app, noting, “There’s no reason why sending money should cost more than a WhatsApp message.”

Their app is particularly popular amongst the unbanked, or those without easy access to mainstream financial services. Rather than sending payments to a bank account, the Coins wallet allows for direct person-to-person transfers, with no cost or processing time for receiving cleared funds.

This is particularly important in the Philippines, where overseas workers remitting payments to the country account for as much as 10% of GDP.

According to Hose, the free and instant payments that Coins offer, combined with the ease of sending payments peer-to-peer on mobile, was key to their growth. He said, “[Peer-to-peer] remittances are free and instant on Coins. When users remit money back to their family, they’re doing it from their phones. That is the core thing driving retention for us.”

Coins allows users to send and receive money through a simple wallet, and through partnerships with local outlets, even allows for withdrawals to cash—with no need for a bank account.

“The key piece is that we are trying to reduce the cost and remove the barriers for people to access the service,” Hose said.

Some 77% of the population of the Philippines remains unbanked, with reasons ranging from a lack of funds to a lack of understanding about basic financial services. For Coins, this market has provided the perfect focal point for their early growth.

By 2020, Hose said Coins is aiming to reach 20 million users.

To achieve this, Hose said, “You have to get everything right—your product, your marketing, your technology. You have to make sure that customer funds are safe, that you’re following regulations and compliance, that someone can help users if they have an issue.”

08-06-2025

08-06-2025