|

Getting your Trinity Audio player ready...

|

As the digital asset market added over $1.5 trillion to its market cap in 2024, boosted by the rise of an insane memecoin rally where even the most absurd projects minted hundreds of millions of dollars (Fartcoin, CumRocket, and Unicorn Fart Dust, to name just a few), one of the big winners was the digital asset ATM sector, a new report has revealed.

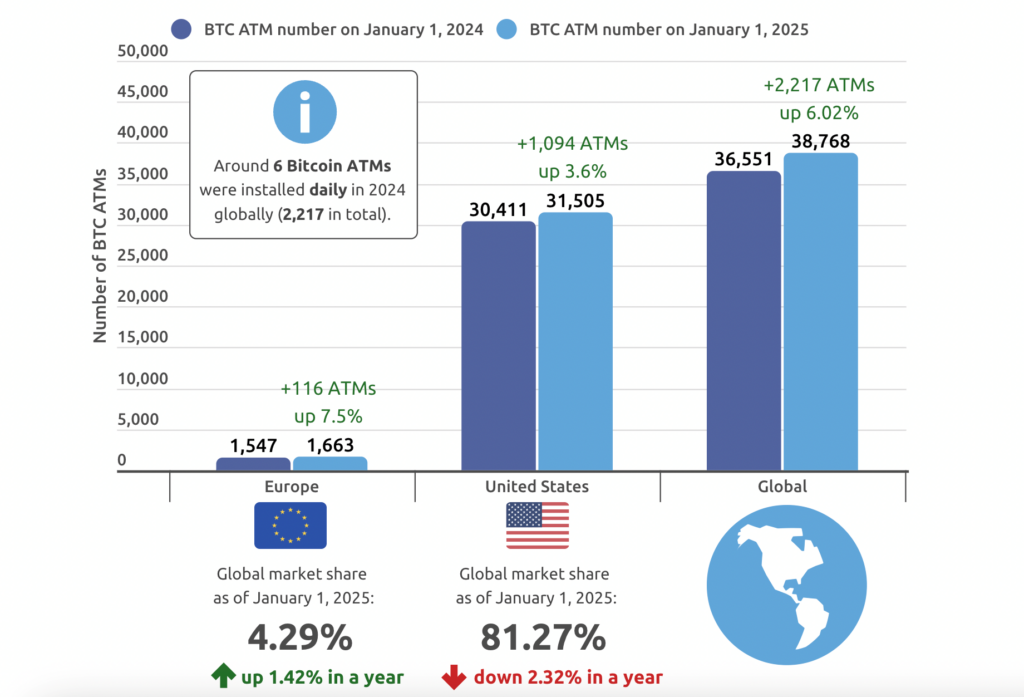

Last year, 2,217 digital asset ATMs were installed globally, a 6.02% rise year-on-year, the report by Finbold revealed. This translated to just over six new machines installed daily as the sector capitalized on the bull market to reel millions of new customers globally.

Digital asset ATMs have remained a controversial component of the industry. Their proponents have argued that they boost financial inclusion as they are easy to access and use, even for novices. They are also favored by those seeking enhanced privacy. However, this same privacy has made them an avenue for criminals, who use them to scam victims and launder the proceeds of crime.

Still, they continue to proliferate, with the U.S. as the dominant force globally. Last year, the country added nearly 1,100 new ATMs, half the number of new machines globally. This brought the number of American ATMs to 31,505, accounting for 81.3% of the global total of 38,768.

The report also revealed that Europe remains the only region with consistent growth in ATM numbers over the years, even during the “crypto winter.” Last year, Europe added 116 new machines, pushing its share to 4.3%.

The rampant growth in digital asset ATMs worries regulators. In Delaware, the Attorney General’s Office issued a warning this week, reminding residents to beware of scammers who have targeted victims through the machines. According to the U.S. Federal Trade Commission (FTC), Americans lost $111 million to the ATMs in 2023. The actual figures were much higher, FTC added, noting that most of the scams went unreported.

The scammers mostly target victims through social media, phishing campaigns, phone calls, and other social engineering techniques, with the ATMs used to send them money.

“Scammers create some urgent justification for you to take cash out of your bank accounts and put it into a Bitcoin ATM. Often, the scammers fabricate an investment that promises great returns with limited risk. If it sounds too good to be true, it is,” Attorney General Kathy Jennings stated.

Watch: Want to develop on BSV? Here’s how you can build with Mandala

02-18-2026

02-18-2026