|

Getting your Trinity Audio player ready...

|

2022 was a challenging year for those involved in the digital currency space. Most markets in the greater economy were in bear market territory for much of the year, which still show no signs of reversing heading into 2023. Regulatory headwinds, exchange insolvency, as well as rising interest rates look to keep a lid on top of the highly speculative token and non-fungible token (NFT) prices.

As interest rates climb toward 15-year highs, the deleveraging impact has been significant. In just over a year, BTC fell from nearly $70,000 to $16,000, almost an 80% drop. Some tokens fell to effectively zero. While there were specific and exceptional circumstances around the coins that did completely collapse, the common denominator depressing these prices is the rising rates. Notably, the current 4.5% federal funds rates are not historically high, but the fact that digital currencies in their 14-year history have never seen sustained rates above 0% are relatively and disproportionately causing carnage.

In the wake of the FTX collapse, we now know that exchanges and digital currency funds were taking extraordinary risks to yield farm, buy NFTs, and hold various tokens, taking advantage of the cheap upfront cost of capital and betting on some form of eventual short-term return to make a profit. All parties involved in “crypto” took advantage of this situation, so when the rates finally did rise, the resultant deleveraging was devastating. The Ponzi-like nature of these assets is dependent on the “Number go up” theology, so when that stops, so does the music.

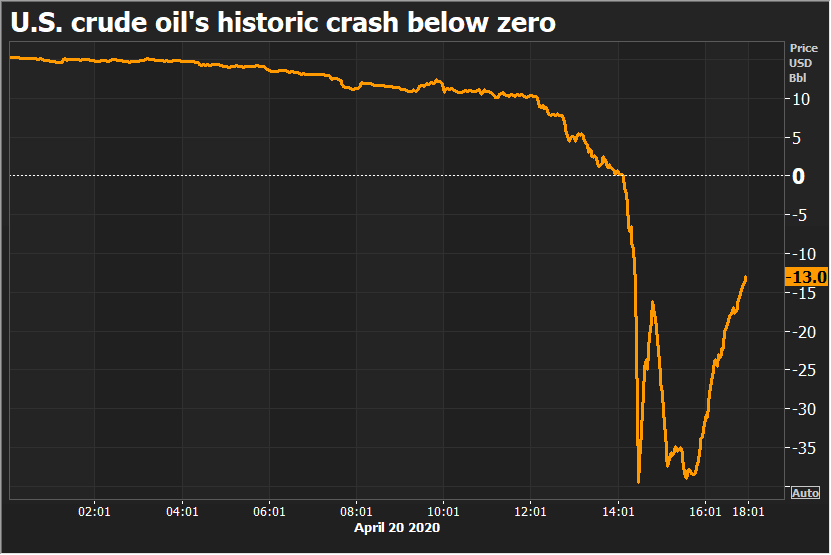

Because of that Ponzi-like nature, the damage done has been massive; many of these coins have zero utility, otherwise, their prices could not fall to zero. For example, remember in April 2020 when crude oil prices fell below $0?

Today, crude oil futures trade for above $70. This is because oil has use, regardless of the market price. 99.9% of digital tokens and assets have zero utility outside of being exchanged, yield-farmed, or HODL’ed. Therefore, no floor price exists; it is zero.

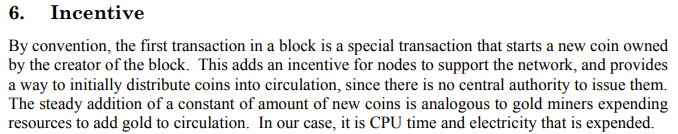

My belief is that Bitcoin, as originally designed, does have true utility. Regardless of anyone’s belief, that is proving to be true. Every single day, I and many others use Bitcoin SV to do activities that are simply not possible with any other technology. As long as that remains true, BSV can remain “Number go down” tech but cannot go to zero. The BSV ecosystem was already starved of capital before the deleveraging took place, so we have been affected even more negatively.

A common sentiment I have observed from other builders in the space is that anyone building on BSV in 2022 is crazy, implying that the economic environment is too poor and risky to do such a thing. With that stated, I would bet that friends and family of those mining Bitcoin on their computers in 2010 were also labeled as crazy.

To end the year, I want to reiterate that those who support and sustain the Bitcoin electronic cash system, especially when times are tough, are disproportionally rewarded for their efforts.

Here is to a more positive and brighter 2023.

Watch: CoinGeek Weekly Livestream with Kurt Wuckert Jr.

03-04-2026

03-04-2026