|

Getting your Trinity Audio player ready...

|

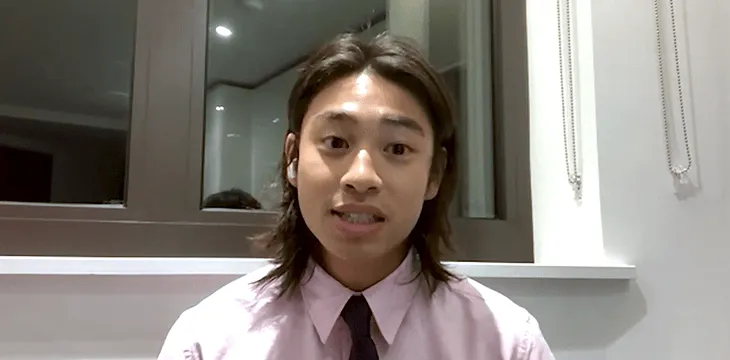

When Facebook announced its plan to enter the Metaverse, companies such as WageCan, a digital asset management platform, expressed their desire to do the same. In an interview with CoinGeek, its Customer Success Specialist Chris Kuo said they are in the process of integrating their real-world system into the Metaverse. They believe they are keeping up with the times while offering their clients more alternatives to meet their needs.

Since 2015, the company has provided its users with services in the digital world. These include a payroll system platform, a prepaid card, as well as asset management and distribution. Users who receive their salaries through WageCan’s HR payrolling program platform can choose to spend their earnings or invest through their products and services. For instance, users can use the WageCan prepaid card to spend the digital assets that they earned. Meanwhile, individuals looking to earn passive income are given the option to invest in WageCan’s DeFi platform. The team helps investors build short and long-term portfolios while managing their digital asset investments.

“We have launched the best multi-functional digital asset on payroll solutions in hopes to assist international gig companies such as Uber, which do things case by use case or start-ups, freelancers and miners who are looking to pay their employees, vendors or contractors online with cryptocurrency, or at least streamlined their experience when dealing with such issues. We supply full-service wealth management programs for the employees, vendors and contractors off the boat or simply any users by having the function for them to invest in their portfolio simultaneously once they received wages on the platform,” Kuo explained.

WageCan is most enthusiastic about the release of their latest prepaid card, the WageCan Wiser Card. As Kuo points out, the card plays a massive role in their product ecosystem to find the best solution to people’s concerns. The card, which accepts all major digital assets, will have multi-functional features that allow cardholders to use their digital currency in the real world. It also offers its clients zero fees amongst its use cases which Kuo says solves one of the problems they see among other ‘crypto’ prepaid cards.

“They charge quite high fees amongst annual charge, transactions, ATM withdrawal or POS use, which is paying online or paying in-store,” he points out.

The new card will charge a flat rate for ATM withdrawals to further address these concerns, whereas similar cards charge a percentage fee based upon the amount being withdrawn. In addition, clients can also get their prepaid card shipped to them for free, regardless of where they are in the world. As of the moment, Wiser Card is accepted by over 55 million merchants worldwide and can be used in 180 countries.

Kuo, who attended the CoinGeek Conference in New York in October, said he was able to interact, develop and exchange ideas with like-minded companies at the event. He also mentioned the intellectual exchanges of information that emanated from the talks. Would he recommend the CoinGeek conference to others? Yes, he says.

“If these companies are trying to launch some sort of product that they don’t have so much knowledge with, CoinGeek provides the best platform for these companies to actually ask and interact and experience, or at least be able to know what these companies have to work with in terms of their challenges when dealing with such products.”

As for the future of WageCan, Kuo asserts that the company, “aims to be the next generation of the digital asset get away and investment tools that appeal to a global mass market.”

Watch: CoinGeek New York presentation, AR & VR & the Metaverse on Blockchain

07-08-2025

07-08-2025