|

Getting your Trinity Audio player ready...

|

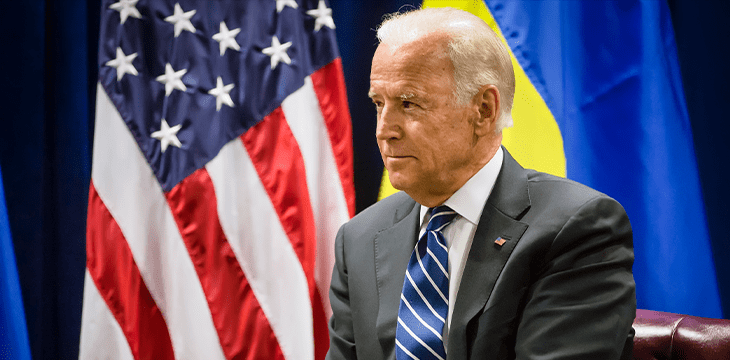

U.S. President Joe Biden has signed an executive order directing federal agencies to collaborate in examining the risks and benefits of digital assets, according to a release by the White House.

“The rise in digital assets creates an opportunity to reinforce American leadership in the global financial system and at the technological frontier, but also has substantial implications for consumer protection, financial stability, national security, and climate risk,” the statement reads.

“The United States must maintain technological leadership in this rapidly growing space, supporting innovation while mitigating the risks for consumers, businesses, the broader financial system, and the climate.”

Specifically, the order outlines the approach of the Biden government towards “addressing the risks and harnessing the potential benefits of digital assets and their underlying technology.” It calls for a series of measures broken down into seven key aims:

- Protect U.S. consumers, investors and businesses by directing the Treasury to develop policy recommendations addressing the implications of the sector;

- Protect U.S. and global financial stability and mitigate systemic risk by encouraging the Financial Stability Oversight Council to identify and mitigate economy-wide risks posed by digital assets

- Mitigate the illicit finance and national security risks posed by the use of digital assets by directing “an unprecedented focus of coordinated access across all relevant U.S. government agencies”

- Promote U.S. leadership in technology and economic competitiveness by directing the Department of Commerce to establish a framework to drive competitive and leadership in the sector;

- Promote equitable access to safe and affordable financial services;

- Support technological advances and ensure responsible development and use of digital assets by directing the U.S. government to take steps to study and support technological advances in the ecosystem; and

- Explore a U.S. central bank digital currency (CBDC)

The order is said to have been in the works since last year, which marked an escalation in government rhetoric regarding regulation and enforcement in the digital asset industry. The order’s impending assent was revealed earlier this week, when the U.S. Treasury mistakenly released a premature statement praising the move as ‘historic.’

It also comes after a year of steadily escalating regulatory and law enforcement focus on the digital asset industry, including key appointments by Biden indicative of a more direct approach to bringing digital assets within the law. This has included the nomination of BTC critic Saule Omarova to run the Office of the Comptroller (OCC). Additionally, lawmakers in the U.S. and beyond have been shoring up regulation, including a U.S. Democrat proposal to bring digital assets within the existing wash-sale rule and the recent creation of a digital asset regulatory and licensing body in Dubai, also announced today.

Though Biden’s order doesn’t address the recent sanctions levied against Russia over its invasion of Ukraine, it was signed amidst growing concern that digital assets can be used to bypass the measures. Him Das, acting director of FinCEN, said on Monday that they had yet to detect ‘widespread’ evasion of the sanctions, he also urged the prompt reporting of any suspicious digital asset activity.

To learn more about central bank digital currencies and some of the design decisions that need to be considered when creating and launching it, read nChain’s CBDC playbook.

Watch: The BSV Global Blockchain Convention panel, Law & Order: Regulatory Compliance for Blockchain & Digital Assets

02-26-2026

02-26-2026