|

Getting your Trinity Audio player ready...

|

Turkey has implemented a new regulatory framework for the digital asset sector, which will take effect in February. The new regime, which tightens anti-money laundering (AML) regulations and enforces the licensing framework, comes at a time when Europe’s MiCA framework is taking effect.

Elsewhere, Malaysia has stepped up its digital asset crackdown on unlicensed operators, with Atomic Wallet and Bybit the latest to face the securities watchdog’s wrath.

Turkey’s renewed ‘crypto’ regulations

Despite being one of the world’s largest digital asset markets, Turkey has long relied on vague and ambiguous regulations designed for traditional finance. However, in June 2024, the country’s parliament voted for the “Bill on Amendments to the Capital Markets Law,” which included a new ‘crypto’ framework.

This bill will take effect in late February. Its primary target is a crackdown on illicit financial transactions that rely on regulatory ambiguity in the digital asset sector.

Under the new regime, signed into law by President Tayyip Erdogan, any Turk conducting a transaction worth more than 15,000 Turkish liras ($425) must share their identifying information with the virtual asset service providers (VASPs). Investors must also provide identifying information when they open new wallets with registered VASPs.

VASPs are tasked with following up on this information from their users; in instances where they can’t access this information, they are advised to label the transactions as “risky,” allowing them to resort to “not performing the transfer or limiting the transactions made with the financial institution in question or terminating the business relationship.”

The new regime also addresses licensing and operational requirements for VASPs, which largely mirror existing practices in traditional finance. Capital requirements, staffing and organizational obligations, and IT and cybersecurity standards are also addressed. The law appoints the Capital Markets Board as the watchdog for the sector.

Speaking about the regulations, Treasury and Finance Minister Mehmet Şimşek stated, “Our main goal with crypto asset regulation is to make this area safer and to eliminate the risks that may arise. Our approach is not restrictive but based on eliminating uncertainties and controlling possible risks.”

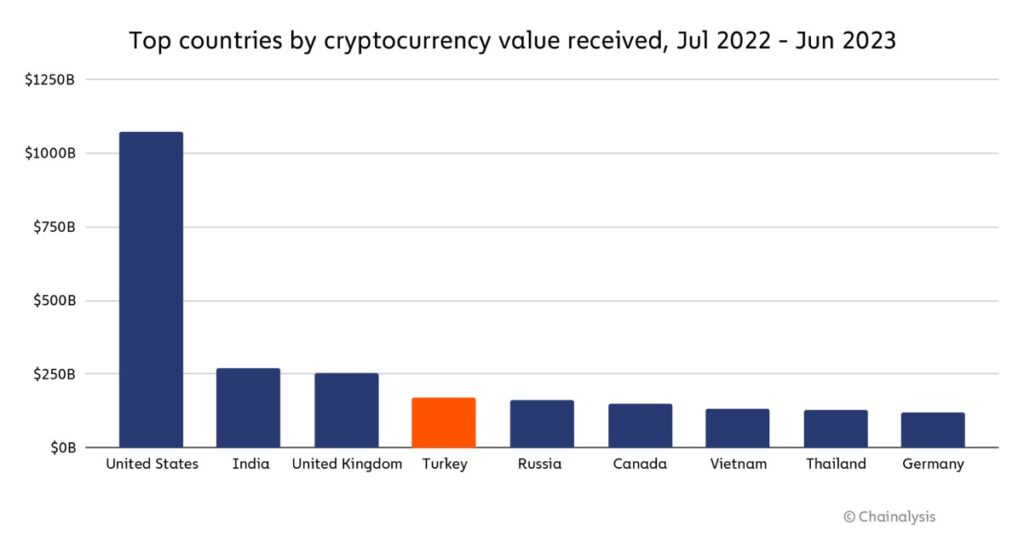

Turkey has consistently ranked as one of the world leaders in digital asset adoption. In the year ending July 2023, the country received $170 billion in digital assets, following the United States, India, and the United Kingdom, respectively.

The Turkish digital asset community has welcomed the new regulations, which will stamp the industry’s legitimacy and usher in new investors.

“With high interest in the crypto market, Türkiye’s regulations to protect investors’ rights instill confidence and strengthen the country’s position as a regional crypto center, paving the way for more confidence in the future, as a wider user base starts to show interest in the crypto market,” commented Kutluhan Akçın, the country manager for Bybit.

Malaysia bans Bybit, flags Atomic Wallet

Meanwhile, Malaysia’s securities regulator has ordered Bybit to shut down its operations in the country and flagged Atomic Wallet as illegal.

The Securities Commission (SC) added Atomic to its investor alert for “operating a digital asset exchange without registration.”

Atomic Wallet joins over a dozen other VASPs that the SC has deemed to be operating illegally in the Southeast Asian country. They include Bitget, LBANK, BingX, MEXC Global, Huobi Global, Paxful and KuCoin.

Atomic Wallet is facing several lawsuits in the U.S. and elsewhere over a hacking incident that led to over $100 million in customer losses last year. Blockchain sleuths attributed the hack to Lazarus Group, the notorious North Korean cybercrime outfit. The group reportedly laundered the funds through Southeast Asian payment platforms.

Days later, SC ordered global exchange Bybit to shut down its operations in Malaysia. In its notice, the watchdog claimed the exchange has been on its investor alert list since 2021 but has yet to obtain licensing.

SC ordered Bybit to disable its website and mobile apps within two weeks, cease social or mainstream media advertising, and terminate its Telegram support for Malaysians.

“This decision comes after concerns about the platform’s compliance with local regulatory requirements and protecting investors’ interests. The SC views this breach seriously,” the regulator stated, adding that Bybit was in breach of the country’s capital markets laws.

Watch: Reggie Middleton on DeFi, booms/busts & crypto regulation

02-23-2026

02-23-2026