|

Getting your Trinity Audio player ready...

|

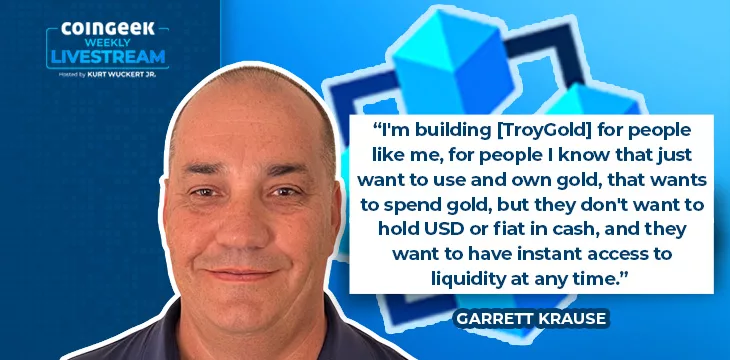

On the 26th episode of the CoinGeek Weekly Livestream season three, host Kurt Wuckert Jr. talked to Garrett Krause about his plans to tokenize gold on the BSV blockchain. The interview also featured a special announcement about some new stablecoins set to launch on the BSV blockchain.

Introducing Garrett Krause

Krause introduces himself as a real-world businessman with a mining, trading commodities, and real estate development background. As a result of his business activities, he knows securities laws and has raised money the legal way many times. Currently, among other things, he mines and exports gold before exporting it to Dubai.

What’s Krause’s background in digital currencies and blockchain? He does enjoy speculating on price fluctuations, but he’s focused on how to build real businesses. He has been toying around with blockchains for five years and has previously tried some things on Ethereum before concluding that they wouldn’t work because it can’t scale or do micropayments.

TroyGold and new stablecoins on BSV

Krause is the founder of TroyGold, which is tokenizing gold on the BSV blockchain. Wuckert asks him what makes TroyGold different from other efforts like Tether Gold. He answers that, unlike efforts built on Ethereum and other unscalable blockchains, building TroyGold on the BSV blockchain makes it spendable as money.

This is only possible thanks to the technical capabilities of the BSV blockchain, with its tiny fees and massive transaction capacity. Given this, people can spend their tokenized gold to purchase everyday items if they wish.

Delving deeper into the payments aspect, Krause points out that stablecoins and ways to redeem gold for currency will still be required to make gold useful as money. He emphasized that he’s building all this for people who want to use gold as money and “not for crypto people.” The app will have other neat features, such as borrowing against your gold and eventually lending it out, too.

Then comes the main announcement of the live stream—Krause and his team will also launch Troy stablecoins for USD and EUR. These will power TroyMoney and will help both onboard new customers and give them a way to sell gold for currency.

Viewer questions and answers

As is natural with such exciting developments, the CoinGeek Weekly Livestream viewers had some questions. Here are the answers to a few of them.

Q. What are your thoughts on regulation regarding Bitcoin as a security?

Krause once assumed he couldn’t build anything on Bitcoin. However, he dug in, found out about the BSV blockchain, and then watched as token after token was classified as a security by the SEC. However, Bitcoin is a commodity and will not be classified as a security, he says.

Q. What advantages do you see in combining the stability of gold with the technical capabilities of the BSV blockchain?

Krause notes that making gold money has always been difficult—there have always been issues related to measuring, storing, etc. The BSV blockchain makes it easier to use as money. It just works, and people using TroyMoney won’t even know they are using a blockchain.

Q. Why gold? Why not other commodities? Will you tokenize other commodities in the future?

They’ll first roll out gold, silver, platinum, and palladium. In the future, it’s possible that oil will also be tokenized in conjunction with some partners. As long as they are liquid commodities, they can be integrated into the blockchain, Krause says.

Q. Who is providing the custodial service?

The gold will be held at Brinks in Zurich or New York. Real-world assets still require trusted counterparties, Krause points out. As for liquidity, it will be provided by the StoneX Group.

Q. Can you delve into the technical details of how the gold backing is ensured and verified on the BSV blockchain? What mechanisms are in place to maintain transparency and security?

Krause points out that Brinks has never lost any gold. They are also insured by Lloyds, and the laws of the United States and Switzerland are some of the safest in the world as far as property rights go. Ultimately, there’s no perfect system of trust, but we can get close to it, and working with companies that have such sterling reputations is the best way.

To hear answers to other questions on minimum withdrawals, buying BSV on TroyMoney, how Krause met James Belding and the Tokenized team, and more, check out this CoinGeek Weekly Llivestream episode.

CoinGeek Conversations with James Belding: Tokenized was built with blood, sweat and tears

Disclaimer:

CoinGeek and the author of this article do not endorse or promote these sites as part of any paid or contractual agreement. The mention of these sites within the article is provided for informational purposes only.

Readers should note that engaging with any of the websites, apps and third-party entities mentioned in this article, is done at their own risk. The author nor CoinGeek shall not be held responsible or liable for any loss, financial or otherwise, that may arise directly or indirectly from the use of or reliance on the information, products, or services found on these sites.

Always conduct your own research and consult with a financial or legal professional if you have any questions or concerns before engaging with any third-party websites or services.

02-17-2026

02-17-2026