|

Getting your Trinity Audio player ready...

|

South Korea is finally lifting a ban on corporations’ involvement in the digital asset world, allowing them to sell their tokens for the first time in eight years.

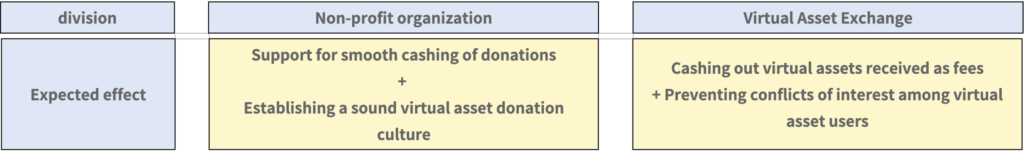

Korea’s Financial Service Commission (FSC) announced that local non-profits and exchanges can now cash out their digital assets if they meet all the compliance requirements. The watchdog banned ‘crypto’ sales by corporations in December 2017 to prevent exchanges from competing with their users and avoid unchecked speculation.

In January 2025, the FSC indicated it was mulling allowing corporations to hold digital assets, but it later changed its tune and called for more time to weigh the policy. The agency is now ready to move ahead with the new directive.

For exchanges, they must be registered as virtual asset operators and can only sell tokens “for the purpose of covering operating expenses,” FSC said during the latest meeting of its Virtual Asset Committee.

To reduce market impact, exchanges can only sell the top 20 tokens by market capitalization on the five major local exchanges and are subject to daily sales limits. Additionally, they cannot sell the tokens on their own platforms, as doing so would present a conflict of interest.

Exchanges must secure a resolution from their board of directors before undertaking any sales and submit disclosure obligations to the FSC.

Meanwhile, non-profits that receive digital asset donations can now sell them for the first time, expanding the sources of funding for the country’s 14,000 non-governmental organizations (NGOs).

To qualify, these corporations must be externally audited by a firm with at least five years of experience. Sales are limited to tokens listed on at least three local exchanges, and the tokens must be cashed out immediately upon receipt.

“Lastly, to prevent money laundering, we have strengthened the confirmation and verification of transaction purposes and sources of funds and only allowed donations and transfers through domestic won exchange accounts, requiring banks, exchanges, and corporations to perform customer verification in an overlapping manner,” the watchdog stated.

Beyond the new corporate trading rules, the FSC warned against listing “zombie coins” whose local daily transaction volume and global market cap don’t meet set thresholds. Exchanges must also list memecoins sparingly, and only when they have exceeded a set transaction threshold or have been trading over a long period of time on reputable offshore exchanges.

The new rules come just days before South Koreans head to the polls to elect their next president. The two leading candidates, representing the ruling People Power Party (PPP) and the Democratic Party (DP), have sought to lure the 15 million digital asset traders with campaign promises of better laws and new ‘crypto’ products.

The two have also pledged to push for digital asset exchange-traded funds (ETFs) and won-pegged stablecoins; the latter has been the subject of debate over which regulator should oversee the industry.Russia’s latest bill allows digital asset seizure

In Russia, the government is pushing new laws that would enable the seizure of digital assets used in crime.

The Federal Ministry of Justice developed the new bill, classifying digital assets as property the government can confiscate. Speaking at a recent industry event, Deputy Justice Minister Vadim Fedorov noted that as ‘crypto’ adoption rises, the government has been devising legal means of combating related crime.

Fedorov stated that the government will enlist blockchain experts to “determine the set of necessary measures to ensure the safety of digital currency for subsequent confiscation or settlement of the victims’ claims.”

The bill, which now heads to the State Duma, acknowledges that some digital assets will require specialized measures due to their inbuilt privacy features.

The minister claimed that digital assets have attracted criminals due to their ‘anonymity‘ and lack of a centralized control system. This makes them more efficient for use in crime than cash and other valuables, he added.

However, according to Chainalysis, crime only accounted for 0.14% of all digital asset volume in 2024.

Separately, the Ministry of Finance is pushing a bill that would establish fines for Russians who make payments in digital currencies within the country. The bill seeks to impose a fine of up to 200,000 rubles ($2,500) for individual violators and up to a million rubles ($12,500) for legal entities.

Russian firms have been increasingly using digital assets as payments in their trading with foreign firms, especially with their Chinese and Indian partners. However, digital asset payments are banned for local usage.

Watch: Breaking down solutions to blockchain regulation hurdles

02-18-2026

02-18-2026