|

Getting your Trinity Audio player ready...

|

The average transaction fee for BTC peaked at $3.19 last Friday. This rise represented a 10-month high for the network the week before the BTC halving. Meanwhile, May 11 saw 1.2 BTC processed at block height 630001—with a transaction fee of close to $100.

BTC is now so congested, moving 1.2 BTC now costs $100https://t.co/bkLTw2bpN1

— Roy Murphy (@murphsicles) May 12, 2020

Bigger isn’t always better. A common narrative coming from many BTC thought leaders is that higher fees on BTC do not hurt the community. To many token holders, it can seem plausible and compelling. It’s easy to conjure scenarios where demand is soaring as more people flood in using BTC. But invoking a surge in adoption to justify higher fees is deceptive.

The fees are not soaring because of a sudden demand for BTC. The token has little utility, and against the backdrop of a global pandemic, very few new adopters are coming into the ecosystem. The fees are soaring because the mempool is being backed up since developers maintaining the BTC protocol choose to place artificial limits on block sizes.

The BTC fee surge being heralded in news headlines has more in common with ‘price gouging’ or ‘surge pricing’ than it does with signaling a rise in new users. It’s a sign the BTC network reached its imposed limits governing how well it can serve its community.

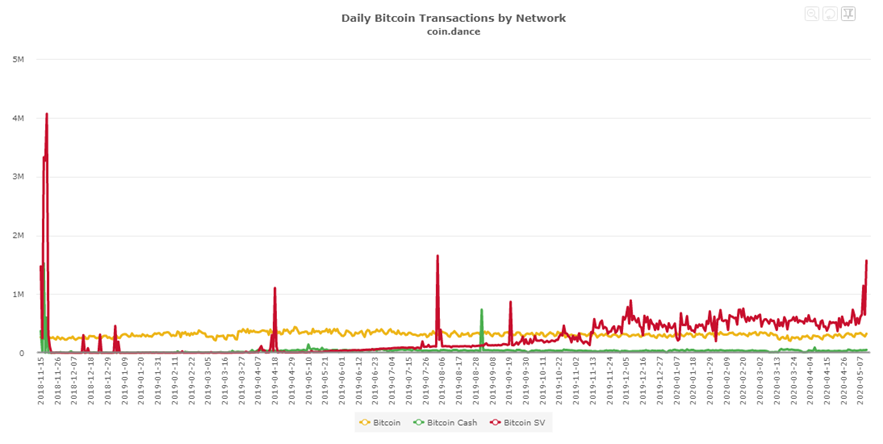

If you head over to Bitcoin SV, you notice that their fees are less than a fraction of 1% of what users pay to send transactions on the BTC blockchain. BSV achieved this pricing model while also processing 2-3x higher in the volume of transactions. It is the only blockchain that massively scales and is the world’s only true micropayments system.

Bitcoin SV follows Satoshi’s economic model that transaction fees will overtake the block subsidy reward as the primary source of revenue for companies supporting the infrastructure. Basic societal norms show that mainstream users will only adopt a fee structure that is stable and competitive with other existing mediums of exchange.

Bitcoin (BSV) to the moon! pic.twitter.com/I3GOT3KdfX

— Stein H Ludvigsen – Bitcoinˢᵛ (@SteinLudvigsen) May 13, 2020

How often would you frequent a grocery store chain where they charged variable fees that exceeds your bank’s charges? They allowed other shoppers to cut in front of you in the queue if they agreed to even higher fees.

Satoshi understood this point, which is why Bitcoin SV protocol developers kept with his vision. The BSV network now rivals credit card processor VISA in terms of transactions per second, opening up the blockchain network to a myriad of consumer services.

Block reward miners view transaction fees as the icing on the cake. They base their income forecast primarily on the market value of the BTC digital currency protocol’s reward that they get for discovering a block. They will still gladly profit from any extra revenue opportunity presented to them as long as they do not have to take new actions.

BTC has proven to be an ineffective solution for a global P2P cash system, hence the community’s pivot into “digital gold” and Store of Value rhetoric. Since the beginning of the year BTC trading has been tracking equities so the digital gold narrative is not only nonsensical as there is no such thing, but its provably not the case with BTC based on facts right in front of your own eyes. Digital gold doesn’t exist—other than as tokens for real gold on top of BSV.

No matter the metric, its utility rest solely as a digital asset for price speculation without regulatory oversight. Basic economic principles suggest that without utility and mainstream adoption, the price is unsustainable.

The rise in fees is block reward miner’s last action at swindling more earnings out of the BTC community. While the Bitcoin SV communities continue forward, building an ecosystem that encourages transactions while promoting growth and adoption.

03-08-2026

03-08-2026