|

Getting your Trinity Audio player ready...

|

Singapore’s largest bank, Development Bank of Singapore (DBS), announced that they will be launching a digital currency exchange–but subsequently revoked their announcement.

The news broke on October 27th, when DBS published a page for their new digital currency exchange on their website; in their official announcement, DBS said,

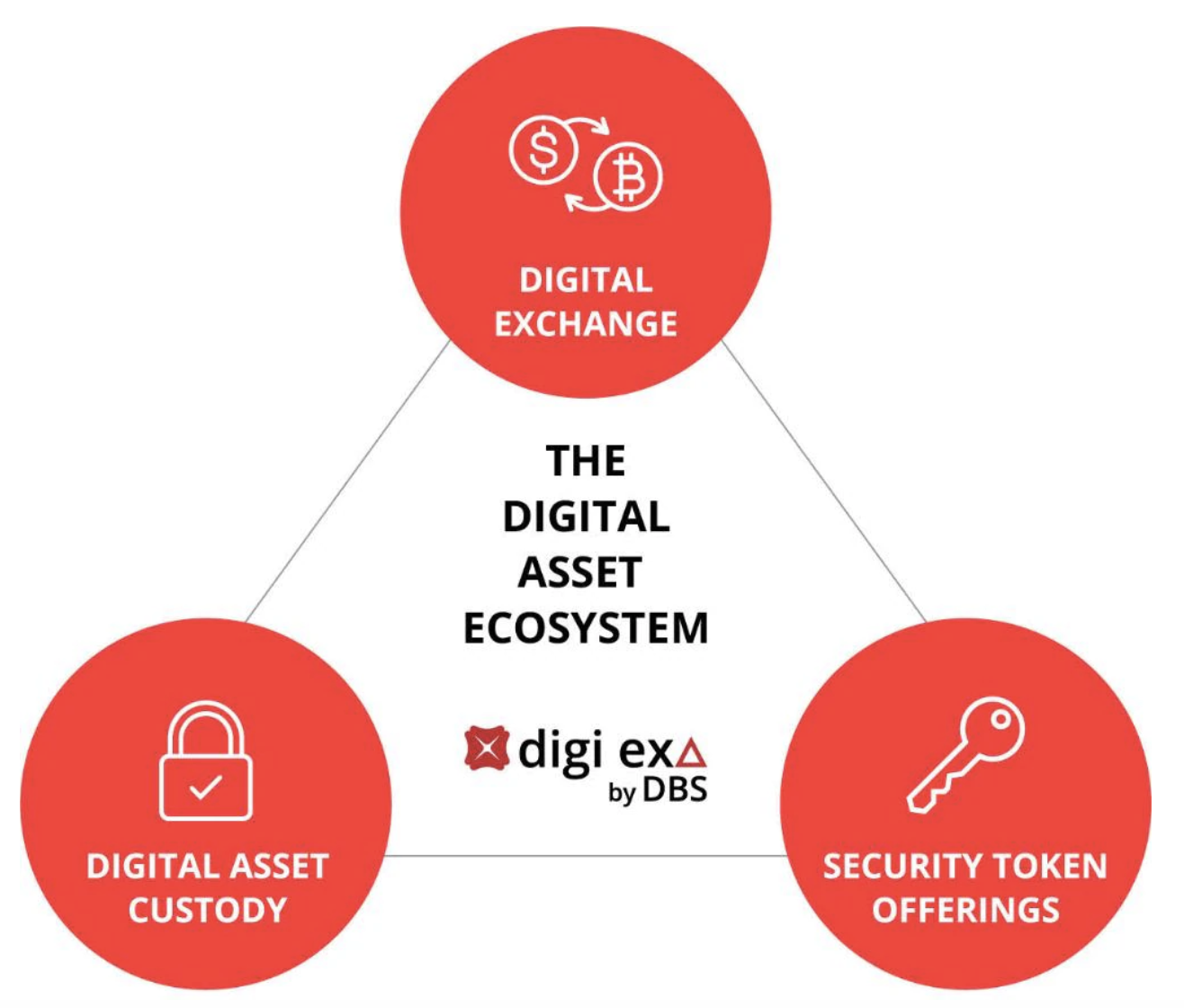

Digital assets are poised to be the future of tomorrow’s digital economy. With DBS Digital Exchange, a bank-backed digital exchange, companies and investors can now leverage an integrated ecosystem of solutions to tap the vast potential of private markets and digital currencies.

Through DBS Digital Exchange, SMEs and large corporates alike can also tap on a Security Token platform to raise capital efficiently through the digitisation of their securities and assets, enabling issuers to reach a wider base of investors that might not traditionally have access to such tokens.

However, shortly after DBS published this announcement, they deleted it. A DBS spokesperson clarified to CoinGeek that, “DBS’ plans for a digital exchange are still work in process, and have not received regulatory approvals. Until such time as approvals are in place, no further announcements will be made.”

Is this good for the industry?

Regardless of the DBS revoking its announcement, this news is positive for the blockchain and digital currency industry. DBS will be providing digital currency to fiat trading pairs for the Singapore dollar (SGD), the Hong Kong dollar (HKD), the Japanese yen (JPY), and the United States dollar (USD) and even mentioned that they will enable companies to tokenize shares in the future.

In addition, the exchange will be regulated by the Monetary Authority of Singapore and backed by the DBS bank. It is always a good sign when prestigious institutions from the traditional finance industry venture into digital currency service offerings. These institutions would not enter the digital currency markets if they did not believe they had a prosperous future.

It is only a matter of time until the DBS Digital Exchange receives regulatory approval and gears up for launch.

Editor’s note: This article has been updated with the DBS statement.

02-22-2026

02-22-2026