|

Getting your Trinity Audio player ready...

|

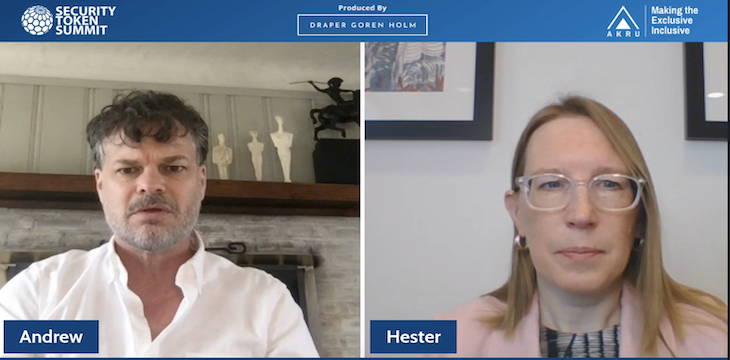

On March 25th, SEC Commissioner Hester Peirce participated in the fireside chat at the Security Token Summit. During the discussion, which was moderated by Andrew Dix, The Founder and CEO of Crowded Media Group, Peirce answered several questions about digital securities, regulatory clarity and guidelines, the blockchain innovation hubs in the United States, why the Coinbase IPO can be seen as somewhat of a milestone in the digital currency industry, as well as her thoughts on traditional equities becoming digitized in the future.

Here are a few of the key takeaways from Peirce’s fireside chat.

Is the Howey Test broken?

Dix began the fireside chat by asking Peirce what a digital security is and if the Howey Test, which is used to determine if an investment vehicle is a security or not, applies to the digital currency space.

Peirce said that the Howey Test is not broken in the sense that the United States needed a “concept like an investment contract that captures things other than stocks and bonds which is typically what we think of when we say security, we needed to capture instances where people say, “Hey I’m trying to start a company and I’m selling X to raise money for the company,” and that the Howie Test successfully interpreted those instances as securities sales.

However, Peirce says that the Howie Test has had some challenges over the years, especially when it comes to the digital currency industry. Peirce alluded to digital currencies being similar to securities in several ways, but also unique in many ways. This could suggest that the Howie Test is not able to capture and define some instances of digital currency sales and distributions the same way it can capture what we would call securities sales.

Has Switzerland taken the best approach to blockchain and digital currency?

Dix asked Peirce what she thinks of Switzerland’s approach to blockchain and digital currency. Switzerland has been one of the most progressive and accommodating blockchain and digital currency innovation hubs in the world and has created an environment that is appealing to blockchain and digital currency companies.

Peirce says that the United States can learn a lot from Switzerland’s strategic approach; that Switzerland is heading in the right direction because they have regulatory clarity and guidance, something that many other countries lack when it comes to blockchain and digital currency.

Peirce points out that in the United States, Wyoming is following in Switzerland’s footsteps and making the regulatory landscape around blockchain and digital currency very clear and easy to follow. She also says other cities in the United States are looking to do the same, such as Miami, the city that is looking to become a hub for blockchain and digital currency innovation.

Thoughts on NFTs?

“We have an interest in anything that could be a security so we are paying attention,” said Peirce, before going on to say that the non-fungible, unique 1 of 1 nature of NFTs make them less likely to qualify as securities.

However, Peirce says the SEC has noticed that individuals are getting creative in their NFT offerings, and if there are instances where an NFT is fractionalized or maybe a basket of NFTs are sold, then it might be an investment product that falls under the broad definition of a “securities sale.”

The Coinbase IPO

Although Commissioner Peirce could not say much about the Coinbase IPO, she did say that this could be symbolic of a broader trend taking place in the blockchain and digital currency spaces. The Coinbase IPO is the first major instance of traditional finance and digital currency meeting at an intersection, and in 2021, you may see even more legacy institutions getting involved in the digital currency space in some way.

Will all securities eventually be digitized?

Lastly, Dix asked Peirce if she believes that all securities will eventually be digitized in the future, whether that means on a blockchain, a distributed ledger, or some other sort of method. Dix said he believes that the digitization of securities seems to be inevitable at this point, and Peirce agreed, saying that she has the same assumption about the future of securities.

02-19-2026

02-19-2026