|

Getting your Trinity Audio player ready...

|

Samsung (NASDAQ: SSNLF) recorded a sharp surge in its operating profits in Q2 as demand for its chips in AI processors skyrocketed.

The South Korean giant announced quarterly revenue of KRW 74.07 trillion ($53.5 billion), a 23% increase year-on-year, beating analyst estimates.

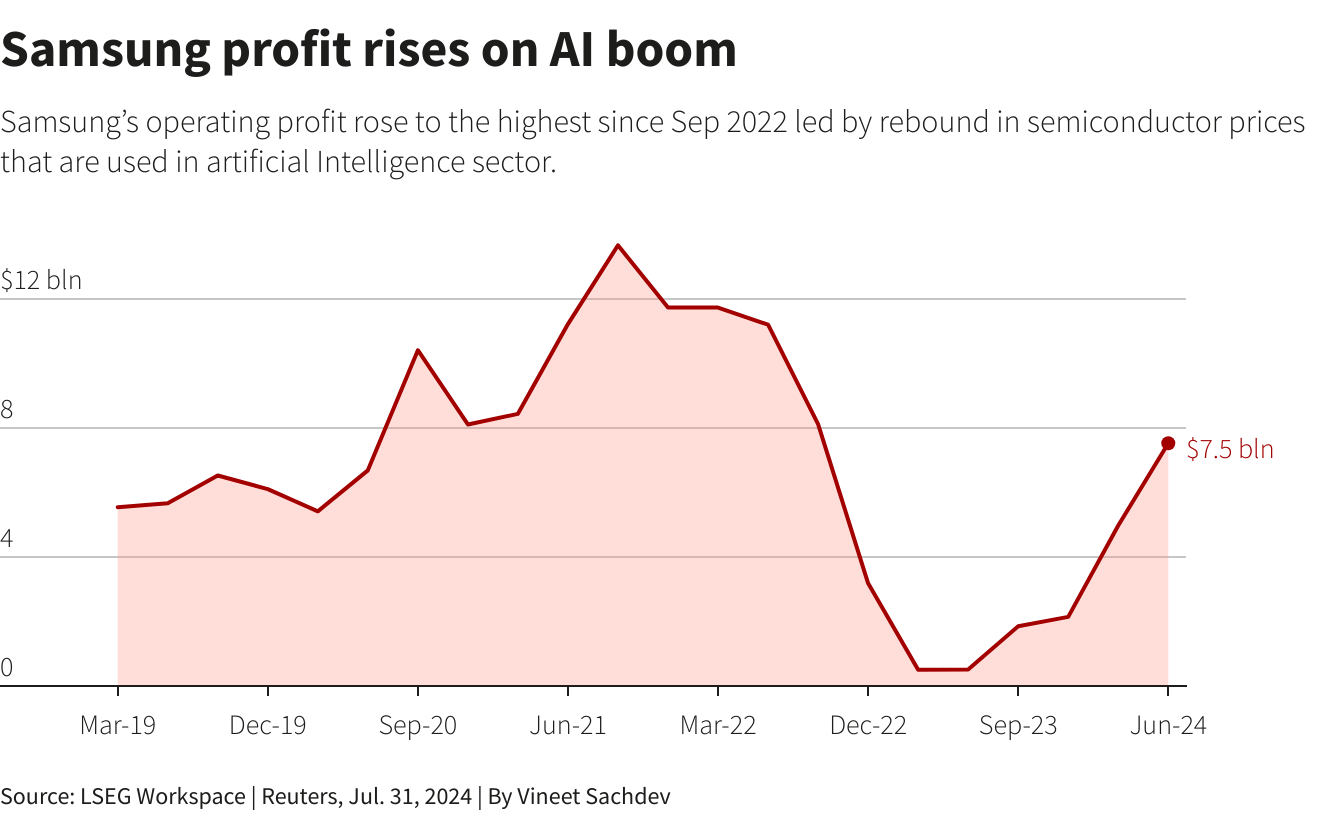

The operating profit for the quarter hit KRW 10.44 trillion ($7.5 billion), surging over 1,450% from the same period last year, when it recorded KRW 670 billion. This was the company’s highest operating profit since Q3 2022.

Like many of its peers, Samsung is riding the AI wave that has pushed some, like Nvidia (NASDAQ: NVDA) and Microsoft (NASDAQ: MSFT), to the $3 trillion level.

The company’s chip division brought in $4.7 billion in profit, its second consecutive quarterly profit as it recovered from a post-pandemic slump. The division is increasingly pivoting towards making AI-focused chips, including those used in data center servers, at the expense of smartphone and PC chips.

Samsung recorded strong growth in demand for its high-bandwidth memory (HBM) chips, which are mainly used in gadgets that run AI applications; HBM revenue shot up 50% in Q2.

“This increased demand is a result of the continued AI investments by cloud service providers and growing demand for AI from businesses for their on-premise servers,” the company said.

Samsung believes this segment will continue to record aggressive growth for the rest of the year as AI servers take up even larger portions of the market.

Despite its outsized growth in Q2, the South Korean giant has massive room for growth in the AI chip sector. Its most advanced HBM chips, dubbed HBM3, have yet to meet Nvidia’s standards for the American firm’s fifth-generation HBM chips, known as HBM3E.

Nvidia currently uses Samsung’s HBM3 to develop its less powerful processors, which the U.S. government has allowed it to export to adversaries like China. Under the Biden administration, the U.S. has been increasingly constraining chipmakers’ ability to export AI technology and hardware to China and other rival nations.

Nvidia has been relying entirely on Samsung’s local rival, SK Hynix, to supply HBM3 chips, pushing the Icheon-based semiconductor vendor to its highest quarterly profit in six years last quarter.

Samsung believes that its chips will meet Nvidia’s standards this year, sparking an explosion in their demand.

Analysts predict that Samsung and its peers will continue to record rapid revenue and profit growth throughout the rest of the year and the first half of 2025.

“With memory’s average selling prices expected to continue their uptrend for the next several quarters, we foresee quarterly sequential profit growth for Samsung Electronics until 2025,” the Hong Kong capital markets firm CLSA said.

In order for artificial intelligence (AI) to work right within the law and thrive in the face of growing challenges, it needs to integrate an enterprise blockchain system that ensures data input quality and ownership—allowing it to keep data safe while also guaranteeing the immutability of data. Check out CoinGeek’s coverage on this emerging tech to learn more why Enterprise blockchain will be the backbone of AI.

Watch: Understanding the dynamics of blockchain & AI

03-09-2026

03-09-2026