|

Getting your Trinity Audio player ready...

|

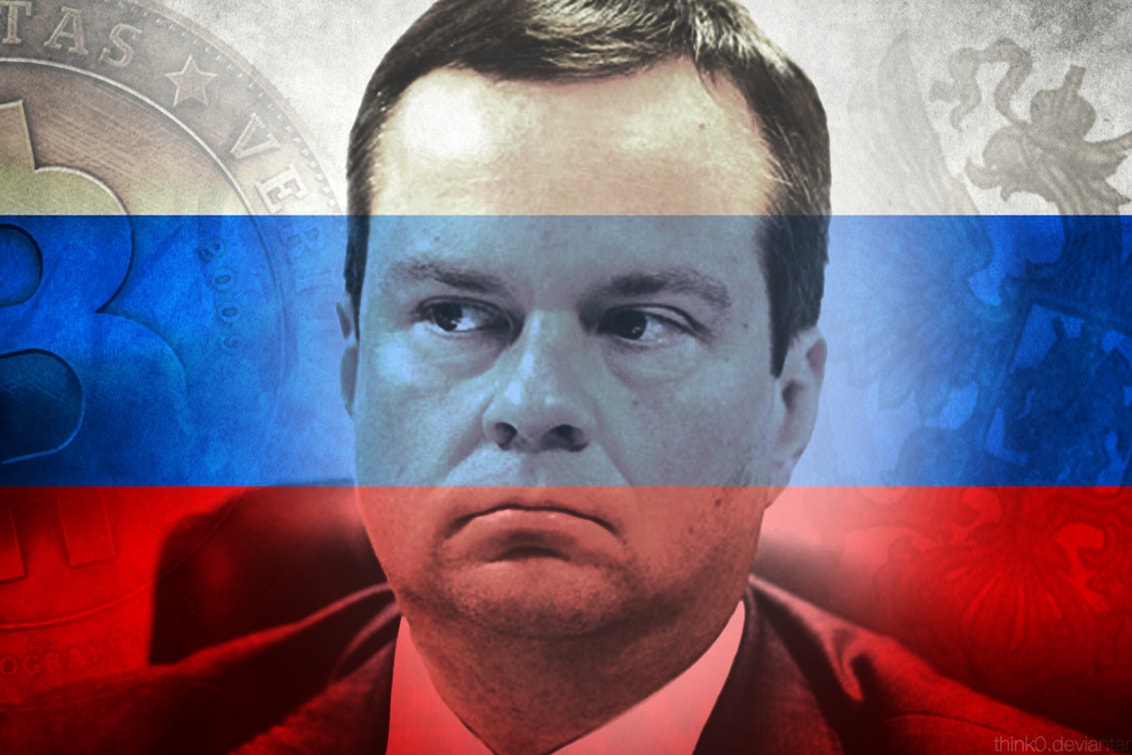

Russia’s Deputy Finance Minister Alexei Moiseev has suggested that bitcoin transactions should be restricted to qualified investors only, a proposal which would exclude retail investors from engaging in bitcoin investments.

The suggestion comes at a time when Russian regulators are pushing for greater oversight of bitcoin and other digital currencies, as the authorities come to grips with the challenges and opportunities posed by the cryptocurrency space.

According to local media reports, the Minister suggested that bitcoin should be regulated as an asset, rather than a currency, and as such, it should be restricted to ‘qualified investors’ – a term which encompasses those with assets over a certain as yet unspecified threshold.

Moiseev’s statements to the press reflect his intentions over the approach, which could soon be referred to lawmakers for drafting.

“We suggest not to call it currencies, do not regulate it as currencies, regulate how…other property, classify it as a financial asset and allow only classified investors to buy and sell them on the exchange.”

Listing bitcoin on the Moscow Stock Exchange would enable the Russian government to bring transactions under their Rosfinmonitoring protocols, a mechanism created by decree of President Putin to ensure Russian authorities have full oversight over certain classes of transactions.

The measures, ostensibly introduced to prevent fraud and provide financial intelligence to central government, would have the effect of halting the growth in digital currency investments from non-qualified investors – i.e. the majority of ‘ordinary’ retail investors.

The approach to bitcoin in Russia has been at times starkly contrasting, with government officials often highly suspicious of the technology and the emerging markets in digital currency. At the same time, the Bank of Russia has been more amenable to these new asset classes, and even senior ministers in the Russian government have on occasion sounded a more sympathetic tone.

Yet the present proposals indicate a hardline approach, and one which is already raising concerns amongst investors, analysts and digital currency commentators.

Pavel Durov, founder of Telegram and VKontakte, said that by “voicing ideas to ban and restrict” the use of digital currencies, the Russian government was hindering steps to decentralise the global financial system, comments which are being supported broadly by analysts in favour of a more liberal approach.

02-25-2026

02-25-2026