|

Getting your Trinity Audio player ready...

|

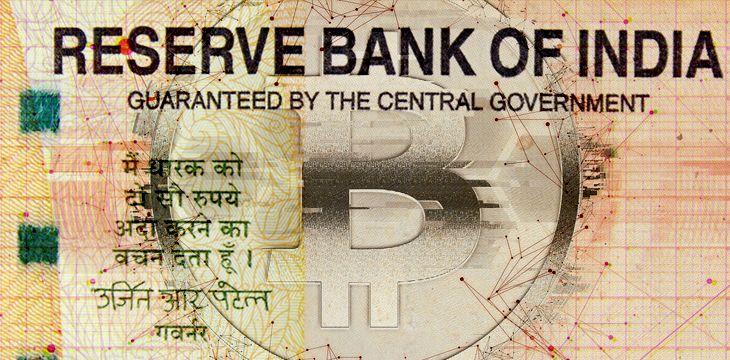

India’s central bank has provided clarity regarding the legal status of banks servicing digital currency-related entities in the country.

In a statement, the Reserve Bank of India addressed the current ban on banks servicing the sector, noting that “no such prohibition exists,” according to the Economic Times report.

A query for information

The RBI released this statement shortly in response to the Right to Information Act query filed by Unocoin co-founder BV Harish.

On April 25, Harish queried the RBI in regards to whether or not it was legal for banks to service digital currency businesses. In April 2018, the RBI directed banks not to deal in virtual currencies or provide services to facilitate any person or entity from dealing or settling in the same. At the time, the RBI believed that servicing digital currency-related businesses came with a significant amount of risk, and therefore, decided that it was best for banks not to service digital currency businesses.

However, in March 2020, India’s Supreme Court overturned the RBI’s previous ruling that prohibited banks from servicing digital currency businesses. The Supreme Court ruling gave banks permission to service digital currency-related businesses, however, many of the digital asset companies and banks operating out of India said the Supreme Court ruling made it unclear whether or not it was legal for digital currency businesses to receive banking services.

When the RBI got back to Harish on May 22 with their statement, it made it clear that there was no banking ban on digital currency-related businesses in Indian.

Boosting bankers’ confidence

“Bankers have been saying that they need new RBI circulars mentioning that there are no more restrictions for them to provide bank accounts for crypto businesses,” said Harish. “Now, we have received a positive response from the RBI,”

Many banks were requesting new guidance from the RBI before they felt safe servicing digital currency businesses once again. But now that Unocoin’s RTI query has been answered, banks are confident that they can service businesses in the digital currency sector without running into legal issues.

03-09-2026

03-09-2026