|

Getting your Trinity Audio player ready...

|

Legendary investor and hedge fund manager Paul Tudor Jones has publicly stated he is buying Bitcoin as a hedge against the great monetary inflation and record debt levels we are currently facing.

One thing we can see for certain that he has publicly thrown his hat into the Bitcoin ring, stating the best profit-maximizing strategy is to own the fastest horse.

“If I am forced to forecast, my bet is it will be Bitcoin,” Jones said.

He is on the mark there with his declaration to delve into Bitcoin, however notably there is no clear mention of the ticker in any of his commentary. As we know, tickers merely represent a protocol’s listing on exchanges.

Bitcoin is far more than a ticker though. It is an economic system that goes well beyond the fixed supply of 21 million coins. There are other factors that make Bitcoin valuable like it having no counterparty risk as peer-to-peer electronic cash, tokenization of real world assets, immutable data storage, smart contracts and ability to make fraction of a cent micropayments with predictably low fees that has opened up the new value based internet ‘Metanet’ to be birthed that seeks to replace the current internet.

I wouldn’t put it past Jones and his incredible track record over the past four decades with his methodical approach to research and analysis to not overlook the details that draws him to what version of the Bitcoin protocol has actual intrinsic value.

Lots of hedge fund managers keep a close eye on his moves and try to emulate his success. But perhaps you can do better if you just take a closer look.

So which Bitcoin is actually the fastest horse?

For the purposes of making it clear, there are two ticker symbols that I will be discussing in this piece: BTC and BSV, both of which share the history of the blockchain from the very beginning in 2009.

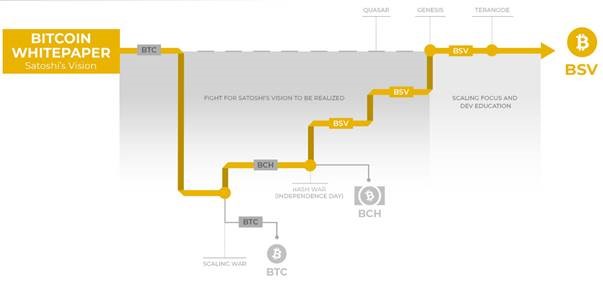

In 2017, scaling disagreements and preservation of the original protocol to ensure the economics of the system remain intact whilst remaining legally compliant were the key differences between the protocol developers for Bitcoin SV (BSV) and BTC. BSV developers fought hard to preserve the original protocol and rapidly scale it.

On the other hand, BTC wanted to keep the block size limit capped at 1MB to deter usage by creating artificially high fee markets, discouraging users from utilising the blockchain as they turned it into a ‘Store of Value’ while they worked on building an off-chain alternative non-blockchain solutions called the Lightning Network. Not only is this new off-chain second layer not operational, it breaks the entire economic security model of Bitcoin as envisioned by Satoshi Nakamoto.

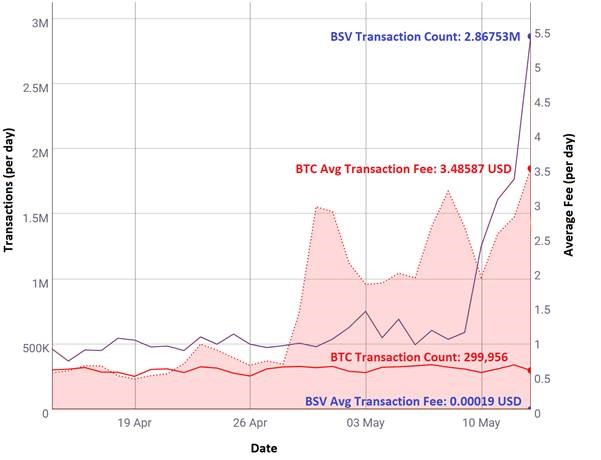

Taking a look at the statistics over the most recent month also paints a picture on how things have played out in the scaling debate in terms of what utilisation and costs are deemed acceptable.

We can see the peak of the past month on May 13, 2020, BSV generated 2.86 million transactions. This is over nine times greater transaction volume (use) than BTC which was just shy of 300,000 for the day.

The average fees for the BSV transactions were 1/50th of a cent, which is an astronomical 1,739,900% cheaper than BTC which averaged $3.48 USD per transaction. You don’t need to be savvy about Bitcoin to know that not only is one substantially cheaper than the other, but even looking at BTC in isolation screams it is far more expensive than current traditional based payment systems like Visa or PayPal. Not to mention much more clunky and tremendously slower.

The largest block ever on Bitcoin (369MB) has also been mined this month on BSV, which dwarfs BTC’s maximum capacity of 1MB per block.

The data on the graphic above shows the trajectory of BSV transactions going upwards while BTC has plateaued. This upward movement in transaction volume on Bitcoin SV will also be the driving force towards placing downward pressure on the fees keeping them predictably low.

As BSV scales, the cheaper it gets and it is just getting started on the scaling front. Teranode is being worked on by the team at nChain with the ambitious goal to have terabyte size block capacity which can handle millions of transactions per second.

BTC doesn’t intend nor have any desire to go beyond 7 transactions per second. They have placed a premium on using it for anything besides holding, making it less useful in any use case. Which is why the BTC daily transaction volume has flat lined at the 300k per day mark for a few years.

Paul Tudor Jones trading philosophy favours asymmetric risk/reward opportunities

It is a well-known that Paul Tudor Jones only takes a trade where he expects to get a minimum of a 5:1 reward-to-risk ratio using his asymmetrical trading philosophy which is summed as the potential outcome for big upside and small downside.

Jones has been telling his clients that Bitcoin reminds him of the “role gold played in the 1970’s.”

For reference, gold went up 25 times in the 1970’s trading at US$35 an ounce in 1971 and peaked at US$850 per ounce by the end of the decade.

Remarkably, at the time of writing this, 1 BTC will get you 50 BSV today.

Unlike years gone by that could have justified a substantial price rise where there was one version of Bitcoin that had utility. Since the split in 2017, BTC can no longer justify its current price let alone another substantial price rise as it is currently inflated.

Due to the disinformation, BSV has flown under the radar, however it is the original Bitcoin in name, not BTC which changed its underlying protocol and created something new. BSV’s technical capability, usability and scalability is greater than ever.

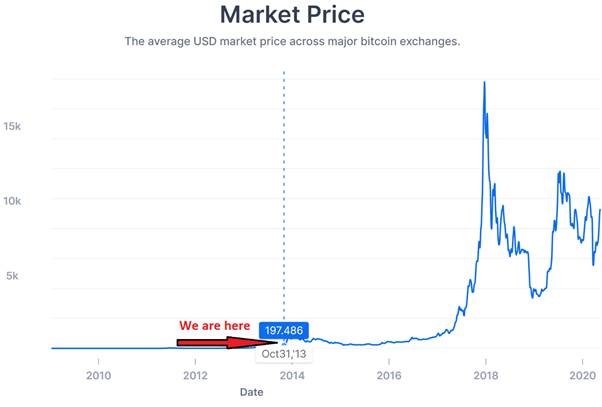

The last time Bitcoin was under US$200, we have to wind the clock back to October 2013.

Bottom line: Bitcoin is more than just a hedge against inflation

Bitcoin will always be hard, scarce, commodity money that is separated from the state and absolutely anything can be recorded immutability on top of the global ledger in a permissionless manner.

BSV has micropayments which are fractions of a cent and unlimited immutable data storage on-chain. Bitcoin as envisioned by Satoshi was designed to handle every single type of transaction in the world on chain.

With velocity of usage and scalability both increasing on BSV, the cost of utilising the public ledger continues to drop making it both a great store of value and means of exchange. BTC most definitely cannot say the same thing.

With the enormous disruption potential to every single industry as Bitcoin technology rolls out, you can imagine that the path towards fulfilling its true potential will not be a clear and straight road.

And the winding and slow road is exactly how it has played out with the mass propaganda and disinformation that exists in the digital asset and blockchain space. And yet with all the attacks, Bitcoin survives under the ticker BSV and remains stronger than ever.

Paul Tudor Jones has too much of a proven track record to miss the fundamental value proposition presented here for which version of Bitcoin has intrinsic value that will translate towards price appreciation. Regardless, for the other hedge fund managers out there that can read between the lines and choose the correct version of Bitcoin, you could just outperform the legend himself.

Recommended for you

The views expressed in this article are those of the author and do not necessarily reflect the position of CoinGeek.

03-04-2026

03-04-2026