|

Getting your Trinity Audio player ready...

|

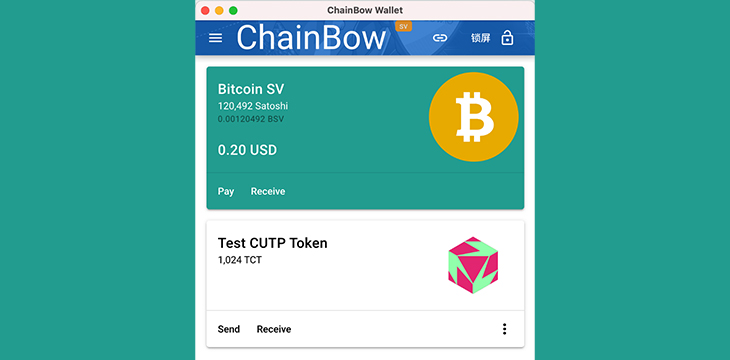

Chainbow, the company responsible for BSV secure note app NOTE.SV, is planning to release a wallet that supports BSV’s “layer one” CUP tokens. The wallet will have the ability to issue, sell and exchange tokens, and is currently undergoing a testing phase.

https://t.co/a4QUqZwWpq The 4th milestone of ChainBow Wallet brings support for BIP270 and Wallet Connect. Defining and improve the communication interface between the wallet and the DApp. For Ethereum users, there is a consistent user experience.#BSV #Bitcoin #ChainBowWallet

— NOTE.SV (@SvNote) June 13, 2021

NOTE.SV is a desktop and mobile app similar to 1Password or Evernote, allowing users to store passwords and other private notes securely. Note content is encrypted and stored on the BSV blockchain, keeping them safe for their creators while hidden from others’ view—far superior to other similar cloud-based services.

The Tokyo-based company has experimented with Ethereum in the past, and still maintains a few ETH projects. But while the idea of a programmable blockchain and tokenization had appeal at first, its account-based structure soon revealed its shortcomings in terms of congestion and cost. BSV also has “set in stone” rules for its protocol, guaranteeing project operators of any size can develop on its network without fear of sudden or major changes to its structure.

CoinGeek spoke to Chainbow CEO Long Li about what drew him to BSV, what he’s building and planning to build, the reasons why he chose a token sale on Ethereum to raise capital to fund his company’s projects, and how Chainbow is participating in developing a healthier BSV ecosystem in Japan.

Interview with Long Li, CEO of Chainbow

When did you start working on NOTE.SV?

Long Li: At first, I needed blockchain technology when I was doing other projects. I wrote some examples of BSV to realize CRUD on the blockchain. The example can Create, Read, Update and Delete the data, just like operating the database. In February of last year (February 2020), COVID-19 and the trade war came, and everyone felt the danger personally. Is there anything we tech people can do to help if something terrible happens? Any centralized service may be disrupted. The decentralization of Bitcoin blockchain, security, and, in particular, “Set in Stone” will never change the consensus of the underlying protocol, which is very suitable for the Pandemic Era. We decided to turn the previous example into a product, launching the first version of NOTE.SV in April last year, which has been continuously upgraded. NOTE.SV can be considered 1Password and Evernote in the blockchain era.

Why did you choose the BSV blockchain?

Long Li: Because BSV is the Bitcoin that I originally wanted, it is a world currency that every ordinary person can pay and use in their daily life.

As a programmer, Ethereum was the first programmable blockchain that many people first came across. Before Bitcoin was restricted under the leadership of Core, it could not be used in a variety of scenarios, and Ethereum provided the only alternative. However, Ethereum’s technical model is based on the account model, which only works from a “computing technology” perspective. But from a “computer science” point of view, there are many problems. In February 2020, Bitcoin SV removed various restrictions added by Core, allowing Bitcoin to gain rebirth. As a result, it can be used in business. I believe that more developers will make applications on BSV.

Can you tell us more about the BSV smart wallet (Chainbow Wallet) and what it can do?

Long Li: In September 2020, we wanted to use tokens to mark the user’s license in NOTE.SV. Unfortunately, the technology didn’t exist. sCrypt proposes a Layer-1 Token prototype. I dug deep and came up with a working version of the first version in October, released the second version on GitHub in November, and released the third version in March 2021. During this period, I learned a lot of knowledge from Xiaohui Liu and many Chinese technicians. After March, we raised funds to develop a wallet and implement a genuinely usable BSV Token wallet.

As a professional blockchain wallet developer, We has two important announcements.

One is the release of #Wallet3, a Ethereum #DeFi wallet.

The second is an upgraded version of the #BitcoinSV wallet, which supports #Layer-1 #CUPToken.https://t.co/ekTqRFoUXy— NOTE.SV (@SvNote) June 21, 2021

In the last five weeks, we have released new versions in a row. So far completed: Wallet independent of centralized servers; analysis and management of various UTXO types; Witness/Oracle services; BIP270; WalletConnect; dApps; and Layer-1 Tokens, within the wallet. It will then continue for a few more weeks to complete the vision. The final vision basically includes all BSVers’ ideas on wallets and make the empty bragging come true. If you have any thoughts, please let us know. We are willing to discuss and implement them.

With the development of the Internet, digital currency that can transfer money across regions is the primary trend. In fact, BSV is the first truly global digital currency. Far earlier than China’s DCEP and Facebook’s Libra/Diem. If BSV is currency, then a token is the proof that BSV is used to purchase something, such as tickets, points, merchandise coupons, copyright certificates, stocks, receipts, and so on. Valuable vouchers that are ubiquitous in society can be digitized. BSV is not only a currency. It also provides the issuance of certificates. Even certain legal currencies, such as the Japanese yen, U.S. dollars, and (Chinese) renminbi, on the BSV network. The technical difficulty, security, and cost of development are far superior to other blockchains.

We know that the driving force behind the development of the Internet economy is “cutting transaction costs.” Once the value certificate is tokenized, the transaction cost will be greatly reduced. In the past, to issue and trade valuable vouchers, it was necessary to design a complex system and an organized supervision system. Because of the unbiased, tamper-proof nature of blockchain technology, these costs disappear. To contribute to the goal of “The Zero Marginal Cost Society”.

How did the CSS token sale (in March) go, and why did you do your CSS token sale on Ethereum?

Long Li: After the rebirth of the original Bitcoin, some basic services were insufficient, but this is not difficult. Technology always has a solution. The hardest thing is to develop a product without income and investment. There is no way to hire programmers, no marketing staff. The reason why the development of Ethereum is very lively is that there is a lot of investment. Although it is not sure, the actual contribution of those developments to society, from 1 to n, is a wealth-making effect. The application of Bitcoin SV is from 0 to 1, and investors pay less attention to it at present. Peter Thiel said “Zero to One” is the most difficult.

We raised funds through Ethereum, which seems to have a great impact on some BSVers. But this is the most responsible approach to investors. And formed a win-win situation for fundraisers, investors, and BSV. Without this part of funds and the help of investors, there would be no ChainBow Wallet.

A lot of wealth has been built upon Ethereum, such as USDC being a government-sanctioned stable currency. This huge amount of money cannot be ignored. And these funds are the easiest to support BSV. However, if we use BSV to raise money, we can’t raise much money, investors can’t trade, and there is no way to mark the price in USD.

Our fundraising token corresponds to the company’s equity. After that, we will continue to raise funds and will consider doing it on BSV’s Layer-1 Token. Currently, the ETH/BSV cross-chain technology is being developed to allow the assets of the two chains to flow with each other. I also hope that investors can contact us. I think cross-chain technology can protect the interests of investors.

Do you know any other interesting BSV projects happening in Japan?

Long Li: We are going to launch a digital point service using BSV Token technology in Japan. Japan’s consumer points market has a size of 3 trillion yen. This is a huge application scenario and can be marketed globally.

There is the most professional communication community in Japan with the best atmosphere: BSV Night, which organizes study sessions on Zoom every month. Everyone is welcome to follow BSV Night on Twitter. BSV Ideathon was organized just last week, and many excellent BSV application directions have been proposed.

02-26-2026

02-26-2026