|

Getting your Trinity Audio player ready...

|

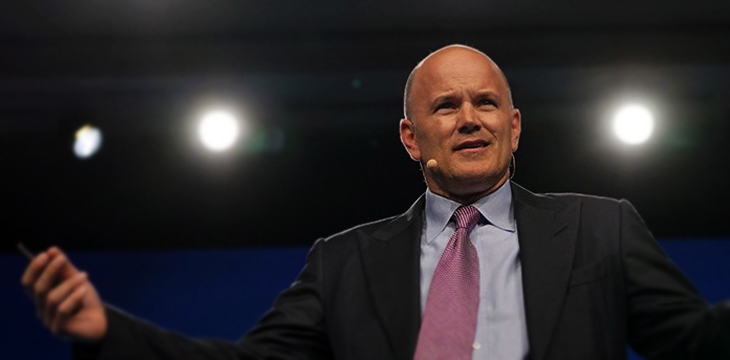

Galaxy Digital may have lost around $272.7 million in 2018 as the “cryptocurrency winter” continued to hold the ecosystem in its grasp, but the crypto investment company just made a huge advance in reducing its losses. Mike Novogratz, Galaxy’s founder and CEO, has relinquished his shares of Block.one, picking up $71.2 million and a 123% return on his original investment in the process.

Galaxy accepted a tender offer that was originally announced in April. The deal has been successfully closed as of May 20, and Novogratz walked away with a nice payday. He said after putting pen to paper to sign the deal, “The acceptance of Block.one’s tender offer reflected a decision to rebalance the portfolio to maintain an appropriate level of diversification after the position increased due to its substantial outperformance relative to the remainder of the portfolio. We continue to work closely with Block.one as a key partner across a number of our business lines, including the Galaxy EOS VC Fund, which invests in companies building on the EOS.IO protocol, and remain excited about the EOS.IO protocol.”

That Galaxy EOS fund was behind a $30-million Series A investment round for the Good Money neo-banking platform last December. The platform was designed to offer banking services and financial instruments to account holders in the United States. The two entities had also worked together on the creation of another fund, the EOSIO Ecosystem Fund, in January 2018 that saw its capitalization initially reach $325 million.

Block.one is a developer for the EOS platform. According to the company website, it is scalable and able to support “thousands of commercial scale Dapps [decentralized applications]” and is the “most powerful infrastructure for decentralized applications.”

Galaxy has its roots in the financial world. Novogratz was a partner at Goldman Sachs and recognized early on the power of crypto. Galaxy began as a multi-service merchant bank and branched out quickly into other areas, including blockchain investments. It now operates four business—trading, principal investments, advisory services and asset management. It is headquartered in New York City and maintains offices in New Jersey, the Cayman Islands, Hong Kong and Tokyo.

03-02-2026

03-02-2026