|

Getting your Trinity Audio player ready...

|

Over 90% of small and medium enterprises (SMEs) in over a dozen countries across the Middle East and Africa accept digital payments and are slowly phasing cash out, a new report reveals.

The third edition of the SME Confidence Index, published by global payments giant Mastercard (NASDAQ: MA), revealed that SMEs have recorded accelerated growth over the past year despite global economic shakeups, such as conflicts in Europe and the Middle East and the transfer of power in some of the largest economies.

African SMEs embrace digital payments

Across the board, SMEs have benefited massively from digitalizing payments, which has resulted in more efficient payment processes for consumers, easier reconciliation and compliance for businesses, and reduced costs.

“Small and medium enterprises are the backbone of economies, driving innovation, employment, and resilience. As digital transformation accelerates, SMEs are unlocking new opportunities through digital payments and financial inclusion,” commented Dimitrios Dosis, Mastercard’s president for Eastern Europe, the Middle East, and Africa.

In Nigeria, 99% of SMEs accept digital payments, Mastercard found.

“Nigerian SMEs are demonstrating remarkable adaptability and foresight by leveraging digital payment solutions to drive economic transformation,” commented Mark Elliott, the company’s president for Africa.

For Nigeria, digital payments have been a lifeline for its 230 million residents as a cash shortage brought one of Africa’s largest economies to its knees. Starved for cash, which dominated day-to-day payments, Nigerians turned to digital platforms to pay for essentials. Surprisingly, the eNaira’s uptake was barely affected as Nigerians continued to shun Africa’s first and only central bank digital currency (CBDC). A new naira-pegged stablecoin that launched this year is hoping to fare better.

In East Africa, Kenyan SMEs lead in digital payments with a 91% uptake.“As SMEs in Kenya continue to embrace digital transformation, access to secure payments, financial services, and strategic partnerships remains key to their success,” Elliott stated.

Kenya’s mobile money adoption is among the highest globally and has been the bedrock of the country’s digital payments revolution. In recent years, Kenyans have been increasingly adopting digital payments, especially for cross-border transfers, as an alternative to the costly traditional channels. An International Monetary Fund (IMF) report earlier this year found that Kenyans have been transacting millions of dollars in stablecoins to pay for imports from Asian countries.

Adoption of digital payments is lower in Northern Africa, with Egyptian SMEs recording an 80% uptake.

“As Egypt’s SMEs continue to evolve, adopting digital payments and innovative financial solutions will be central to their success,” commented Adam Jones, Mastercard’s president for Western Arabia.

Middle East’s digital payments revolution

The Middle East has also undergone a digital payments revolution, with the United Arab Emirates emerging as the regional leader. According to the Mastercard report, 91% of Emirati SMEs accept digital payments, leading to optimism about their business outlook and projections of higher revenues in 2025.

“As the UAE advances its vision for a thriving digital economy, SMEs play a crucial role in driving innovation and growth. Their confidence in the future reflects not only their resilience but also the impact of an ecosystem designed to support their success,” commented Mastercard’s East Arabia president, J.K. Khalil.

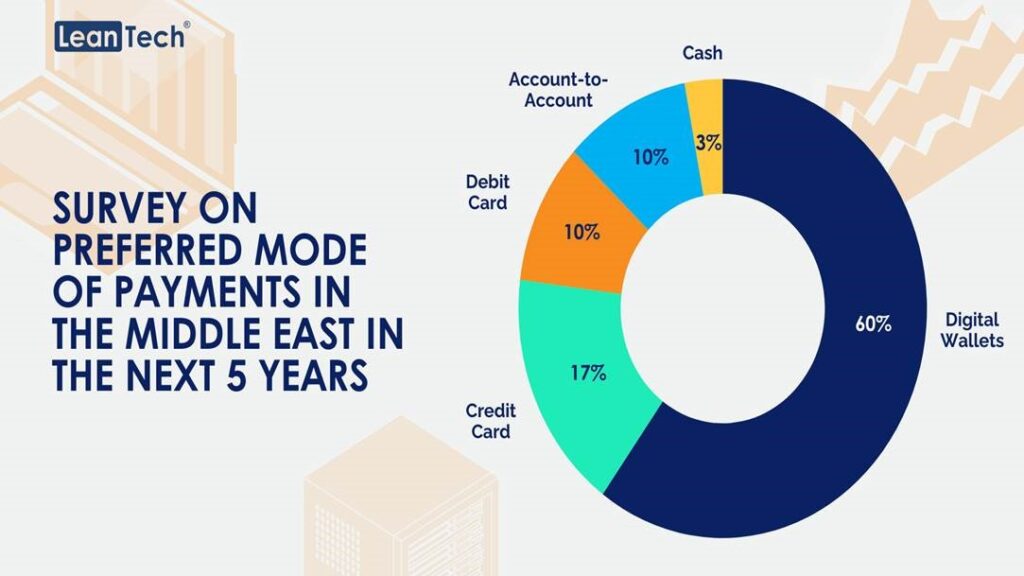

Mastercard’s findings align with an earlier report by Singaporean fintech consultancy LeanTech, which found that nearly two in three Middle Eastern residents prefer paying using a digital wallet. Credit cards were a distant second at only 17%. Only 3% of the respondents chose cash, which aligns with other findings about the dying usage of banknotes.

In 2024, the Middle East recorded 855 million digital payment transactions, accounting for 12% of the total global number. This figure is projected to hit three billion by 2028 as the region’s global share rises to 22%, the highest growth rate in that period. It will also place the Middle East above North America and Europe on digital payment transactions.

As digital payments rise, digital assets have also recorded increased prominence in the region, with one country—Turkey—ranking 11th globally for adoption after receiving $137 billion last year.

While Turkey led in overall volume, the UAE recorded the highest growth in adoption, boosted by positive regulations. The UAE’s digital asset sector has been handed a major boost by independent enabling regulations in two of the country’s largest financial free zones: the Abu Dhabi Global Market and the Dubai International Financial Centre.

Watch: Universal Blockchain Asset unlocks the future of payments

02-22-2026

02-22-2026