|

Getting your Trinity Audio player ready...

|

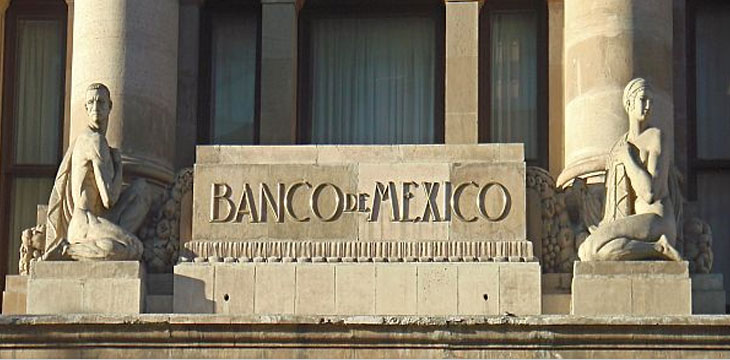

Mexican businesses that want to offer the trading of cryptocurrencies must be registered with The Bank of Mexico, the country’s central bank, according to a report from local news outlet El Siglo de Torreon.

The Bank of Mexico’s Circular 12/2018, which took effect last Tuesday, requires cryptocurrency exchanges to specify the fees it would be charging, when registering.

The circular reads, as roughly translated to English, “It is advisable to establish a regulatory framework that, on the one hand, allows the development of innovation in the payment services of the country… and, at the same time, establish conditions adequate to mitigate the risks associated with such services.”

The conditions for trading cryptocurrencies are provided as well. “The institutions of electronic payment funds must request authorization from the Bank of Mexico so that they can use those technologies associated with any of the virtual assets,” the circular read.

Such requests are to be sent via email, and must have a “valid Digital Certificate.”

The current Bank of Mexico governor is Alejandro Diaz de Leon. Its former governor, Agustin Carstens, who was replaced in 2017, had classified BTC as a commodity, stating that no government or central bank backed it.

Mexicans are reportedly the second-largest buyers of cryptocurrencies in Latin American, next only to Brazilians. In a recent survey, it was found that BCH was the second-most popular cryptocurrency in the country, with 38.8% of respondents recognizing it. The survey also showed that 26.5% of respondents had already purchased cryptocurrencies.

Last March, the Mexican Congress approved legislation regulating the crowdfunding and the cryptocurrency industry in the country. Guidelines are provided for anti-money laundering compliance, and cryptocurrencies are placed under central-bank jurisdiction.

The new law also provides that financial information of users shared through public application programming interfaces (API) was made accessible to cryptocurrency companies, on the condition of the express permission of their clients.

03-11-2026

03-11-2026