|

Getting your Trinity Audio player ready...

|

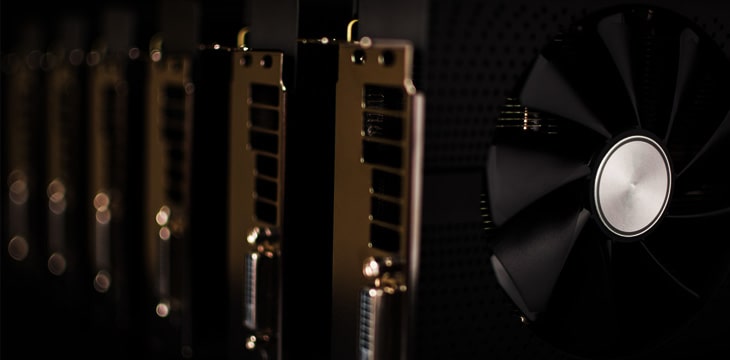

U.S.-based Marathon Patent Group announced it had completed the installation of 700 Whatsminer M30S+ ASICs mining machines manufactured by MicroBT. Marathon purchased the miners on May 11, which are expected to boost hash power by ~70 PH/S.

Company CEO Merrick Okamoto earlier indicated that hardware expansion would be central to the organization’s 2020 plans. In a statement, Okamoto said: “The combined purchase is another step supporting the Company’s recent strategic initiatives focused on expanding its bitcoin mining operations.”

Further, the NASDAQ-listed block reward mining company is awaiting delivery of 1,160 Antminer S19 Pro from Bitmain in the next 60 days. Once installed, this addition will add ~127.600 PH/s more to the hashrate under its control, increasing Marathon’s compute power from the previous S-9 production level of 46 PH/s.

This aggressive buying spree comes as Margon was facing an aging hardware fleet rendered unprofitable to maintain after the BTC halving. Last December, Marathon announced in a press release that it had 3,600 Antimer S9 still operating with another 3,600 held in reserve. During Q4 2019, it briefly suspended block reward mining operations due to BTC price volatility.

Whether Marathon’s aggressive expansion will pay off remains a high-risk and unwise gamble. The block reward mining sector is in the midst of upheaval as the BTC token price continues remaining at levels unprofitable for most outside of China to mine. As a blockchain platform, BTC is significantly overvalued.

What seemingly propels Marathon is confidence is the FOMO narrative, feeling as though mainstream users will eventually flood into BTC, driving up prices for traders. To prepare for this windfall, the organization has made a substantial capital investment in its infrastructure to help maintain the failing BTC blockchain.

Marathon does not seem ready yet to travel down the only path that leads to long-term profits and sustainability. That road leads to the Bitcoin SV blockchain.

Now that Bitcoin has been unlocked, it has entered a transitional phase where block reward miners must adopt mature company processes and strategies as they develop into transaction processors. Bitcoin SV is the only public blockchain with continuous momentum to attract developer talent, corporate enterprises, and user enthusiasm for mainstream adoption.

Whether or not block reward miners realize it, if their management’s strategy for profiting and scaling depends on supporting artificial price manipulation on BTC, they do not have a sustainable path towards steady earnings.

The May halving was a defining moment in the life-cycle of block reward miners that put them on the pathway to long-term growth or eventual ruin. In the post-halving world, we will see the digital currency ecosystem shed a lot of bad companies and poorly managed teams which made ill-advised gambles on the BTC network.

03-11-2026

03-11-2026