|

Getting your Trinity Audio player ready...

|

- London Blockchain Conference 2025 is live

- London Blockchain Conference 2025 launches with bold vision

- Building driverless cars with Sebastian Thrun

- The case for driverless morality

- Thrun: AI has entered the singularity

- Speed is key in Digital Asset Recovery

- Panel flags early errors in hack response

- The thorny issue of building trust in AI

- Blockchain offers audit trail for AI

- FICO study: Focused AI beats general models

- Blockchain makes for a responsible AI

- Panel discusses building trust in AI systems

- Breaking down EU’s MiCA law

- Banking leaders discuss MiCA’s impact on ‘crypto’ regulation

- Blockchain will make us trust AI’s future

- AI as Language Model: Change your perception

- Redefining money amid fintech upgrades

- Crypto innovation vs. global regulation

- Smart Contract Security: Key insights from the experts

- Quantum risks are coming

- Catch up or miss out on Web3

- Bitcoin shakes up capital markets

- From slow trades to instant settlements

- Elata: Shaping the future with the Internet of Brains

- Trading reimagined: Minutes, not days

- Stablecoins: The quiet revolution roars

- Stablecoin surges in on-chain activity

- MiCA vs GENIUS Act: Who rules stablecoins?

- Facing Dollarization: The rise of local currency stablecoins

- adeus: Blockchain solutions for hassle-Free wills

- Blockchain and AI for everyday use

- AI Agents to handle 80% of blockchain transactions by 2030

- VeChain’s VeBetter: Merging AI and blockchain for good

- Mastering your narrative in TradFi and DeFi

- Regulation: A competitive edge in digital asset custody

- AI transforms custody into predictive trust layer

- Exploring regulatory insights with FCA’s Jane Moore

- Ending ban on crypto exchange-traded notes in the UK

- Creating law is more rewarding than just interpreting it

- Jane Moore emphasizes dialogue as key to effective policy-making

- Resify: A blockchain app to combat phone addiction

- What constraints do regulators face?

- VeChain’s VeBetter rewards users for sustainable actions

- MetaMate app incentivizes sustainable energy

- Men dominate global digital asset adoption statistics

- Political rhetoric fails to boost crypto adoption rates

- Barriers to crypto adoption in EU remain significant

- Key factors and barriers influencing crypto adoption today

- Larisa Yarovaya highlights the need for education in crypto

- Mandulis Energy transforms waste into energy using blockchain

- Can blockchain transform government procurement processes?

- Day 1 at London Blockchain Conference concludes—join us for Day 2!

London Blockchain Conference 2025 is live

London Blockchain Conference 2025 is here! CoinGeek is LIVE from Evolution at Battersea Park and will be delivering up-to-the-minute insights, announcements, and cutting-edge perspectives straight from the stage to your device—starting with this live blog. Join us for the entire two day conference.

London Blockchain Conference 2025 launches with bold vision

“It’s no longer about promises: it’s about progress,” – Lilly Douse

London Blockchain 2025 kicks off with an aggressive opening message: it’s no longer about promises, it’s about progress. The endlessly enthusiastic Lilly Douse, CEO of Talk Crypto To Me, returns to chair the proceedings for another year, promising an action-packed event and some exciting new formats. “It’s about coming together and improving the blockchain industry.”

Building driverless cars with Sebastian Thrun

Our first keynote: from self-driving cars to autonomous economies. Renowned Waymo visionary Sebastian Thrun shares first-hand stories from the early days of AI applications. Having taken a small team to compete for DARPA’s $1,000,000 prize for building the first self-driving car back in 2005, Thrun was approached by Google to make one for them. Thrun was told: “If this works, the driverless car business could be 10x bigger than Google.”

His response: “Maybe we should give it a try.”

The case for driverless morality

“We’re at the point where it’s immoral for a human to drive a car” – Thrun

Waymo visionary Sebastian Thrun explains that self-driving cars have outpaced humans on safety, having reached an inflection point around 2023. Given that car accidents are among the leading causes of death of young people in many countries, he says we’re now at the point where it’s immoral to have a human drive a car.

Thrun: AI has entered the singularity

“We’re in the middle of a singularity” – Sebastian Thrun

Speaking on the AI revolution, Thrun ends on a highly upbeat note. He says we’re at a point where no one can say where we will be even two years down the road. Things are changing constantly and in fundamental ways – ways we may never understand, he says: “In AI, there’s a push for transparency. But expecting this will kill the industry. We can no longer live in a world where things can be understood – they can only be proven correct. It’ll be a major shift for society.”

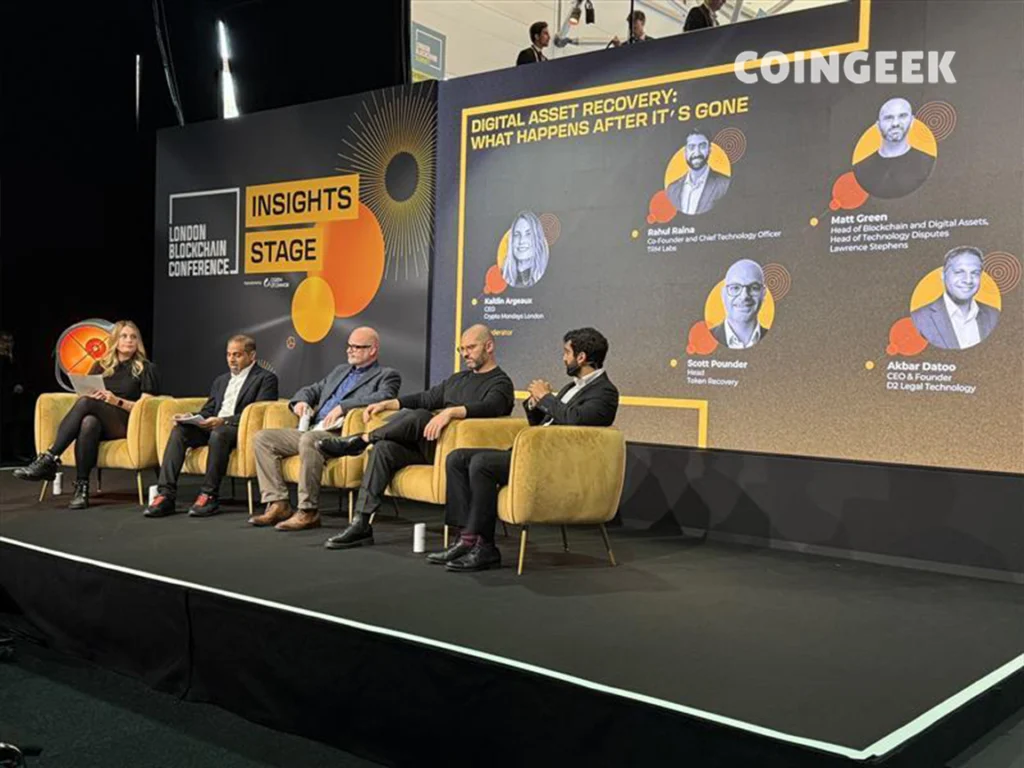

Speed is key in Digital Asset Recovery

Digital asset recovery panel says ‘speed is key’ when responding to a hack

We’re at the first panel of the day. The subject? Digital asset recovery. Experts walk the crowd through all the steps that recovery experts take when they’re hired to track stolen digital assets: verify the hack took place, assess the scale of the problem, and then start following the money. Speed is the key in those early hours.

Panel flags early errors in hack response

Stay focused and notify the right people – digital asset recovery panel

The panel discusses common mistakes that get made in the early hours after a hack: “Sometimes a lack of focus can be a problem. With the tracing, they can throw it out too wide. If they’ll start peeling it off and moving it into smaller amounts, you don’t want to get too lost in the tracing. The key thing is to notify the right people.”

The thorny issue of building trust in AI

“Blockchain will govern AI” – Dr. Scott Zoldi

In the second keynote of the day at the London Blockchain Conference 2025, Dr. Scott Zoldi, Chief Analytics Officer of analytics company FICO, tackled the thorny issue of how to build trust in AI. Zoldi’s solution: Blockchain. He opened by telling the packed crowd at the ‘visionaries stage’ that too often AI is treated as a science project and not an enterprise-grade tool, and that blockchain can become the “enforcer” of AI standards.

Blockchain offers audit trail for AI

AI black box getting darker, blockchain can shed some light

Zoldi explains the problem with AI development at the moment—“the black box of AI is getting darker and darker, and the lack of transparency is increasing.” This is where blockchain can step in, he says. According to Zoldi, blockchain can be used to audit AI development and implementation. Through the use of blockchain, every task and test in the development progress can be recorded.

“The blockchain is not just a checklist of “I met my task,” it’s a successive chain of successes and failures,” says Zoldi, “it records the whole process and every stage.”

FICO study: Focused AI beats general models

Focused AI is the future

One of the problems with Large Language Models and Generative AI, according to Zoldi, is that “they know as much about how to make mushroom soup as financial services.” He explains, citing studies by FICO, how so-called ‘Focused models,’ trained “responsibly” on specific and focused data sets, outperform generalist AI on ‘instruction following’ and ‘financial knowledge,’ while generalist models only outperform on ‘universal knowledge.’ This suggests focused models may be better solutions for many companies.

Blockchain makes for a responsible AI

Blockchain is the key to responsible AI

Scott Zoldi rounded off his keynote by emphasizing that generative AI can provide significant value and efficiency, but it is not a perfect tool. This is why there is a need for an increased level of auditability, transparency, and monitoring—something the blockchain can provide.

“We need the immutability of the blockchain to know when we should apply AI,” says Zoldi, concluding that “blockchain is the key to responsible AI.”

Panel discusses building trust in AI systems

“Trust is what drives society forward” – Sebastian Thrun

A panel discussion on building trust that can be proven is now ongoing at the visionary stage, where Danny Fortson is moderating four experts who examine the connection between training data and creating a system with a foundation of trust. Fortson emphasized that finding a real use for AI and a return on this investment should be looked upon, setting the tone for the discussion.

Breaking down EU’s MiCA law

MiCA: Europe’s landmark digital asset legislation

Over at the insights stage, we’re getting treated to a full-bore exposition of MiCA, the EU’s landmark digital asset regulation now in force, moderated by Juan Iganacio Ibanez, the general-secretary of the MiCA Crypto Alliance. The Alliance is set on coordinating and supporting the industry as they get compliant with the new law.

Panelist Seamus Andrew, founder at Velitor Law, speaks of the seachange of which MiCA is a part: “We’re increasingly seeing disputes about contracts that have blockchain provisions in them that haven’t been interpreted by the courts before. We’re seeing a flood of new work relating to the MiCA regulations, advisory work on how people can protect themselves and be prepared for what MiCA is doing.”

Banking leaders discuss MiCA’s impact on ‘crypto’ regulation

Stablecoins a key transition point in MiCA

The EBA’s Christian Moor identifies stablecoins as a dynamic of interest under the MiCA regime.

“In Europe, it’s more dynamic between stablecoin issuers and CBDC issuers. Back in August, industry complained at a global level that the bar for crypto standards were too tough and outdated. That’s being reexamined and something might come out of that.”

Velitor Law’s Seamus Andrew agrees, saying that the MiCA requirement that so much liquidity be held in bank deposits is causing a lot of controversy among Velitor’s client base. “I think the way it’s perceived is – one can understand why that’s necessary from a banking perspective – one has to keep some sort of control of the banking system and the deposits in banks are such a fundamental part of the system, if one were to lose control of that it’d be potentially problematic.”

Blockchain will make us trust AI’s future

Most great inventions are not linear; Blockchain stands for trust.

Back at the Visionaries Stage, Sebastian Thrun and Scott Zoldi shared a bold prediction: blockchain could become the backbone of the next AI revolution—especially in the rise of Agentic AI.

In an era where artificial intelligence blurs the line between fact and fiction, Zoldi argues that blockchain may be the key to restoring trust.

“The average consumer will trust a ChatGPT more than a scientific expert,” Zoldi warned. “That’s a problem. So what is truth anymore? AI isn’t a storage of truth—and that’s exactly where blockchain will play a critical role.”

AI as Language Model: Change your perception

“AI is based on language behavior.” – Tatiana Kalganova

AI should still be considered as a language model, Tatiana Kalganova of Brunel University said at the “Auditable AI: Building Trust You Can Prove” panel. She sees that AI is still built on data and predictions and must not be treated as a “magic card.”

“All these large language models… they are based on language behavior. We are not putting inside protocols, how we get used to working on to get the answers and the agenda is key.”

“People [must] start to change mind and don’t treat AI as a magic box,” Kalganova.

Redefining money amid fintech upgrades

With blockchain upgrades in finance, the average retail user benefits from fewer intermediaries, greater liquidity, enhanced protection, and freer capital flow. It truly empowers people, said Tezos Co-founder Arthur Breitman.

For Lasha Antadze, Founder at Rarilabs, recent tech upgrades are turning money into a product, allowing corporations to leverage it in new ways to generate more value.

Crypto innovation vs. global regulation

Tezos Co-founder Arthur Breitman argues that imposing strict rules can stifle innovation, suggesting that private contracts is better suited for the industry. He pointed out that much of the sector exists precisely because traditional practices were inadequate or flawed, creating a space where new approaches can emerge.

“Regulation is harmful. This entire industry existed because the industry is bad, said Breitman, adding that “regulation is not here to save the day.”

What’s particularly interesting to watch in the coming years is how the U.S. push for crypto development will interact with the regulatory frameworks being implemented in the EU and other regions around the world, said VP Business of Corporate Development at MNEE Nakul Chandraraju. Observers are now eager to see whether these differing approaches will clash, align, or create new opportunities for cross-border innovation.

Smart Contract Security: Key insights from the experts

Lessons from the frontline: smart contract security

After lunch, we’re back at the Insights stage for a session on Smart Contracts Security: Lessons From the Front Lines.

Luca Piermarini, co-founder of the Blockchain Student Association in Italy, was joined by three professional panelists, each with hands-on experience with smart contracts and the central role they’re beginning to play. As Piermarini said:

“With that central role comes significant risk. New attack vectors, cross-chain vulnerabilities, while others, such as quantum computing, may challenge our notions of digital trust.”

Quantum risks are coming

Risks posed by quantum computing risk must be addressed now

There’s one big looming threat that all panelists seem to acknowledge: quantum computing. Even though the technology might seem far-off, developers need to start thinking about it today, as David Lello, CEO at Burning Tree explains: “Right now, that issue is one that isn’t real today because quantum computing is not at the mature level it needs to be to become the threat it’s going to be. But it’ll take long enough for us to solve the problem that we should be starting today to address it.”

Catch up or miss out on Web3

Don’t get left behind in the age of Web3

Speaking to the ‘Innovation Stage’ of the London Blockchain Conference, Professor Naseem Naqvi, founding President of the British Blockchain Association (BBA), explains how he helped put together the United Kingdom’s ‘blockchain roadmap.’ He starts by posing the question: “Why is blockchain strategy important?”

His answer is, “because we have a national strategy for everything,” pointing to AI, education, industrial strategy as examples.

“Without a national plan and strategy a country can’t go anywhere,” says Naqvi.

Bitcoin shakes up capital markets

Next up on the Insights Stage: Capital markets.

Specifically, we’re hearing about how Bitcoin is transforming Treasuries as a reserve asset and beyond.

Described by moderator Stefania Barbaglio, CEO at Cassiopeia Services, as the greatest panel session at the conference, it certainly has the roster to back that up: Barbaglio is joined by Yves Choueifaty, President and CIO at Tobam; Andrea Maria Cosentino, CEO at Impact Fundry; Roy Kash, CEO at Falconedge and Alex Green, Counsel at Norton Rose.

From slow trades to instant settlements

Capital markets are “slow, fragmented and costly” says Steve Haigh, Chief Technology Officer of U.K.-based financial services company Tokenovate. He tells a standing room only audience at the ‘Innovation Stage’ of the London Blockchain Conference how in traditional capital markets “it can take up to two days after a trade is made for the assets to be settled.” This, says Haigh, introduces risks, disrupts further trading, and affects the market more broadly.

“We believe this is where a blockchain can come in and help,” he says. For this reason, Tokenovate have adopted distributed ledger technology. Haigh says Tokenovate’s blockchain protocol has been proven to deal with a million transaction per second and is fit to be a global payment network.

Elata: Shaping the future with the Internet of Brains

Building the “internet of brains”

At the “Innovation stage” of the London Blockchain Conference, Elata co-founder Andreas Melhede introduces what he calls “the internet of brains,” a crypto-powered platform designed to accelerate neuroimaging.

He explains how Elata is helping build this decentralized ‘internet of brains’ as an open-source network that empowers global collaboration in everything from game development to advancing neuropsychiatry technologies and research.

Trading reimagined: Minutes, not days

Real world assets on chain can be traded in minutes

Haigh shows a video demonstrating how quickly and efficiently a trade can be made and settled on the blockchain. The whole trade happens including finalization, in less than five minutes. It is achieved by putting real-world assets on chain via a “digital twin.” This almost instantaneous trade means that the assets can be “put to work” immediately, without having to wait the lengthy settlement and finalization periods associated with traditional capital markets.

Stablecoins: The quiet revolution roars

“It’s not hype at all.”

Chairing the panel is Kene Ezeji-Okoye, Chief Blockchain Officer at Ubyx. He says the panel was originally pitched as ‘the quiet revolution’ of stablecoins.

‘Safe to say, the revolution is not so quiet anymore.’

This change he attributes to big catalysts: Trump’s election, the Stripe acquisition of Bridge, and the passage of the GENIUS Act.

Marian Scheele, senior counsel at Clifford Chance and the Tech Team lead in Amsterdam, agrees: “It’s serios business right now. It’s not hype at all. The figures speak for themselves. What we see now is the huge dominance of USD backed stablecoins. But we also see there’s a lot of interest in other types of stablecoins.”

What’s more is they’re being used in many ways; not just payments but cross-border payments, settlements, treasuries, and they’re being used by TradFi, too.

Now we see many more use cases—they’re used for payments, cross-border payments, settlements, treasuries, and not only ‘crypto’ parties but also, particularly when talking about issuance, TradFi.

Stablecoin surges in on-chain activity

Stablecoin summer: 30% of on-chain activity is stablecoins

We’re in a stablecoin summer, says Luke Dufour of TRM Labs. Work from his company shows that 30% of all on-chain activity is related to stablecoins—a staggering figure.

Part of what kicked this off, according to Dufour, is that regulations such as MiCA and the GENIUS Act have cleared a path for institutions to adopt stablecoins in a manner that might not have been possible otherwise.

MiCA vs GENIUS Act: Who rules stablecoins?

A pointed question from the moderator: Does MiCA do enough to support EU stablecoins compared to GENIUS Act?

Scheele says the GENIUS Act is focused on stablecoin use for payment purposes only, which isn’t the case for MiCA.

“What they both try to do is to build trust in stablecoins: You must have a license, a reserve of assets, must redeem instantly if a holder wants. So, in that sense, it’s more or less the same, but there will be differences.”

She also echoes the same thought expressed by Donega: Under MiCA, there will be possibilities for local regulators to stop the use of non-EU stablecoins in the market.

Facing Dollarization: The rise of local currency stablecoins

Stablecoins: Is dollarization a risk?

What can jurisdictions like the U.K., the EU, and even smaller jurisdictions do to stand up against a wave of USD stablecoins? Riccardo Donega, blockchain engineer at Italy’s Banco Sella, points out that currently, USD stablecoins are mostly used for trading activity rather than representing any real customer base, say, a bank.

Donega says that once banks enter the market, they’ll attract new clients. If they start offering local currency stablecoins—perhaps paired with some regulatory nudging from strong jurisdictions such as the EU—that might rebalance the scales between USD stablecoins and others.

adeus: Blockchain solutions for hassle-Free wills

adeus, providing blockchain solutions to contested wills

Less than half of all adults have a will, and less than 41% of people in the U.K.. There’s a perceived barrier, it’s inconvenient, it’s stressful. And even when people do make wills, they can be challenged for a range of reasons. How do you make this process more accessible while ensuring that people’s wishes are followed?

The answer, says Mark Hedley, co-founder and COO of ‘adeus,’ a digital-first wills and legacy planning platform, lies in blockchain technology. “We’re finally moving on from paper wills in the U.K.,” says Hedley, speaking on the ‘Innovation Stage’ at London Blockchain Conference. “Now it can be done electronically, using digital ID, using digital signatures.”

According to Hedley, this information is then stored on the cloud, and a digital fingerprint is placed on the blockchain, allowing provenance to be proven. This way, a system that has remained largely unchanged since 1837 can be brought up to date.

Blockchain can solve many of the reasons wills are contested. “adeus true wills makes sure a will is executed properly,” says Hedley. “If you have it on blockchain, its immutable, it can’t be edited, it can’t be deleted… if there’s any question about the will we can prove its provenance.”

Mental capacity is another major reason wills are contested. Hedley says adeus is also working on a mental capacity assessment that can be put on blockchain at the time of making the will, which negates such challenges.

Blockchain and AI for everyday use

Building blockchain and AI applications for millions of everyday users

Next up is the afternoon keynote session, which explores how the masses are likely to interact with technologies like blockchain and AI. The speaker is Anthony Day, Marketing Director at VeChain.

To set up his point, Day takes a poll. Who has used AI this week? Virtually the whole room raises its hands. Blockchain? A little less, but still many. Applications on mobile? Everybody, of course.

“Important distinction: blockchain in isolation, as infrastructure, as a domain, is really hard to contextualize. For the most part, what blockchains give you are building blocks that sit underneath applications.”

This sits at the core of Day’s keynote: that these tools— AI included—are infrastructural. It doesn’t make sense to spend too much time talking about ‘using’ blockchain or even sending adoption into the stratosphere.

“Ultimately, we’re not trying to maximize blockchain—we’re trying to maximize the appropriate use of blockchain in places that fit in applications that humans can use.”

AI Agents to handle 80% of blockchain transactions by 2030

80% of blockchain transactions could be managed through AI agents by 2030

Agents are applications that perform tasks on our behalf—and they’re getting significantly better. And they’re going to keep getting better, says Day. They’ll interface between all of your disparate apps, even without having to ask it to do so.

Day shows a statistic on screen that makes the room raise their smartphone cameras: 80% of blockchain transactions could be managed through AI agents by 2030.

VeChain’s VeBetter: Merging AI and blockchain for good

AI and blockchain enable real-world impact

Anthony Day starts to talk about the company he’s a part of: VeChain. Their product, VeBetter, already integrates blockchain and AI: it’s an app-store-like platform that hosts applications that reward people for doing things that are better for themselves and the planet.

It allows customers to receive micro-rewards from completing small actions—whatever the app owner wants to incentivize. This could involve large institutions nudging customers towards sustainable actions that can both improve the world and contribute to the institution’s ESG targets, or a sports team trying to drive engagement.

The platform already tokenizes over one million real-world actions each week.

Mastering your narrative in TradFi and DeFi

How do you tell your story in the TradFi and DeFi spaces? Laura Estefania, founder and CEO of Conquista PR, a strategic communications consultancy, explores this business-crucial topic in her talk at the London Blockchain Conference.

“One of the most important currencies is your narrative and knowing how to tell a story,” says Estefania. She goes on to explain that she is seeing a surge in crypto coverage from top publications, for better or worse.

In the worse—during times of crisis—this is when PR becomes more important than ever. She points to the prominent examples of FTX and Argentine President Milei as PR response done badly in crisis.

Conquista PR, says Estefania, assists companies get their messaging correct and change public opinion in order to give companies “authority” in the market.

Regulation: A competitive edge in digital asset custody

Regulation can be a competitive advantage, says Carol Lago

Digital asset custody is evolving, but why does it matter? According to Blockchain & Web3 strategy advisor Carol Lago, “custody is the cornerstone of trust and institutional adoption.”

Lago tells the London Blockchain Conference “Innovation stage” how “custody is transforming into intelligent infrastructure, enabling tokenization, CBDCs and regulatory alignment.”

On the latter point, she suggests that MiCA (the EU’s landmark digital asset regulatory framework) has opened the door in the EU for firms to “achieve things,” as has the UK Financial Conduct Authority’s work in the area – regulation, says Lago, is not an obstacle but a competitive advantage to those who work with it.

AI transforms custody into predictive trust layer

According to Carol Lago, the advancement of AI is turning custody “from reactive to predictive.” This matters because the next wave of regulation, from DORA to MiCA, will expect intelligent design, says Lago.

She concludes by saying that “custody is not the end of the chain, it’s becoming an intelligent, programmable trust layer,” but that “regulation and institutional design must advance together.”

Exploring regulatory insights with FCA’s Jane Moore

Fireside Chat: A regulator’s perspective

The Visionary Stage’s penultimate session offers the regulatory perspective: Jane Moore, head of department for payments and digital assets at the Financial Conduct Authority, joins the BBC’s Mark Lobel for a fireside chat.

“We’re going to find out tonight: what Jane thinks, what she does, what she thinks she needs from you: founders, innovators. And also what goes on behind the scenes at FCA and where international collaboration works and doesn’t work.”

Ending ban on crypto exchange-traded notes in the UK

Moore lifted the ban on crypto exchange-traded notes

Whether the room is conscious of it or not, Moore is responsible for one of the biggest headlines to come out of the U.K. regulatory environment in recent weeks: she recently lifted the ban on retail access to crypto exchange-traded notes (CETNs) in the United Kingdom, allowing their inclusion in ISAs and other tradfi instruments.

Now, her focus is on the U.K.’s ‘crypto’ roadmap. Over the course of the year, Moore and her team issued consultation papers and discussion papers as they developed the regime for crypto in the U.K.

Creating law is more rewarding than just interpreting it

Making law is better than interpreting it

What drives a regulator? For Moore, coming from a background of corporate law, she says she ultimately found the idea of making the law far more satisfying than interpreting it.

“I enjoy problems and making things better: making sure crypto will be safe for public use.”

“There are so many parallels to existing finance and regulation, so we get to look at what’s already in place, look at what doesn’t work and what doesn’t work.. and then develop a regime that delivers what it needs to deliver – consumer protection and market integrity – while protecting innovation.”

Jane Moore emphasizes dialogue as key to effective policy-making

Moore: “Being alone in a room is not going to make us good policy: talking is going to make us good policy.”

For the entire roadmap, Moore says she has spoken to hundreds of firms and people around the world. They’ve held roundtables and policy sprints, and one in particular —April 2024—brought together 100 people at the FCA’s Stratford office to brainstorm wholesale policy ideas.

“You can see the trail form the ideas we mooted at the time, through the discussion paper and the final result.”

“Being alone in a room is not going to make us good policy: talking is going to make us good policy.”

Resify: A blockchain app to combat phone addiction

Tackling the mental health crisis with blockchain

Alec Burns, head of R&D at VeChain, introduces Resify, an app designed to help tackle the mental health crisis.

“I think one of the biggest problems is phone addiction… there’s been a billion-dollar industry built around attention,” says Burns. “We’re trying to address that.”

The way they do this, he says, is by “rewarding people for not using their phone.”

“You can earn money for not using your phone,” says Burns. “We can reward people in a decentralized way to solve the problem before it occurs.”

He explains that the “business result” is a potential huge benefit to the NHS, in terms of money saved on mental health treatment.

“This is Web3 for real-world problems… and we’re just getting started,” says Burns.

What constraints do regulators face?

Regulators’ biggest constraints

Enough with the positivity: what are the constraints on the regulatory side that innovators miss?

FCA’s Jane Moore says it’s the breadth of the regulations that apply, and the fact that “we have to balance market integrity against innovation and competition to an extent.”

“We are looking to support growth, we’re looking to support innovation, but it has to be right for the U.K. and it has to be right for consumers.”

VeChain’s VeBetter rewards users for sustainable actions

In a presentation on the “innovation stage” of the London Blockchain Conference, Jake Campton, communications and social media lead at blockchain protocol VeChain and Alec Burns, explain the ideals behind its VeBetter DAO ecosystem, aimed at rewarding sustainability.

“What VeBetter DAO does is allow you to bootstrap applications to solve real-world problems,” says Alec Burns, head of R&D and VeChain.

Once an application is launched, Campton says users can then get rewarded for sustainable actions.

“We have a green TVL growing at the moment,” he adds.

MetaMate app incentivizes sustainable energy

Rewarding lower energy use through blockchain

Dougal Rea, DevOps Engineer at VeChain, tells the London Blockchain Conference Innovation Stage about MetaMate, an app designed in the VeBetter ecosystem to “redefine household habits” and incentivize more sustainable behavior.

By rewarding lower energy usage, MetaMate uses financial incentives to “tap into subconscious behavior.”

“The lower your consumption, the higher your reward; the higher your consumption, the lower your reward,” explains Rea.

More frequent uploads of energy readings are also rewarded, incentivizing increased use of the app and further changing bad habits into good.

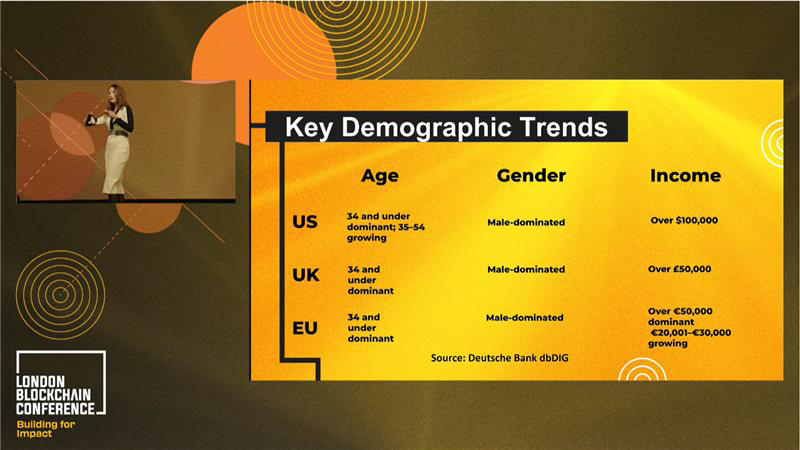

Men dominate global digital asset adoption statistics

The statistics

To answer these questions, Yarovaya references research her outfit conducted in partnership with Deutsche Bank, which conducted a repeated survey across major jurisdictions. This means that 3,400 consumers were surveyed monthly between August 2023 and June 2025, resulting in 78,200 responses.

It shows that across the globe, adoption has been dominated by under 35 males (though in the U.S., the 35-54 bracket is growing), typically with higher incomes (over $100,000 for the U.S., over £50,000 for the U.K., and over 50,000 EUR for the EU—though lower incomes are growing fast).

This matters because if digital asset companies continue to target these narrow demographics, they’re leaving a lot of meat on the table.

Political rhetoric fails to boost crypto adoption rates

Regarding Trump’s endorsement, Larisa Yarovaya shows there was no sharp rise in adoption immediately afterward. In other words, political rhetoric alone is insufficient.

What is growing is investment use, while transactional use remains limited.

- • Peak in U.S.: 15% used crypto for purchases in October 2023.

- • In EU, there’s a consistent 4-6% transactional usage

- • U.K. fluctuates between 3-7%

Barriers to crypto adoption in EU remain significant

How about barriers?

Larisa Yarovaya of the Centre of Digital Finance continues to roll through adoption stats, now focusing on barriers to adoption: in the EU, 40-44% view crypto as ‘too risky’, with the higher risk perceptions coming from Germany.

The knowledge gap also remains huge: 65% of customers in the EU report minimal-no understanding of digital assets. The highest knowledge gap exists in France, Germany, and Italy. Spain is better positioned, with 25%-32% reporting ‘fair knowledge.”

Key factors and barriers influencing crypto adoption today

What are the determinants of crypto adoption?

Larisa Yarovaya of the Centre of Digital Finance begins discussing determinants of adoption. She highlights four key factors: age (younger users are most likely to adopt), gender (women are almost half as likely to adopt), income (higher income = more adoption), and employment (full-time workers are most likely to invest, whereas part-time workers are more likely to use digital assets for purchases.

As for barriers, Yarovaya identifies three big ones: volatility (especially in Germany), environmental concerns (especially in Italy), and fraud (this is the barrier that most clearly reduces adoption).

“If you’re introducing a new product, make sure that it has by no means been associated with fraud. That’s what will kill trust in your product and prevent users from using it.”

Larisa Yarovaya highlights the need for education in crypto

We shouldn’t confuse the actual adoption rates with prices and market capitalizations. “These are useful markers, but we really need to observe and monitor what is happening with actual adoption.”

Next, retail lags behind market hype. Only educating customers on what cryptocurrency is and what blockchain is will bring them up to speed. Yarovaya says their surveys show the knowledge gap and that it needs to be addressed. “It’s a key bottleneck.”

For regulators and other industry stakeholders, education is again key. Everything that helps customers trust products will encourage them to buy and use them. Everything that could potentially cause your customer to lose confidence in your product or team must be addressed through education.

Mandulis Energy transforms waste into energy using blockchain

Mandulis Energy: Turning waste into energy via blockchain

How can we, as a world on the brink of climate catastrophe, begin to meet the challenges of becoming carbon neutral before it’s too late?

Elizabeth Nyeko explains to the London Blockchain Conference how the company she co-founded, Mandulis Energy, is applying blockchain technology to meet this most vital of challenges.

She demonstrates how her company is already assisting communities in a remote corner of Uganda in converting their waste into carbon credits, which they can use to purchase electricity, utilizing blockchain to track and log the process.

“Our system delivers real-world impact, changing lives on a day-to-day basis,” says Nyeko. Using smart contracts, “farmers are paid in energy credits the moment the biomass is verified.”

And Mandulis Energy is scaling the project, with twelve sites in Africa already and eight more in development.

Can blockchain transform government procurement processes?

Can blockchain improve outdated government procurement?

Governments spend $13 trillion per year on public procurement, says barrister Brian Sanya Mondoh, speaking at the “Innovation Stage” of the London Blockchain Conference.

“What’s important in public procurement is end-to-end transparency,” says Mondoh. This can be affected by a range of factors, including unreliable suppliers, regulatory changes, market volatility, human error, and inefficient processes.

To improve transparency in public procurement, Mondoh says, “We have blockchain.” However, there remains an issue of whether to use a public or private blockchain—there are positives and negatives to each, he suggests.

“Could we come up with a system where there’s a hybrid blockchain?” asks Mondoh. He also suggests using different blockchains for different needs, if certain information needs to stay private. Another idea he posits is whether zero-knowledge proofs could be a consideration for things such as sensitive defense contracts.

“I don’t have the answers,” says Mondoh. What he does know is that “it’s early days, because the old guard sitting in those institutions [governments] don’t understand what’s going on” – this gap in understanding amongst governments and officials, of the possibilities and challenges of these new technologies, means that change will be slow, concludes Mondoh.

Day 1 at London Blockchain Conference concludes—join us for Day 2!

That’s a wrap for Day 1 of the London Blockchain Conference 2025. CoinGeek will be reporting live from start to finish for the second and final day: join us back here tomorrow.

10-22-2025

10-22-2025