|

Getting your Trinity Audio player ready...

|

Stocks soared after the announcement, but will this finally save the company from dying again?

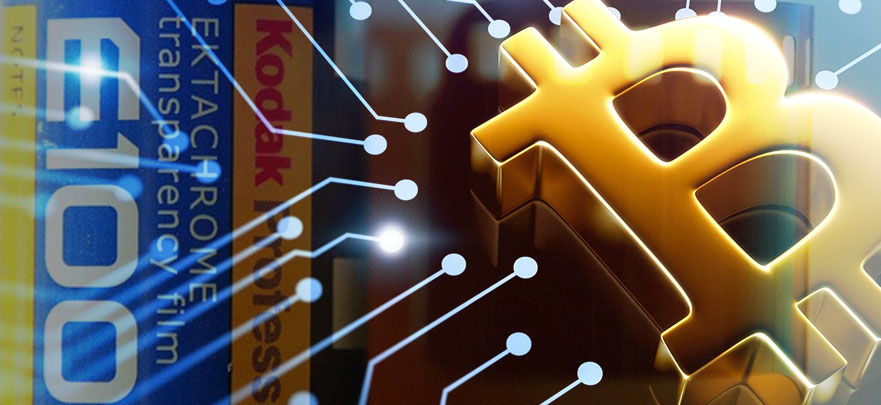

Kodak has announced that it’s getting in on the blockchain trend with three core products: its own cryptocurrency, an image rights management platform, as well as plans to line up BTC mining rigs in their Rochester, New York headquarters—which they plan to rent out under the brand name Kodak Kashminer.

And as is the trend nowadays, any company attaching the word “blockchain” to its name will see its stocks rocketing by the multiples—whether the venture has any credence or not. In the case of Kodak, it more than doubled to a high of $7.65 after the announcement and closed at $6.80 by 4pm yesterday from its record-low of $3.05 in January 4. Could this be the move that will finally lift them up from the ashes of collapse and restore their glory days?

As we know, ICO’s can potentially rake in ginormous amounts of money. Obviously, that fact is not lost to the struggling company.

The past decade has been rough for Kodak: as the transition to digital cameras outdated their longstanding bread and butter, and they struggled to keep their chunk of the market. Last year, in a fifth anniversary feature of Kodak’s 2012 Chapter 11 bankruptcy protection filing, Forbes contributor Tendayi Viki powerfully described the tragedy behind the historic brand’s temporary collapse, when it tried to stifle the invention of the digital camera by their own engineer Steven Sasson in 1975. Kodak did not want the digital camera to come out and dislodge its hold on the photography film market, which was then raking them large profits. Despite eventually caving in and releasing the new cameras, Kodak ultimately lost the market to competitors innovating faster based on the new technology, and delivering them cheaper.

“The tragedy is that Kodak invented the change that eventually killed it.

…It is not that Kodak had failed to imagine a new future. It had failed to capitalize on the imagination and inventiveness of its scientists.”

Kodak has been trying to get back on its feet, but things have been shaky since.

Kodak pairs this ICO with the value proposition of giving photographers control over their image property rights—a blockchain-powered eye monitoring any unauthorized use of their images, which seems like a dignified use case. The token would supposedly function as a medium of exchange for image licensing within this photographer community.

As the cryptocurrency trend is booming, there are far too many ICOs sprouting out while very few are worth any attention. Since Kodak is a historic name, it undoubtedly catches the eye. But based on the company’s history of fickle (and failed) attempts at restoring their relevance, this venture could very well be just as volatile.

02-26-2026

02-26-2026