|

Getting your Trinity Audio player ready...

|

The former head of Chinese mining company Bitmain is reported to be launching a new startup as soon as July, with a focus on crypto services.

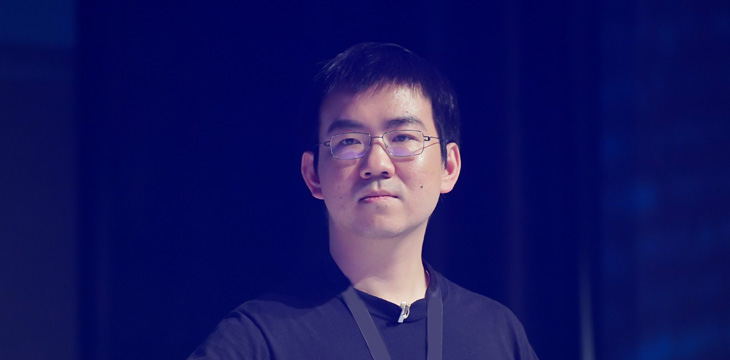

Jihan Wu, the ex-CEO of the crypto mining giant, will launch his new custody and trading firm Matrix next month, with Bitmain understood to be one of the first and most significant clients of the company, The Block reported.

Sources familiar with the matter told the crypto news outlet that Matrix was incubated during Wu’s time at the crypto mining manufacturer, and that the firm is expected to continue to work closely with Bitmain after launch. Should Matrix offer custody and trading services to Bitmain as anticipated, this is expected to create a “liquid pool” for its over-the-counter (OTC) trading service.

According to one of the insiders, the partnership would make Matrix instantly the biggest OTC desk and asset manager of its kind. They said, “Put it this way, they will be the biggest OTC desk and asset-manager [in the world] overnight…With liquidity like that, [low] prices follow.”

Wu, currently facing several lawsuits including one filed in Florida, and Micree Zhan resigned from their positions as co-CEOs of Bitmain in early 2019, and were succeeded by Haichao Wang, formerly the product engineering director at the crypto mining maker. Now under new management, Bitmain is reportedly pivoting away from Bitcoin Cash (BCHABC) and now focusing on building “a long-term, sustainable business.”

Wu’s eventual role in the project remains unclear, amid reports that he had already been demoted from a board director to “supervisor” in November.

Question marks remain over how the project will be interpreted by authorities in China, where an outright ban of cryptocurrency remains in force. Some sources have suggested Matrix is likely to operate through an offshore holding company, and could ultimately gain a discreet nod of approval from the Chinese state.

Sources close to the firm claimed, “It’s more of a ‘if we can’t beat them, how do we direct them’ attitude,” adding, “This is going to make Asia the new centre of gravity for crypto OTC.”

03-09-2026

03-09-2026