|

Getting your Trinity Audio player ready...

|

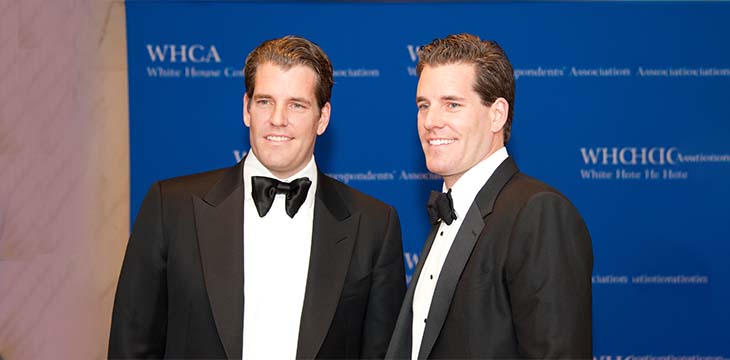

Gemini exchange and its founders, Tyler and Cameron Winklevoss, are facing a class-action lawsuit over their interest-bearing accounts. Investors allege that the exchange offered securities without registering the products with the U.S. Securities and Exchange Commission (SEC).

The lawsuit was filed in the Southern District of New York by investors Brendan Picha and Max J. Hastings on their behalf and “others similarly situated” this week.

Gemini has been offering interest-bearing accounts under the Earn program in which they promised investors up to 7.4% in interest, the filing claims. The offering qualified as a security, but the Winklevoss twins failed to register it with the SEC, violating securities laws.

Then, in mid-November, Gemini suddenly halted redemptions for all its Earn program customers. This was after its main trading partner, Genesis Global, was hit by the ‘crypto contagion’ that claimed FTX, Alameda, and related firms. Some reports claim that Genesis and its parent company, the Digital Currency Group (DCG), owed over $900 million to Gemini Earn program clients.

“When Genesis encountered financial distress as a result of a series of collapses in the crypto market in 2022, including FTX Trading Ltd. (FTX), Genesis was unable to return the crypto assets it borrowed from Gemini Earn investors,” the filing states. As a result, Gemini “refused to honor any further investor redemptions, effectively wiping out all investors who still had holdings in the program.”

On December 23, Gemini provided an update on its website, saying it was working with utmost urgency to resolve its liquidity crisis.

The investors claim that had Gemini registered the product with the SEC, they would have received adequate disclosures before investing that would have allowed them to better assess the risks involved.

In response, the exchange says it’s “committed to providing a secure and compliant platform for our customers” and will be “vigorously defending itself against these baseless allegations.”

Interest-bearing accounts have become a common feature in the digital asset industry, and during the bull market, their business model seemed to be working without a hitch. However, this year’s bear market has exposed most companies, with some of the biggest players, including Celsius Network and BlockFi, going bust.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple,

Ethereum, FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

02-25-2026

02-25-2026