|

Getting your Trinity Audio player ready...

|

Contrary to popular belief, many initial coin offerings (ICOs) had the foresight to sell their Ethereum (ETH) and profit off their holdings before the price of the coin fell, according to a new report by BitMEX Research.

ETH’s downward trajectory has partly been attributed to ICO projects panic selling their “large treasure trove of Ethereum” in order to pay their bills. However, a recent BitMEX analysis showed that a lot of ICOs had already sold off their coins before the current steep drop in prices and made profits.

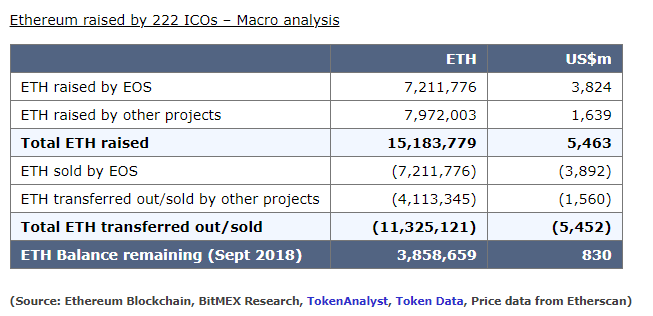

The BitMEX team analyzed 222 projects, which raised an estimated $5.5 billion worth of Ethereum—and were believed to have already sold almost exactly the same amount, at least in U.S. dollar terms.

“These ICOs currently hold 3.8 million Ethereum, around 25% of the Ethereum they originally raised,” according to BitMEX. “However, in US$ terms, these projects have essentially sold the same amount of Ethereum which they originally raised, leaving them a nice holding of US$830m of Ethereum.”

To show the profit and loss realized by Ethereum-based tokensales, BitMEX came up with two columns—one contained the ETH raised and sold by EOS, and another for other projects. EOS, during its year-long fundraiser, managed to raise about the same amount of ETH as the rest of the market put together, which was why it was placed in a separate column.

An analysis of the 222 ICOs showed that close to 15.2 million ETH were raised. Of this number, some 11.3 million coins have been transferred out or sold, leaving behind a collective balance of 3.85 million ETH.

Furthermore, the research showed that older ICO projects that raised their funds in early 2017 got a lot of profits after selling their ETH holdings. In comparison, projects that raised funds in late 2017 and early this year experienced some losses. According to BitMEX, “Despite the peak to trough 85% fall in the value of Ethereum, the projects are still sitting on unrealized profits of US$93m.”

5/ It is not a rosy picture for every ICO. The below chart shows the projects with the largest net losses from holding Ethereum. The overwhelming majority of the losses are unrealised. pic.twitter.com/2YyvWAfW3t

— BitMEX Research (@BitMEXResearch) October 1, 2018

In conclusion, BitMEX noted that ICO treasury accounts have a lower level of exposure to ETH price, saying many projects “essentially made out like bandits”—at least with their ETH holdings.

“Quite what this means for the Ethereum price going forwards is unclear, however we believe we have shown the ‘panic sell’ thesis is either false or will only occur to a lesser extent than some expect,” according to BitMEX.

02-22-2026

02-22-2026