|

Getting your Trinity Audio player ready...

|

The Ethereum Classic (ETC) network suffered yet another 51% attack on August 29, resulting in a 7,000 block re-org. It marks the third 51% attack on the network in August, with the first taking place on August 1 followed by another on August 5.

Today another large 51% attack occurred on the #ETC network which caused a reorganization of over 7000 blocks which corresponds to approximately 2 days of mining. All lost blocks will be removed from the immature balance and we will check all payouts for dropped txs.

— Bitfly (@etherchain_org) August 29, 2020

Low hanging fruit

The ETC network is repeatedly being 51% attacked because it is relatively easy—and cheap—to attack. On the Crypto51 site, which calculates how much it would cost to 51% attack a blockchain for one hour, it was found that it would only cost $5,332 to 51% attack ETC—and it is only going to get cheaper unless the ETC community comes up with a solution to mitigate the chance of a 51% attack taking place.

Why is it only going to get cheaper?

After each 51% attack, Ethereum Classic digital currency miners have been discontinuing their support for the network. The less hash there is pointed at the ETC network, the easier it becomes to 51% attack the network; especially since you can purchase the hash power you need to 51% attack the ETC network from the hash provider NiceHash.

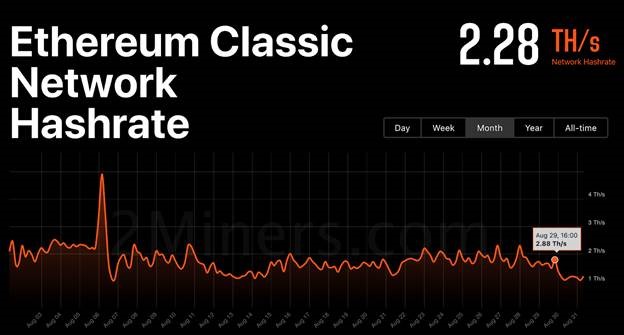

After the August 29 attack, the ETC hash rate plummeted roughly 20%, dropping from 2.88 TH/S to 2.28 TH/S post-attack.

The solution?

Ethereum Classic Labs proposed a 51% attack protection plan that includes a defensive mining strategy and a potential change in consensus algorithm, however, it has not been implemented yet.

Until a solution is implemented, digital currency service providers are encouraged to increase the number of confirmations that they require for ETC transactions.

Given the recent network attacks on Ethereum Classic, we have increased the confirmation time for ETC sent to Coinbase & Coinbase Pro to ~2 weeks. We are actively monitoring the situation and will provide updates as they become available.

— Coinbase Support (@CoinbaseSupport) August 8, 2020

Shortly after the August 29th attack, Coinbase increased the confirmation time for ETC transactions to a whopping 2 weeks (336 hours!). But until a solution is discovered, you can expect more service providers to follow in the footsteps of Coinbase, or to delist ETC, like OKEx threatened to do after their exchange experienced a $5.6 million loss due to the August 1st ETC attack.

02-22-2026

02-22-2026