|

Getting your Trinity Audio player ready...

|

Throughout the past years, several big banks have been pulling out from the Caribbean due to risks.

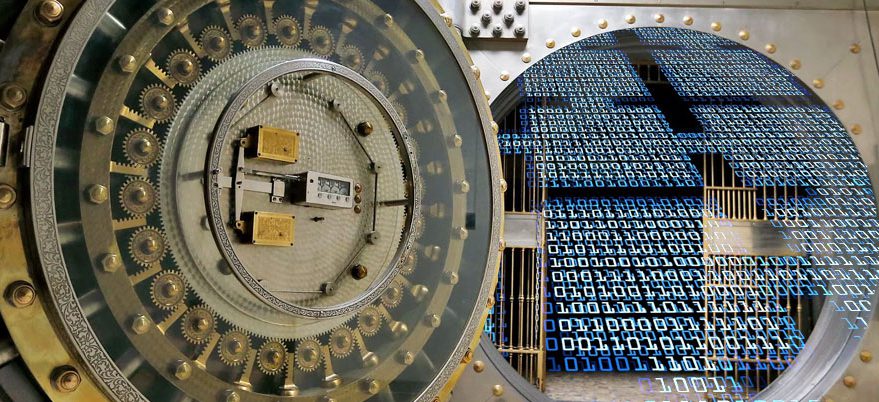

As US banks instigated tighter regulations and control to curb money laundering and terrorism financing, Caribbean countries have been hit hard and were left out in the cold with few banking options. In what is called “de-risking” or “de-banking,” banks terminate relationships—whether with people or entire countries—if the risks and costs of compliance outweigh their benefits.

“The poor and unbanked have been further squeezed as the money service businesses they patronize have been especially hard hit. For example, Jamaican cambios – small foreign currency exchange services – have faced shutdown as a result of having their local banking services terminated (Francis 2015). In the Bahamas, Western Union operations were closed in July 2015 as a result of derisking by the banks that owned the franchise (Hartnell 2015). Companies seeking to establish more innovative money service businesses, such as mobile money products and digital currency exchanges, have struggled to find banks that will provide checking account services to them.”

Due to associations with terrorism plus a history tainted by money laundering, as well as narcotics trafficking, several big banks have decided to simply pull out of the Caribbean, cutting poor countries off from global trade. Despite efforts from Caribbean fintech companies to implement KYC/AML/CFT compliance procedures, banks have shunned countries in the region.

Robert Crane Williams, Associate Information Management Officer of the Caribbean Knowledge Management Centre, subregional headquarters for the Caribbean, Economic Commission for Latin America and the Caribbean (ECLAC), has published a paper outlining potential use of blockchains and cryptocurrencies in helping Caribbean countries get back on their feet amid bank abandonment.

According to Williams, blockchains offer a safety net for institutions due to its trustless nature—the settlement and clearing systems imposed by traditional banking and the costs associated with them can be eliminated through blockchain-based systems. Instead, third parties dedicated to analysing blockchain data and risk assessment at a reduced cost can take the burden of detecting illegal activity away from banks.

Although not perfect, Williams is optimistic that upcoming developments in blockchain technology can circumvent current deficiencies, such as those surrounding privacy issues and possible abuse by government in case of a central bank-controlled digital fiat. In such cases, Williams specifies permissioned blockchains have an advantage over open blockchains like Bitcoin and Ethereum.

Blockchains and cryptocurrencies have a myriad of potential use cases, especially in the realm of financial inclusion—getting the unbanked included in the global trade. Unsurprisingly, several social impact projects are being launched and developed to maximize their potential, spanning across a wide range of industries in and beyond finance.

02-24-2026

02-24-2026