|

Getting your Trinity Audio player ready...

|

Thursday was an eventful day for the U.S. Securities and Exchange Commission (SEC). Chairman Jay Clayton and Commissioner Kara Stein visited Georgia for a town hall meeting where they discussed the future of cryptocurrencies and blockchains in the United States. Essentially, the two officials invited innovation in the blockchain space, although they’re still concerned with possible cases of fraud. Also, initial coin offerings (ICOs) are securities.

On the other side of the country, another SEC official declared that cryptocurrencies like BTC Core (BTC) and Ether (ETH) are not considered securities under federal regulations.

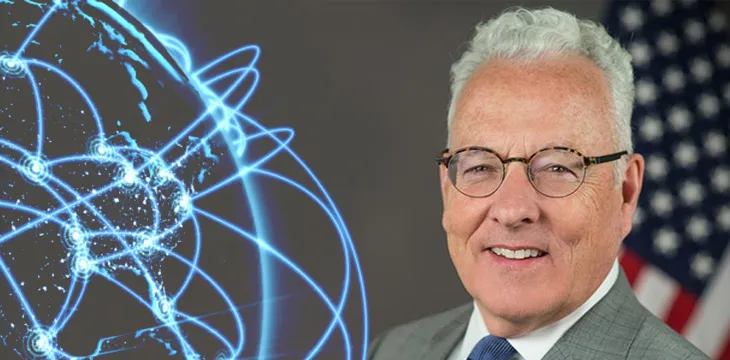

William Hinman, SEC Director for the Division of Corporate Finance, was a speaker at the Yahoo Finance All Markets Summit: Crypto in San Francisco, where he shed light on the question whether a digital asset initially offered as a security can, in the future, become other than a security. Hinman said some ICOs may fall under the securities category, but if the network on which the token is based is “sufficiently decentralized,” then the assets may no longer represent an investment contract.

“Central to determining whether a security is being sold is how it is being sold and the reasonable expectations of purchasers,” Hinman said, noting that, “This also points the way to when a digital asset transaction may no longer represent a security offering. If the network on which the token or coin is to function is sufficiently decentralized—where purchasers would no longer reasonably expect a person or group to carry out essential managerial or entrepreneurial efforts—the assets may not represent an investment contract.”

Identifying an issuer or promoter to make the required disclosures can become difficult, not to mention less meaningful, in truly decentralized networks. Hinman pointed out, “When the efforts of the third party are no longer a key factor for determining the enterprise’s success, material information asymmetries recede.”

Current ICOs claim they’re capable of creating an innovative application of the blockchain technology, but most of these business models and viability of theirpromised applications are still uncertain. To assess whether or not a digital asset is a security, Hinman said the primary factor to consider is whether a third party—a person, entity or coordinated group of actors—drives the expectation of a return.

In this context, Hinman said networks like BTC and Ethereum are decentralized, which means they fall outside the federal definitions of a standard security.

“The network on which Bitcoin functions is operational and appears to have been decentralized for some time, perhaps from inception. Applying the disclosure regime of the federal securities laws to the offer and resale of Bitcoin would seem to add little value,” he said. “And putting aside the fundraising that accompanied the creation of Ether, based on my understanding of the present state of Ether, the Ethereum network and its decentralized structure, current offers and sales of Ether are not securities transactions.”

As a whole, Hinman’s speech was positive towards cryptocurrency and its underlying technology, blockchain. He commented that there are “exciting legal times” ahead—a process that he’s pleased to be a part of.

“What I believe may be most exciting about distributed ledger technology—that is, the potential to share information, transfer value, and record transactions in a decentralized digital environment,” Hinman said, adding that potential applications of the technology include supply chain management, intellectual property rights licensing and stock ownership transfers, among others.

07-09-2025

07-09-2025