|

Getting your Trinity Audio player ready...

|

I am about to commit heresy: data is not the new oil.

It’s just not. Aren’t the following rather significant differences?

- Oil is limited in quantity. Data is infinite

- Oil is expensive to acquire. Data can be collected cheaply

- Oil can only be in one place at a time. The same data can be in many places at once

- Oil can do valuable work but gets used up in the process. Data is still valuable after value has been extracted from it.

One comparison I will grant is that both data and oil start off in less useful forms than they need to be in to be worth something. They both need refining—from crude oil to petrol or aviation fuel and from incomprehensible data points into information, knowledge or—the ultimate refinement—wisdom.

So how far can we go with that particular, in my view legitimate, comparison—especially in relation to Bitcoin? With talk of BSV powering the world economy through a unique mix of money and data, how should we manage the ‘refining’ of the binary code of Bitcoin into human-friendly forms?

If Bitcoin’s equivalent to crude oil is the inaccessible lines of code inside blockchain nodes, who are the workers getting their dungarees black and their hands greasy to make it useful? Developers? Who are the smart-suited executives financing the infrastructure through which it flows? Entrepreneurs and investors? Who are the smooth-talking marketers encouraging motorists to fill their tanks at their local petrol station? BSV proselytisers on social media?

But remember, motorists don’t like to see the oil. They stick the pump handle into the back of the car and avoid even a drop falling on their hands or feet. Is that what Bitcoin should be aiming for? That users don’t need to know about it unless they happen to be interested or are doing a school project?

I was talking to a well-informed and worldly BSVer the other day (OK, it was @EquityDiamonds) about how I thought block explorers could be more user-friendly. After all, a transaction isn’t hard to understand in principle. But when you look at the block explorer page with all those long strings, laid out as if you would know what’s what, it’s off-putting, to say the least. He was sceptical about my idea that it could be easier to understand: “It’s possible, but maybe it’s like doing auto mechanic work: it’s a bit too complicated for the ordinary Joe to be pulling things apart?”

Maybe he’s right. In the past, motorists were more likely to know what’s under the bonnet (I mean “hood”, Americans) but today’s cars are more reliable. That’s allowed their owners to know less. When I had a puncture last week, I first had to discover whether my car, which I’ve had for a couple of years, had a spare tyre. Then I called a professional to come and change the wheel for me, where in the past I would have done it myself.

When Bill Gates started computing at school, he learnt machine code and the results were delivered as strings of numbers and letters on ticker tape, as meaningless to most people as dealing with Bitcoin addresses. Today’s teenagers probably know less about how computers work than Gates’ generation.

So should we expect the same distancing from the mechanics in relation to Bitcoin that has happened with both cars and computers? When the infrastructure has been built and the system is working smoothly, nobody needs to know what’s going on beneath the hood. Yes, why not?

But hang on—you protest—data is not claimed to be the new oil because of its visibility or otherwise. It’s because they are both valuable (not that the old oil has been doing well in that department, its price having just about halved in the past ten years).

It’s true that the tech giants and big financial institutions have grown rich on data—acquiring and organising it on a scale not possible until now. And it’s true that, with its low transaction fees and massive scaling potential, Bitcoin SV looks all ready to grab some of that kind of business.

If the comparison is simply to say that data is valuable, ubiquitous and makes the world go round, then oil isn’t such a great example of something that does that. As I said, its supply is limited, it gets used up and you can only acquire it by investing in rigs, pipes and other expensive kit.

So, with the promise of BSV’s data-handling properties, data will be the new …what?

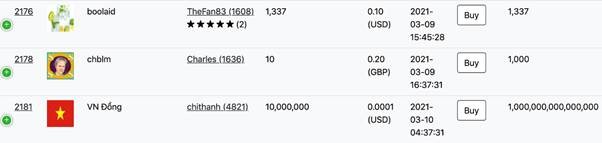

Well, look at the explosion of tradeable tokens. There are already more than 1,200 listed on Bitcoin Token Exchange (including my own highly sought-after chblm tokens):

There may not be many world-beaters among this lot—any more than there were many websites among the first on the World Wide Web that are used today. But the principle has been proved: Bitcoin can host tokens which can be easily and cheaply created and traded.

And tokens are data: they are receptacles of information—about people and institutions and the contractual relations between them. It will only take one more creative leap for someone to figure out why we need them in our lives—to buy and sell, boast about, complain about, envy our friends for.

At that point, it will be clear enough: data is the new…money.

Recommended for you

The views expressed in this article are those of the author and do not necessarily reflect the position of CoinGeek.

03-07-2026

03-07-2026