|

Getting your Trinity Audio player ready...

|

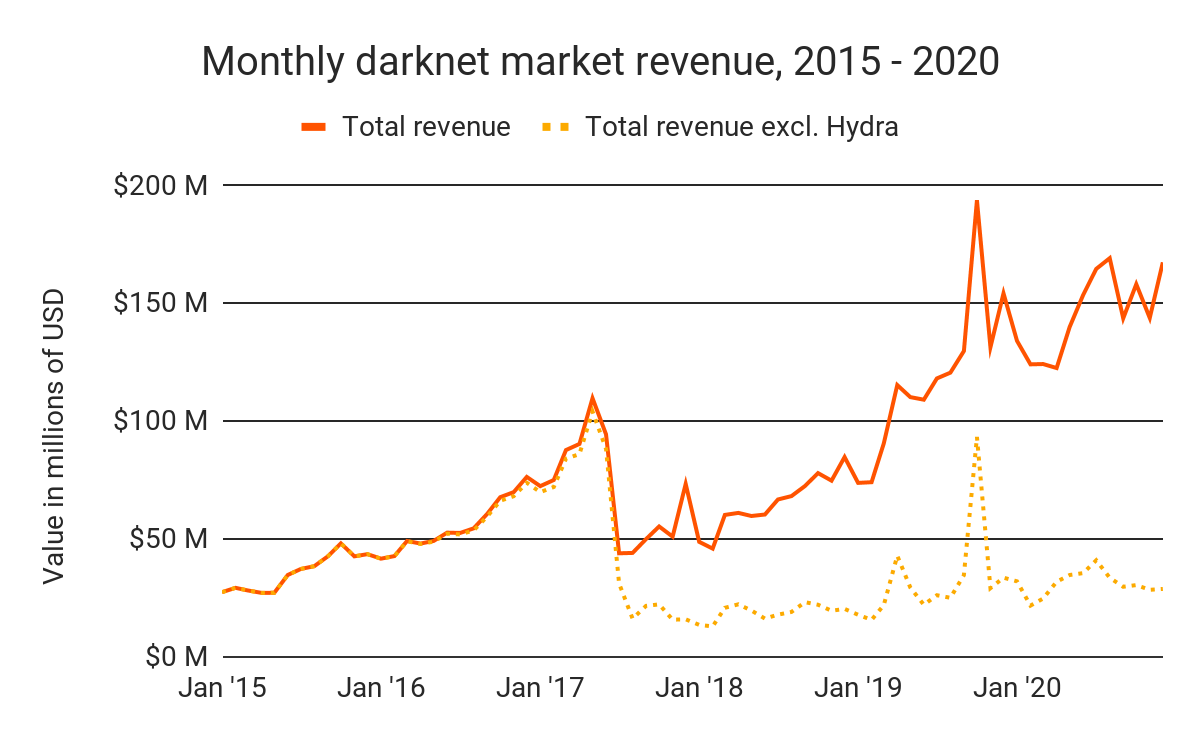

Darknet markets raked in an all-time high of roughly $1.7 billion worth of digital currency in 2020. Despite reaching record highs in regard to revenue, the number of individual buyers declined–so how were darknet markets able to bring in record-high revenue? Because one darknet marketplace, Hydra, experienced significant growth in 2020; so much so, that Hydra accounts for more than 75% of the darknet market revenue brought in during 2020.

Hydra is a darknet marketplace that only services Russian-speaking countries. Unlike legacy darknet market places that mail contraband to buyers, Hydra operates a “drop-style” marketplace. Once a buyer makes a purchase, the Hydra merchant will arrange for their merchandise to be hidden in a physical location close to the buyer–this way, transactions can happen with a higher degree of anonymity and a lower probability of the buyer or seller being tracked or caught.

Interestingly, when Hydra is removed from the equation, darknet market revenues hardly changed from 2019-2020.

What do the markets sell?

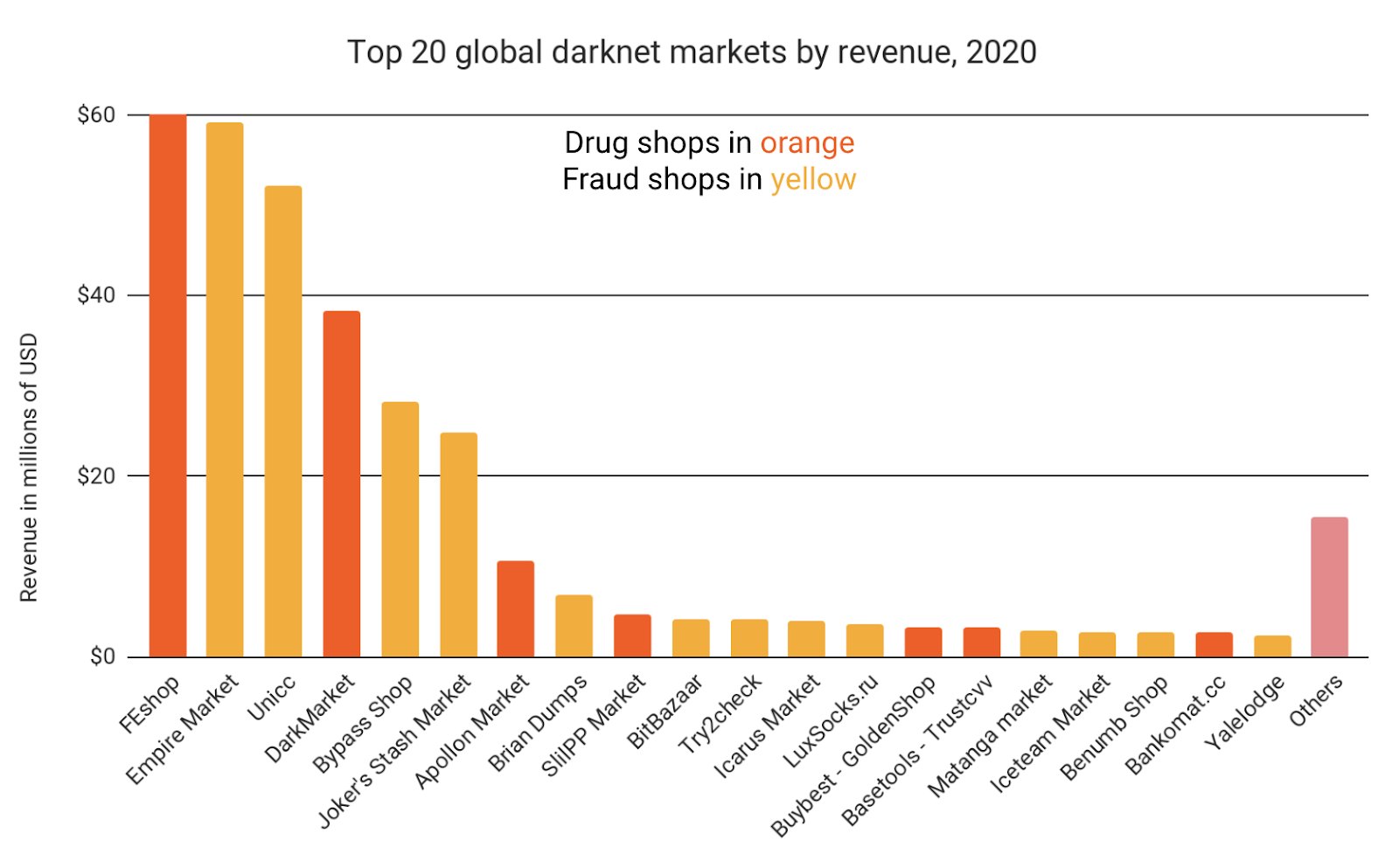

The blockchain analytics firm Chainalysis was the first to unearth this data; Chainalysis also learned that a majority of the darknet markets analyzed in their 2021 Crypto Crime Report, were not drug markets. Instead, the majority of these darknet marketplaces were fraud shops, marketplaces that sell stolen credit card information, and other data that can be used for fraud, including personal identification information.

Whose sending funds and where do they go?

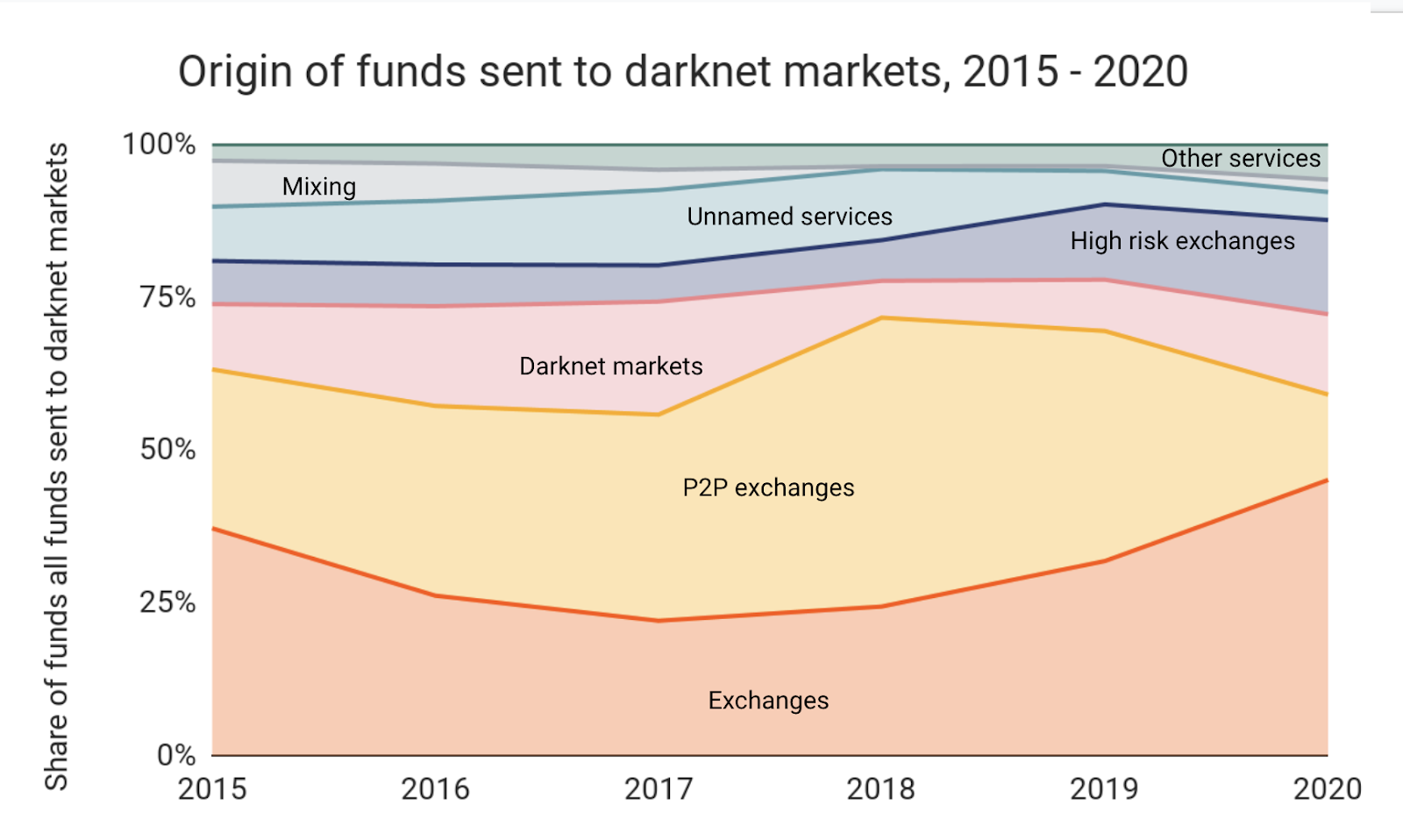

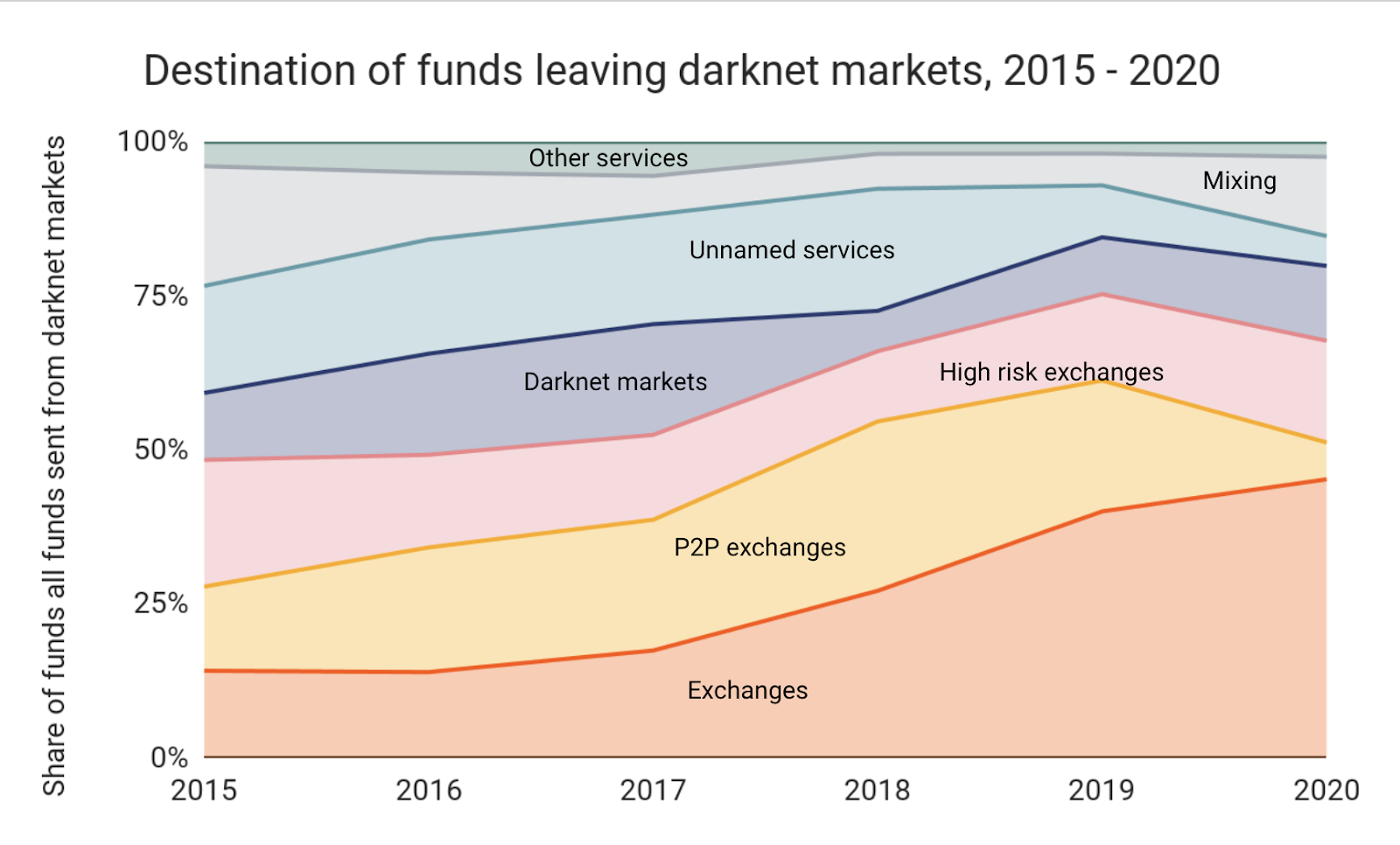

Chainalysis also discovered that a majority of the funds entering and leaving darknet marketplaces come from/go-to digital currency exchanges.

“Interestingly, 2020 has seen standard exchanges send a larger share of total darknet market revenue — about 46% in 2020 versus 30% in 2019 — while P2P exchanges’ share has declined significantly,” says Chainalysis. “ Given that standard exchanges tend to be more popular and easier to use, this could suggest that darknet markets attracted more first-time customers who are new to cryptocurrency in 2020, possibly due to declines in street sales during the Covid pandemic.”

Chainalysis’s “Geographic Distinctions in Darknet Market Activity: U.S. and Western Europe Have the Most Vendors, Eastern Europe and China Lead in Money Laundering” report is an excerpt from the Chainalysis 2021 Crypto Crime Report that is being released later this month. If you are interested in reading the full crime report, you can sign up for access here.

02-22-2026

02-22-2026