|

Getting your Trinity Audio player ready...

|

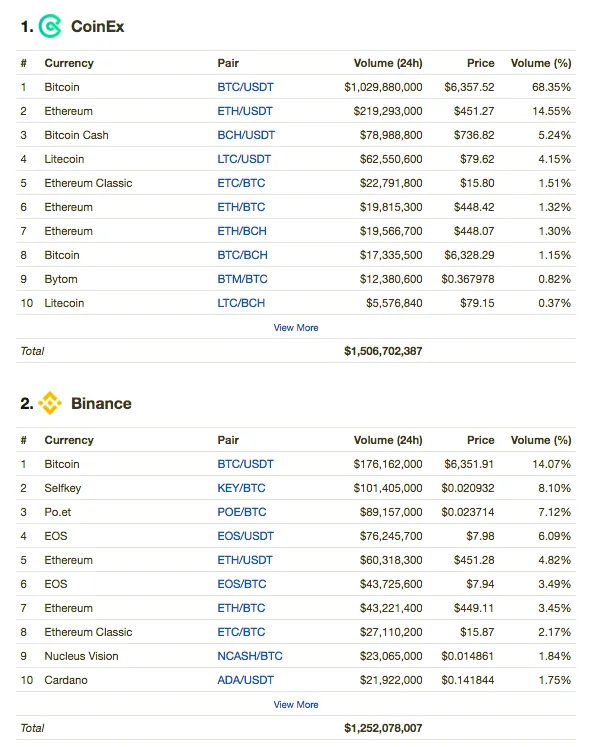

The exchange’s volume spiked up from $5 million to a whopping $1.24 billion within 24 hours.

While cryptocurrencies continue to fluctuate and race against each other for dominance, a different kind of flippening just happened. CoinEx, which has headquarters in Singapore, Hong Kong, and Shenzhen, has now overtaken Binance as the world’s biggest cryptocurrency exchange by volume, at least as of the last 24 hours as CoinMarketCap shows.

Yesterday, CoinEx saw its trading volume surge by 24,000% after announcing the release of its “trade-driven mining” and “dividend distribution.” Through trade-driven mining, the exchange is releasing “release 3.6 billion CET for free allocation to CoinEx users.” CET tokens are Coinex’s own native token. They are also dedicating 80% of their daily transaction fee income to CET holders who hold at least 100 CET, they said in an announcement.

“From 0:00 July 1st, 2018 (UTC), CoinEx will adopt a “Trade-driven Mining” method to release 3.6 billion CET for free allocation to CoinEx users. We will calculate 100% of our transaction fee income into CET against the real-time rate and give them away to all traders proportionately to their trading volume,” they wrote on their website.

While it’s too early to tell whether CoinEx will keep its newly acquired ranking, it’s clear to see that the release and allocation of CET tokens are giving the exchange a large push—bumping their trade volume from around $5 million to a whopping $1.5 billion within 24 hours.

As expected, CoinEx’s move has garnered controversy, with one particular criticism coming from the competition itself. Binance CEO Zhao Changpeng last week said that this is a new ICO in disguise, and that it is vulnerable to manipulation.

“If an exchange doesn’t get revenue from transaction fees and solely profits from the price of its token. How would it survive without manipulating the token price? Are you sure you want to play against a price manipulator? The same price manipulator who controls the trading platform?” – Zhao.

But despite criticisms of this model, other Chinese exchanges have done this before and it did well with traders. And CoinEx is definitely riding in on the move, seeing a massive trade volume spike just like the other Chinese exchanges that adopted the model.

07-04-2025

07-04-2025