|

Getting your Trinity Audio player ready...

|

Bitcoin stakeholders need to acknowledge the fact that the technology faces a grim future without serious changes to the status quo.

The Bitcoin world is still digesting Wednesday’s blockbuster announcement that nChain chief scientist Dr. Craig S. Wright has initiated legal action against developers for the BTC, BCH, BCH ABC and BSV technologies. Wright is seeking the recovery of billions of dollars’ worth of Bitcoin, the private keys to which were stolen from his network by unknown hackers last year.

Wright’s action doesn’t accuse the developers of being behind the hack; rather, it’s intended to establish that the rule of law—as it relates to personal property—applies as much to Bitcoin as it does to other ‘real world’ assets. And that those who oversee the digital networks through which stolen assets travel have a responsibility to ensure that personal property rights are observed, in a very legally binding sense.

Craig’s legions of antagonists are trying to convince the world that he’s out to inflict damage on Bitcoin network gatekeepers, but nothing could be further from the truth. He’s simply trying to get them to recognize that their privileged position imposes certain duties and obligations that they cannot ignore if Bitcoin is to survive, let alone thrive.

The old legal maxim is that possession is nine-tenths of the law. To date, Bitcoin developers and the network support ecosystem—exchanges, wallets, miners, etc.—have taken the view that possession is ten-tenths of the law.

This represents an abdication of authority on par with the social media giants who until recently declared that they bore no responsibility for content distributed via their platforms. But Facebook, Twitter et al have now begun taking tentative steps to amend their previous hands-off approach, largely due to the looming threat of government intervention, which could portend regulatory changes far beyond content moderation.

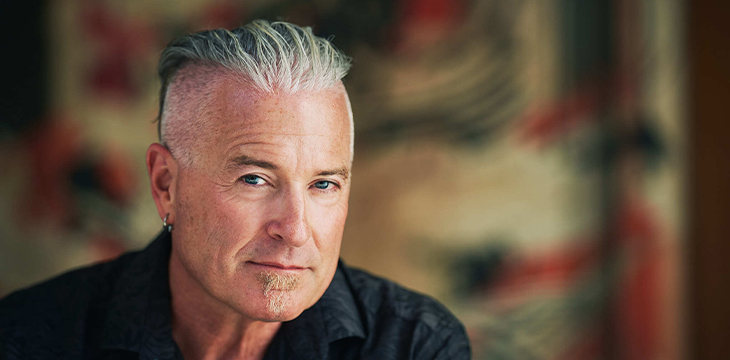

Take it from someone who was targeted by U.S. law enforcement agencies nearly two decades after I began my online gambling career. The authorities may move slowly—they are a branch of government, after all—but they will move aggressively when they see activity that they believe contravenes their rules (although in my case, WTO rulings affirmed the rights of Antigua-based gambling sites offering services to American bettors, which played a role in U.S. authorities dropping all felony charges against me).

My entry into the online gambling world began in what is widely referred to nowadays as the industry’s ‘wild west’ period, where bad behavior and a fairly juvenile approach to business was the norm. But that phase didn’t last long, in part because adults bearing bona fide business degrees—myself among them—assumed the duties and obligations that the early operators chose to ignore, which allowed online gaming to step out of the shadows as a respectable and legally compliant business sector.

The reason that most enterprise businesses have so far steered clear of Bitcoin is only partly explainable by the BTC world’s insistence on maintaining a strict 1MB block cap, which prevents the technology from ever realizing its true data management potential. (The BSV protocol that both Craig and I support suffers from no such limitations.)

But these businesses are also leery of investing any serious amount of time, effort or assets into developing Bitcoin-based projects because they realize that these assets could all too easily be stolen by criminals or accidentally lost through unreliable data security efforts.

To put it another way, I was all of 20 years old when The Road Warrior (Mad Max 2 for you Aussies) was released, and while I thoroughly enjoyed its depiction of a post-apocalyptic struggle between freewheeling anarchists and more high-minded survivors trying to rebuild society, I wouldn’t want to live there, and I certainly wouldn’t want to start a business in a world without laws.

The misguided belief that ‘code is law’ never had much acceptance outside the insular world of coders. In the real world, law remains law, and those who choose to ignore that reality will soon feel the full weight of the law pressing down on them.

Craig has every right to use the law to obtain relief from the crime that has been perpetrated against him as do others, but this legal action isn’t just about Craig. It’s about imposing order on a sector that has gone without it for too long. Without order, Bitcoin will forever remain on the fringes of the business world, a ‘digital gold’ curiosity with no other use case, leaving future historians confounded by the brief hysteria it provoked.

Significant change rarely comes easy but maintaining the status quo is no longer a viable option. Bitcoin can either adapt and thrive, or resist change and fade into obscurity. The choice is yours … and the clock is ticking.

03-12-2026

03-12-2026