|

Getting your Trinity Audio player ready...

|

The South American nation of Bolivia lifted its decade-long ban on digital assets a year ago, and since then, trading has skyrocketed. It’s now seeking to regulate the sector and has tapped neighboring El Salvador for guidance.

While Bolivia warms up to digital assets, Algeria is moving in the opposite direction. The North African country has announced a sweeping ban on ‘crypto,’ criminalizing all digital asset activities.

Bolivia taps El Salvador for ‘crypto’ guidance

The Central Bank of Bolivia (BCB) has signed a Memorandum of Understanding (MoU) with El Salvador’s National Commission for Digital Assets (CNAD) to share knowledge and exchange regulatory and technical expertise. The MoU took effect immediately and will remain in force indefinitely, the two revealed in their announcement.

The regulators will share their experience in blockchain intelligence tools, data analytics, risk analysis, and market oversight. They’ll also jointly train their staff and exchange information on virtual asset service providers (VASPs) operating in both countries.

BCB Acting President Edwin Rojas Ulo, who signed the agreement with CNAD’s Juan Carlos Reyes García, says it’s part of the Bolivian government’s ongoing efforts to promote digital asset adoption in the country. However, Bolivia is keen to ensure this growth is within the existing legal framework and protects investors while preserving monetary stability.

CNAD reiterated its commitment to promoting digital assets in the region, with Garcia pledging the agency’s support to any South American country expanding its ‘crypto’ presence. El Salvador was the first country globally to adopt BTC as legal tender (although it didn’t pan out as President Nayib Bukele expected); Garcia says this has equipped it with experience in managing digital assets, and it’s willing to lend this expertise to its neighbors.

The MoU is Bolivia’s latest effort to boost digital asset adoption after lifting its decade-long ban in June 2024. While announcing the ban in 2014, it claimed it was protecting its official currency, boliviano, from depreciation and preventing ‘crypto’ use in illegal activities like money laundering and tax evasion.

Ten years later, the government changed tune as adoption peaked in other Latin American nations like Argentina, Brazil, Venezuela, and El Salvador.

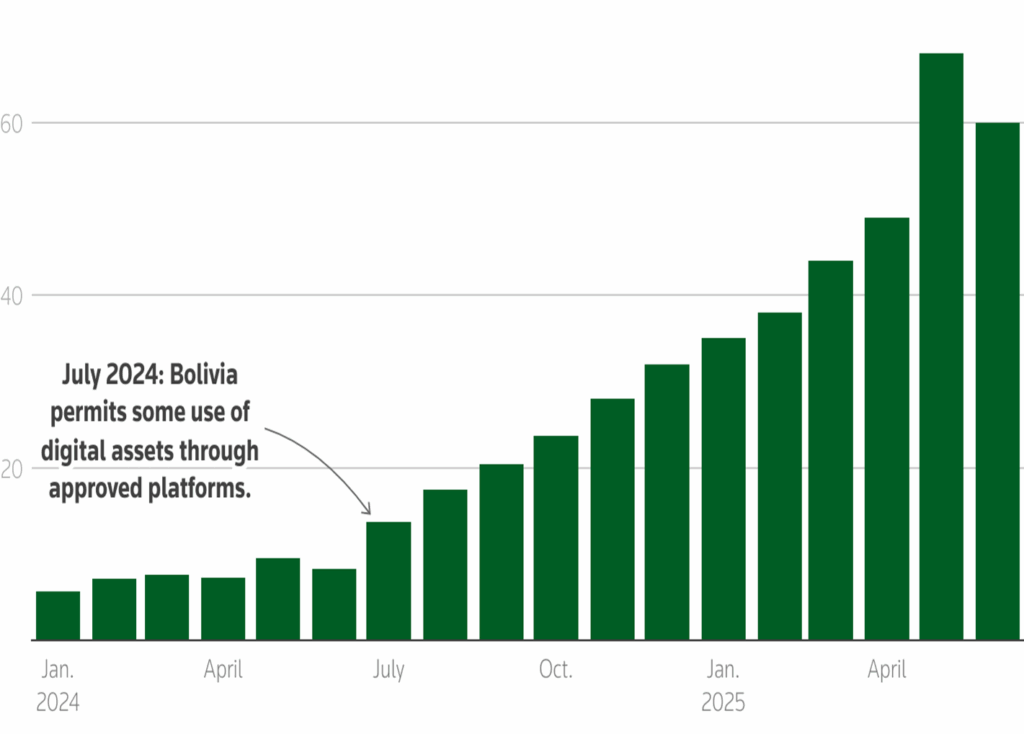

According to BCB data, digital asset transactions soared over 500% in the first six months of this year to hit $294 million.

Digital assets “have facilitated access to foreign currency transactions, including remittances, small purchases and payments, benefiting micro and small business owners across various sectors, as well as families nationwide,” the central bank said.

For Bolivians, digital assets offer the best alternative amid a steep depreciation of the local currency and peak inflation. This year alone, the boliviano has lost half its value against the USD in the black market, with official dollar reserves plummeting to near zero.

Algeria bans digital assets

As Bolivia opens up to digital assets, Algeria is heading the other way. The North African nation has enacted a new law that criminalizes any use, exchange or mining of digital assets.

According to a local report, the crackdown was enacted through Law No. 25-10 of July 24, 2025, and takes effect immediately. Under Article 6A, Algerians are prohibited from issuing, purchasing, selling, possessing, using, or promoting digital assets. It’s also illegal to develop or operate trading platforms or digital wallets, individually or through third-party online platforms.

Beyond trading, Algeria has also banned block reward mining. The country’s mining activities are insignificant compared to other African countries like Ethiopia, but it is gaining ground in the southern provinces where electricity is much cheaper.

Algerians who violate the new law face a prison sentence not exceeding one year, a fine ranging from 200,000 dinars ($1,500) to 1 million dinars ($7,700), or both. These penalties could be heightened if the ‘crypto’ usage is linked to other forms of organized crime, like money laundering.

The new ban was unexpected and bucks a global trend where governments are racing to enact the friendliest laws to boost adoption and attract global capital.

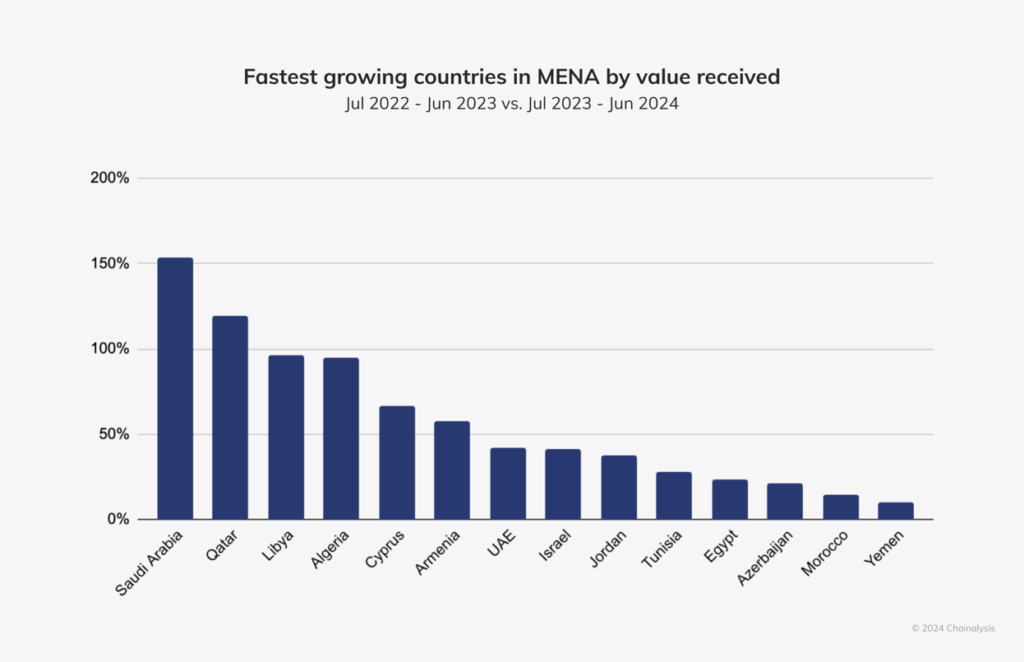

It also comes against the backdrop of rapid adoption in Algeria. According to a Chainalysis report last September, the country was the fourth-fastest growing by value received in the Middle East and North Africa (MENA) region, outpacing titans like the United Arab Emirates, Israel, and Egypt.

Watch: Is your company ready to ride the wave of blockchain adoption?

03-10-2026

03-10-2026