|

Getting your Trinity Audio player ready...

|

Jimmy Nguyen, founding president of Bitcoin Association, is back with another episode of Blockchain Policy Matters.

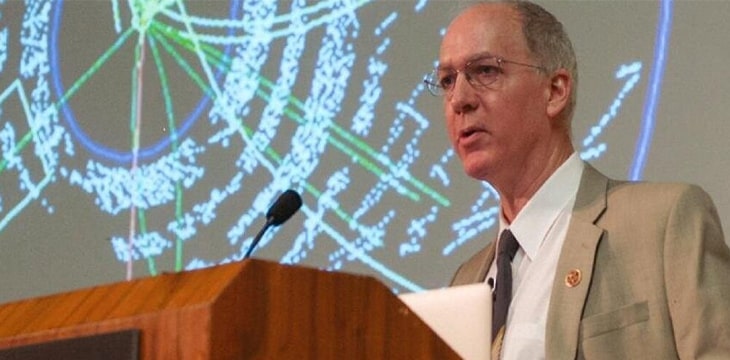

In the latest episode, he is joined by U.S. Congressman Bill Foster, a Democratic Representative from Illinois who serves as the co-chair of the U.S. Congressional Blockchain Caucus. Rep. Foster also sits on the committee for financial services and is chairman of the taskforce on artificial intelligence. He also serves on the Science, Space and Technology Committee, and approaches the challenges of blockchain policy from the perspective of being a self-proclaimed “blockchain and tech guy.”

In this episode of Blockchain Policy Matters, our Founding President @JimmyWinSV speaks to U.S. Congressman Bill Foster about blockchain legislation and his work with the Congressional #Blockchain Caucus. https://t.co/C0x035cN7Z

— BSV Association (@BSV_Assn) August 16, 2021

Joking that he is the only blockchain programmer in Congress, Rep. Foster said he was certainly among the first members of Congress to develop an interest in blockchain, and what he describes as the “miracle of public key cryptography.”

From a hard sciences background, Rep. Foster said he was astonished that cryptography works as a concept and a technology, dating back 30 years from his first introduction to the topic.

Rep. Foster discussed how he was present during the Facebook and Libra hearings, which saw the parties “speaking out of both sides of their mouths” on issues such as anonymity and custody. Citing this as an example of the tough choices lawmakers need to face in shaping blockchain policy, he said policy must decide whether it wants high volumes of untraceable transactions being conducted through digital assets, or whether it wants to bring that into the light of transparency, which introduces its own series of challenges.

He also spoke of the need for a mechanism for reversing transactions, for example during coin thefts and hacks. He said that if someone robs a bank, then buys a burger at McDonalds with the money, there is a highly developed set of rules around when McDonalds can keep that money, and when those types of transactions must be reversed. If McDonalds believed the money to be legitimate, they get to keep it. If they were acting in bad faith, they cannot. Rep. Foster argued there was a need for similarly defined laws to operate in the crypto domain too.

In particular, the mobility of digital currency assets makes this a more pressing concern for lawmakers, with things like ransomware and digital thefts making it much easier for criminal elements to prevail. Without rules around these circumstances, it remains a free for all for criminals to operate.

Rep. Foster also said he was not a fan of anonymity. He gave the example of transactions on a regular exchange. You don’t know who is on the other side of the bid and offer. Even after the trade, the public knows the trade happened without knowing the participants. On the other hand, the regulator knows everything, and has to know everything to prevent things like wash trades and other illegal practices. Rep. Foster said he is aware this is not a rare thing in crypto assets, where markets are subject to significant manipulation. He argues there needs to be a regulator who sees the identity of all participants—while acknowledging this is anathema to a lot of the bitcoin community.

Part of his solution here is trusted digital identity, which Rep. Foster says is an essential next step for the technology, and one the U.S. must embrace with the same vigor as the EU. While acknowledging the limitations on civil liberties, he argued that only a trusted digital ID can help solve these emerging and increasing problems.

Any digital ID scheme must prevent fraud—but also people need to be prevented from operating multiple IDs. It needs to be authenticated with sworn testimony, birth certificate evidence and even biometrics, according to Rep. Foster, though he acknowledges that this creates politically fraught problems for lawmakers and politicians.

Asked by Nguyen how the U.S. can work to introduce national digital identity schemes, Foster said the first step was to come up with a way of getting a unique list of participants. This is a limitation on freedom, he acknowledges, but given the mobility of people and the heightened expectations of safety, this is now something that the people want. He described this as “a change in culture,” but one where the public is already ahead of politicians.

Nguyen said BSV is not anti-government or anti-bank, unlike other implementations of Bitcoin. In order for BSV to reach its true potential as the foremost blockchain technology platform in the world, the community must embrace government and big business, in order to provide a platform with the necessary regulatory backing.

Foster argues that in delivering these types of digital identities, there is a need to go beyond current AML and KYC processes when verifying identity, to provide the degree of trust necessary for digital systems to properly function.

Lasting around half an hour, the discussion gives a valuable insight into the policy considerations and thinking of one of the lawmakers shaping U.S. policy decisions in this field.

You can find episode four of Blockchain Policy Matters on Bitcoin Association’s YouTube channel.

03-03-2026

03-03-2026