|

Getting your Trinity Audio player ready...

|

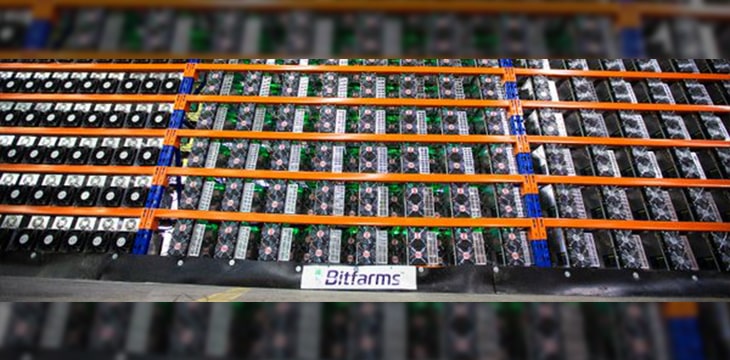

Toronto, Canada-based Bitfarms Ltd (TSXV: BITF) announced it has entered a multi-million dollar subscription agreement for a private placement of equity securities with institutional investors. H.C. Wainwright & Co. is serving as the exclusive placement agent.

The publicly listed block reward mining operation expects gross proceeds of nearly CAD$40 million via the sale in the United States of 11,560,695 common shares, alongside warrants to purchase another tranche of the same number of common shares, all at a purchase price of CAD$3.46. The warrants will have an exercise price of USD$3.01 per common share and an exercise period of 3 1/2 years.

Bitfarms Announces CAD$40.0 Million Private Placement with U.S. Institutional Investorshttps://t.co/wDo6ANSfJF

— Bitfarms (@Bitfarms_io) February 8, 2021

Such an offering is not unusual given the current market climate. The strategy is part of a growing trend amongst publicly traded block reward miners.

Bitfarms is striking while BTC continues to hit all-time highs driven by renewed mainstream interest. This transaction marks the firm’s third financing sale in a month, bringing the overall total raised to CAD$80.0 million.

“We are pleased to announce our third financing, having just closed two financings in January of CAD$20.0 million each (see press releases of January 7 and January 13, 2021),” said CEO Emiliano Grodzki.

“This additional financing will allow us to further grow our miner count and expand infrastructure. We are very pleased to continue to expand our institutional presence in the United States,” he added.

According to their press release, the net proceeds of the private placement will be used by Bitfarms to buy additional blockchain miners, expand infrastructure, and improve its working capital position. The company currently has a BTC mining market share of approximately 0.66% from 0.965 Exahash. It aims to provide 3 Exahash of computing power by the end of 2021.

Bitfarms expect this latest private placement to close this week, pending approval by TSX Venture Exchange. According to their corporate update, Bitfarm’s management is also actively seeking an additional stock exchange listing for the company in the United States.

See also: TAAL’s Jerry Chan presentation at CoinGeek Live, The Shift from Bitcoin “Miners” to “Transaction Processors”

02-23-2026

02-23-2026