“Why is Bitcoin super complicated?”

If you’ve asked this question, don’t worry—you’re not alone.

Bitcoin for beginners can be a challenging subject. There are a lot of underlying concepts and terms that surround the technology, and the more you encounter them out of context, the more lost and confused you might feel. It’s typical for every industry to use its own jargon, but bitcoin includes terms and concepts from economics, finance and the information technology fields, so it may seem impossible to navigate it wisely!

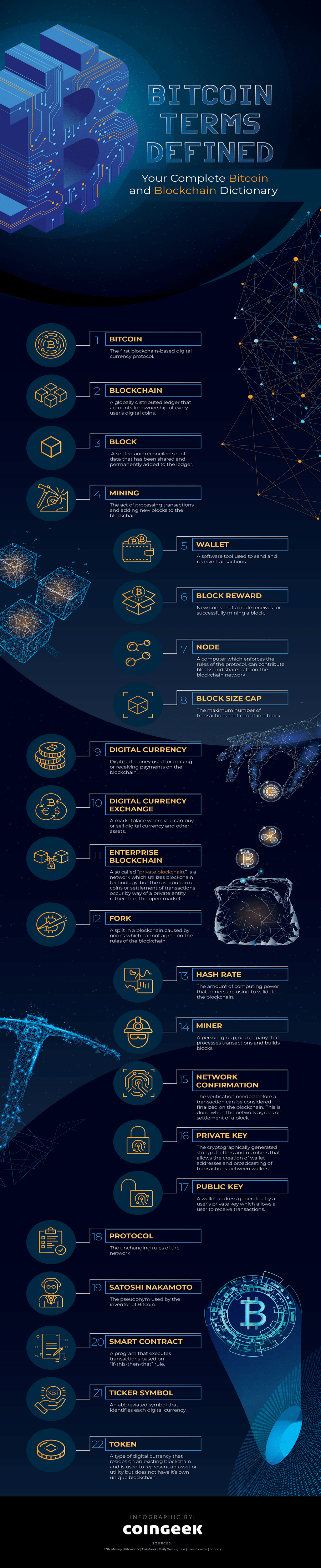

To be sure you can reap all the benefits of Bitcoin, we’ve created a dictionary of terms written to make Bitcoin simple, clear, and easy to understand. With a complete list of the most important terms used by adopters of the technology, this is the only Bitcoin and blockchain dictionary you need to navigate the digital currency world with ease.

Definition of Bitcoin Terms

This Bitcoin and blockchain dictionary defines and explains commonly used words and phrases related to cryptocurrency:

- Bitcoin

Launched in 2009, Bitcoin is a digital currency that acts as a form of payment for electronic transactions without passing through traditional financial intermediaries like banks or clearinghouses that typically charge high transaction fees.

Bitcoin is also the name of the network on which bitcoins are transacted, and it is the name of the protocol which defines the unbreakable rules of the bitcoin network. This is the cause of some confusion over naming conventions. Furthermore, folks may use the term “bitcoin” as a generic term for other decentralized blockchains, which would be a mistake. The term “bitcoin” can only refer to an unbroken chain of bitcoin signatures which are in consensus with the bitcoin network which follows the bitcoin protocol as set out in the bitcoin white paper.

- Blockchain

The unique technology that Bitcoin introduced to the world. A blockchain, unlike other database types, writes transaction data to a public, distributed ledger. That data is settled to blocks which are sequentially linked in a chain. Each block of data also contains information about the preceding block, making a nearly infallible chain of time-stamped truths simple to validate in order of occurrence.

The blockchain is distributed among many computers around the world, which makes recorded data in the ledger exceedingly difficult to alter. Since the data contained in the blockchain is not centralized, the collapse of one or many network participants cannot affect the entire network.

- Block

Similarly to how credit cards have a “pending” period before transactions are settled, bitcoin transactions, when they are first broadcast to the bitcoin network, will be held in a pool of unconfirmed transactions. Transaction processing nodes (commonly called “miners”) will compete to gather unconfirmed transactions and reconcile with the most efficiency before sharing them with other nodes. If the majority of nodes agree on the reconciliation of transaction data, the transactions will be settled into a data structure called a “block.”

Blocks become increasingly difficult to re-reconcile every time a new block is settled, which is one of the main economic security features that makes bitcoin unique.

- Bitcoin mining

Mining refers to the process of validating Bitcoin transactions by checking that the rules of the network were followed and then building blocks which reinforce those rules. Building blocks through “mining” is achieved by solving computational puzzles to find the proper hash which secures the block. Miners use specialized hardware (called an “ASIC”) and software to compete to be the most efficient to secure the block so that they can be rewarded with newly minted Bitcoins and the fees attached to the transactions.

- Bitcoin wallet

Unlike traditional wallets which store money or credit cards, a Bitcoin wallet is a software tool that communicates with the blockchain network to send and receive bitcoin transactions.

Your Bitcoin wallet may be called a ‘hot wallet’ or a ‘cold wallet’. The first type is connected to the internet, while the second type was generated on a computer with no internet connection.

Wallets may also be custodial or non-custodial. A custodial wallet is managed by a trusted party, similarly to a bank account. It is typically accessed with a username and password, and transactions can only be made by permission and in accordance with terms of service of the custodian. A non-custodial wallet is generated by the user who is the sole owner of the private keys, which means transactions can be generated by the wallet’s owner at any time.

- Block reward

A block reward is a subsidy that was programmed by the creator of bitcoin to reward transaction processing nodes for securing the network in its infancy. The reward is earned by the miner who successfully solves the cryptographic puzzle and adds the latest block to the chain.

The first block reward was 50 bitcoins. Every 210,000 blocks (roughly 4 years), the block reward diminishes by 50% in an event commonly called “the halvening” so as to encourage miners to shift from working for subsidies and toward working for transaction fees. The reason for that is to incentivize miners to invest in businesses and do the necessary research and development to efficiently grow the circulation of bitcoin transactions.

If the total value of transaction fees does not out-pace the diminishing value of the block reward, miners and transaction processors will go out of business, and bitcoin will become too insecure to store or transact large amounts of value. Currently, the block reward on the Bitcoin network is 6.25 new Bitcoin plus the fee for each transaction in the block. By 2140, the amount is expected to hit zero, but by 2028, the block reward will only be about 1.5 bitcoins. By then, the value of a single bitcoin will have to at least match the cost of securing the transactions within every block, or the size of every block will have to be sufficiently large for transaction fees to pay for the security of the blockchain.

- Block size cap

Since most blockchains are not heavily used, their infrastructure is not designed to allow much traffic to exist on the network. Due to the weakness of the infrastructure, networks become susceptible to being forced to crash by a flood of malicious transactions that overwhelm the network. This attack is called a “Denial of Service” (or DoS) attack similar to how a retail website may crash from too much traffic on Black Friday. To counter this lack of robust infrastructure, a software limit is imposed on most blockchains to limit the amount of business that can occur in each block.

On BTC, the network is limited to less than 7 transactions per second, which comes out to 5000 transactions per block before the network is too congested to function. That averages out to about one transaction every year or two for every American before the network grinds to a halt. On Bitcoin (BSV), the only blockchain with no block size limit, blocks have been mined which show the network is capable of at least 350 times the capacity as BTC. Testing models show that the bitcoin protocol is capable of millions of transactions per second if the network is properly implemented.

- Digital Currency

A digital currency is a form of digitized money that uses blockchain technology to verify and secure transactions. Digital currencies like Bitcoin can be used as a medium of exchange to pay for goods and services online, or they can act as a sort of network toll in order to launch an application, smart contract or to write important data to the blockchain.

- Digital currency exchange

Digital currency exchanges are secure online marketplaces where you can exchange your digital assets based on their market value for other assets. In some digital currency exchanges, you can trade fiat money with digital currencies and vice versa. Others also serve as custodial digital currency wallets, allowing you to store tokens in the wallet provided by the exchange.

- Enterprise blockchain

A private or enterprise blockchain is a permission-based blockchain. Since participation on a private blockchain is exclusive, you cannot join without an application or invitation. The private nature of these blockchains means that the distribution rules and consensus rules of the network are decided by committee, and they are typically only used to benefit from a blockchain-style data structure while diminishing any usefulness as money outside of the closed network. Aside from verifying internal transactions, the main reason that corporations are investing in enterprise blockchains is to help them with Know Your Customer (KYC) compliance.

- Fork

A fork happens when changes are made to the code that runs a particular digital currency. If all nodes agree to the change, the fork functions as an upgrade to the rules of the network. If nodes do not agree, there may be a split of the network. Commonly, two different kinds of forks are utilized on blockchain networks: soft forks and hard forks.

A soft fork is a rule change which is packaged up into a software envelope which tells nodes to ignore the rule change in order to trick them into not splitting the network. The nodes trust the rules of the envelope, but do not typically have the ability to validate the transactions within. Therefore, soft forking only requires cooperation among software developers, and puts them into a governing role over the network rules which is convenient amid contentious upgrades where transaction processing nodes may disagree with proposals made by software developers. Some of the most contentious changes to bitcoin have been made by soft fork, so as to stop any ability for nodes to debate. These changes include the addition of P2SH, RBF and Sewit changes to the protocol.

On the other hand, if nodes do create their own software which demands that all bitcoin transactions be governed by bitcoin rules enforced by honest nodes, the disagreeing nodes will create two separate chains with competing rulesets. This occurred when BCH split from BTC over the refusal to accept the Segwit soft fork, and it happened again when BSV split from BCH over the refusal to accept a new transaction ordering and scripting tool. Both splits were done in order to enforce an ideologically sound bitcoin protocol maintained by BSV in the face of threats from rogue software developers who believe that they can redefine bitcoin’s rules to suit their shifting goals.

- Hash rate

The hash rate is the speed at which network computers can take any set of information and convert it into a hash—a series of letters and numbers—to make data immutable or incapable of being manipulated. The Bitcoin network uses the Secure Hash Algorithm (SHA) 256 function, which generates a fixed 256-bit (32-byte) hash, to identify blocks and transactions on the blockchain uniquely.

- Miner

A miner can be anyone or anything that provides computing power to secure blocks to the validated history of all transactions on the blockchain’s public ledger. They are also commonly called “transaction processors,” or “node operators.” Satoshi Nakamoto, the creator of bitcoin, simply called them “nodes” or “honest nodes” in the bitcoin white paper. Miners compete for the privilege to add new blocks of data to the chain. If they successfully add new blocks of data, they are rewarded with newly minted Bitcoins and the transaction fees of the blocks that they mined.

You can mine Bitcoin on your own or by joining mining pools, which gives you a certain percentage of the Bitcoin earned by the pool – relative to your total contribution of power used to mine the block.

- Network confirmation

For a new transaction to be included in a block, each computer in the network has to issue a confirmation that the transaction follows valid bitcoin rules, and they signal that confirmation to the network by building a block which contains that transaction and by signaling with their hash rate that they will defend that transaction from being overwritten. Each block added by honest nodes adds an additional layer of security to previous transactions by raising the cost which would be required to rewrite an invalid transaction.

- Node

A node is any computer or participant within the Bitcoin network responsible for validating transactions. Listening nodes without any hash rate act as simple data servers which can be queried for the state of the network, but they cannot build blocks. These are commonly called “block explorers.”

Pruned nodes keep hashes of all of the blockchain data, but do not contain the totality of the blockchain’s data. These are common among certain types of specialized transaction processing companies that have lots of hash rate but not particularly high quality internet connectivity for sending lots of data across the network.

Full nodes are those which keep a complete copy of the blockchain for archival and data-serving purposes and have lots of hash rate at their disposal, and are therefore a complete (or full) node service provider. These are commonly held by large miners or commercial entities which act as relays for important business data services.

- Private key

The cryptographically generated string of letters and numbers that allows the creation of wallet addresses and broadcasting of transactions between wallets. If a private key is lost, it cannot be regenerated unless a significant portion of the hashrate agrees to mine the key, which is highly improbable, and therefore practically impossible on a high value network such as bitcoin.

- Protocol

A protocol is a set of fixed rules that defines the various aspects of managing the blockchain, such as the block size cap, total supply of coins, and so on. For instance, the protocol specifies how double-spending or using the same Bitcoin twice can be avoided through validation of key criteria and the required number of confirmations from the network.

Protocols are rules which cannot be broken. These are also referred to as “bitcoin rules” which cannot be broken because they are fundamentals of the definition of bitcoin set in stone by the bitcoin white paper.

- Public key

The public key is derived from your private key and is used to verify that you are the rightful owner of a Bitcoin address that can receive and spend funds.

- Satoshi Nakamoto

Satoshi Nakamoto is the inventor of Bitcoin. Satoshi wrote the 2008 whitepaper titled “Bitcoin: A Peer to Peer Electronic Cash System” before releasing the first open-source Bitcoin software in 2009.

The word/name Satoshi also represents the smallest divisible unit of one Bitcoin, with one satoshi equal to 0.00000001 Bitcoin.

- Smart contract

A smart contract is a digital agreement that contains a predefined, automated digital script, allowing software to execute the terms of the agreement once certain conditions are met.

To help visualize how a smart contract works, think of a vending machine and it’s “if-this-then-that” operation. Inserting a coin is the deployment of the contract, pressing buttons are the operations of the contract, and the retrieval of the snacks are the settlement of the contract.

When using Bitcoin to make a payment, a smart contract helps determine whether the Bitcoin should go to one person, a group of people, back to the person who sent it or whether it will pay a piece of on-chain software to deploy a complex application to perform many processes before settling.

- Ticker symbol

Each digital currency has its own ticker, a shorthand symbol that is used to identify and distinguish it from other digital currencies. The ticker symbol for Bitcoin is BSV, BTC is the ticker symbol for Core Coin, ETH is the ticker symbol for Ethereum.

- Token

A token is a digital asset deployed by a smart contract that does not have its own unique blockchain. For example, ERC-20 tokens live on the Ethereum blockchain, but do not have their own blockchain. In other words, tokens are created and live on top of a blockchain that already exists. Tokens can be used to represent an asset or utility, such as when a token holder is allowed to stream content on a video-sharing blockchain. A token can also represent a digital dollar, such as the case with USDC which runs on multiple blockchains, including BSV.

Bitcoin 101

Bitcoin for beginners requires a good grasp of important terminologies used in the industry. To know more about Bitcoin, head on over to CoinGeek where you’ll find a complete range of Bitcoin-related resources.

Recommended for you

Tiny payments are changing the expenses landscape. Micropayments and nanopayments are not entirely new concepts and practices. But with the

You can earn money when you explore the world of Bitcoin and understand its intricacies. Once you get the hang

03-12-2026

03-12-2026