|

Getting your Trinity Audio player ready...

|

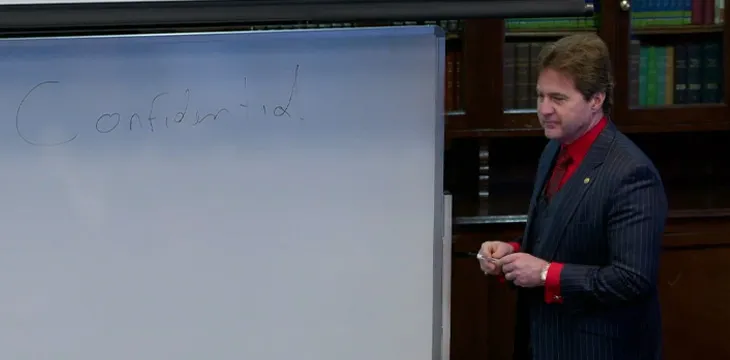

This is the first article in a series covering Dr. Craig Wright’s The Bitcoin Masterclasses. Dr. Wright gave a lecture on confidentiality, how it differs from anonymity, and why it’s crucial to distinguish between the two concepts.

Confidentiality is very simple. It is ensuring that the right people have private information. – Dr. Craig Wright

Bitcoin is not anonymous

Dr. Wright explains that security needs three elements: authentication, integrity, and confidentiality. No identity on Bitcoin means we can’t authenticate people. Bitcoin is all about data integrity, individuals’ authentication, and privacy.

Dr. Wright reminds us that identity is firewalled from the blockchain in the Bitcoin white paper. That does not mean it doesn’t exist—this is not an anonymous system. Authenticating people is essential for several types of transactions, and anonymity makes this impossible.

What are some reasons we might want to authenticate people when doing transactions? Regulations, tax, and receiving goods are some examples. For example, if we buy a TV on Amazon (NASDAQ: AMZN), we want to receive it, get a warranty, potentially return it, etc. We can’t have it delivered to Central Park behind the oak tree—we need to share our address and identity.

Confidentiality and maintaining privacy

Confidentiality means we share our identity with the right people, governments, and those we deal with. It means the right people have private information. It is not losing information or being anonymous.

How do we maintain privacy in a completely traceable system? Not reusing addresses is one method. “It’s a public blockchain,” Dr. Wright emphasizes, noting that anyone can look anything up.

Splitting up payments, mixing direct and indirect payments, and saving coins in different wallets aids privacy. Someone extremely concerned with privacy could even randomly send transactions back and forth between various wallets. While nobody else can tell what these transactions are, the individual or company concerned will still have records of the transactions if they’re ever needed.

Dr. Wright points out that there are also instances where someone might need to prove who they are without publishing that information on the public blockchain. The record of the transaction can be on the blockchain and can thus be validated for years to come without the personal information of the two transacting parties being publicly known.

“Who else knows?” Dr. Wright asks, “it comes down to who needs to know.”

For example, someone might share the information with relevant government entities and insurance firms when buying a car.

Dr. Wright explains how we can maintain privacy when exchanging information related to transactions while ensuring those who need to know have the necessary information. Using PKI certificates, which contain attributes such as personal information and which can be linked to registered, certified keys, and thanks to Merkle trees in Bitcoin, which allow selective disclosure, we could verify information such as that a document is issued from a given country without necessarily revealing anything else.

As it’s easy to see, Bitcoin has revolutionary implications for financial transactions, data management, and exchange. It can introduce true privacy without crossing the line into anonymity. It can also bring about a new era of accountability, recording exactly who accessed information, when, and why on an immutable public blockchain. Non-fungible tokens (NFTs) can play a role in all of this, and Dr. Wright will elaborate on this later in the lecture.

IP-to-IP transactions and identity certificates

Dr. Wright reminds us that the original version of Bitcoin was IP-to-IP. He acknowledges that with IPv4, this is less than ideal. However, he maintains that as long as users have identity certificates, man-in-the-middle attacks won’t happen. Why?

“Because there is no man in the middle,” he says. “If I have a certified key, you know it’s mine. Likewise, I know who the other organization is.”

These peer-to-peer transactions with verified identities have other benefits, too. They make tracking and tracing easier for business purposes, such as issuing refunds. They also make it easier to prove real transactions between distinct parties that took place in the event of things like audits. Dr. Wright mentions Worldcom and Enron, who infamously engaged in wash trading. It would be much easier to prove no other party was involved in a transaction with a system such as this.

How the quest for anonymity killed previous attempts at digital cash

Dr. Wright points out that without identity, you can’t sign with a digital signature. He explains that digital signature legislation goes back to 1986 in the U.K., but it ultimately stems from Roman legislation.

“There’s no such thing as an anonymous signature,” he says. There can be signatures with pseudonyms, such as company names, but they are ultimately all linked to people.

Referencing previous attempts to create ‘cryptocurrencies’ such as karma, Dr. Wright says they all failed because everyone, including university lecturers, got one thing wrong: they all sought to be anonymous and not private. This led to illicit use by bad actors and the subsequent crackdowns by authorities.

The problems with bank accounts and how Bitcoin is different

Outlining some of the problems with bank accounts, Dr. Wright identifies the fact they often delve into your finances and ask you to explain transactions. They are inferior to cash in terms of privacy for this reason.

Other problems include the fact that many people don’t have bank accounts in many parts of the world and that others who may be joint account holders can see our transactions.

Bitcoin is analogous to taking cash out of your bank account. Yes, there’s traceability, but nobody has to know exactly where it went or for what. Paying for something, for example, an item from Amazon, from three wallets, gives you further privacy. The buyer and Amazon can prove it, and it can be proven in court thanks to the key linking the addresses, but third-party observers can’t see what’s going on.

In this way, Bitcoin has many of the benefits of bank accounts and cash combined. It allows for privacy, like cash, while making it easy to keep records of what was spent.

Register for free to attend the next The Bitcoin Masterclasses with Dr. Craig Wright in Ljubljana, Slovenia, on February 22-23, 2023.

Watch: The Bitcoin Masterclasses Highlights: Identity & Privacy

07-09-2025

07-09-2025