|

Getting your Trinity Audio player ready...

|

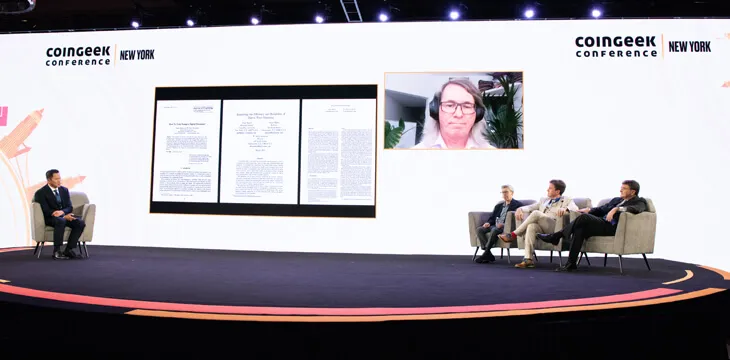

The theme for the CoinGeek New York event is “It’s About Time.” Although one of Bitcoin‘s most common tropes is that everything will happen someday (or the dreaded “SoonTM“), it’s important to look at the decades of work that produced the technology we’re building on today. The first day wrapped up with a panel featuring some of the men whose early work on verifying digital information inspired Satoshi Nakamoto’s invention: Stuart Haber, Ian Grigg, and W. Scott Stornetta.

The three joined Dr. Craig S. Wright on stage for a discussion heavy on reminiscing, titled “Blockchain: The Future of Technology Building on Achievements of the Past.” For Bitcoin’s older people (i.e., over the age of 40), it’s strange to think of the 1980s, 90s and even early 2000s as the distant past, but everything has moved so fast since then that it has become so.

Wright cited Haber and Stornetta’s work three times in the footnotes to the 2008 Bitcoin white paper. Working together at Bellcore in the 1980s and 90s, they developed a system for “time stamping” digital documents—perhaps an uninteresting idea for most people, but vitally important in a world where data could be replicated at the touch of a key.

Stornetta was “obsessed with the idea of how to guarantee the integrity of digital records” at the time, Haber said. Stornetta said this came from his time working at Xerox PARC, which gave him a clear vision of where the world was heading—and made him realize there was (at the time) no way of authenticating if a digital document was real. If left unsolved, this would cause big problems in the future.

Even Bitcoiners today take these questions and their subsequent solutions for granted. But at one time they were considered a hard problem. So hard, in fact, that it might be impossible to solve. It was in attempting to write proofs that the problem couldn’t be solved that Haber and Stornetta actually found a solution. That solution, which involved hashing data and placing it in a chain that became more secure over time, became what we know today as “the blockchain.”

Ian Grigg is also well-known in Bitcoin circles for his invention of Ricardian contracts. Though the three had researched ways to solve the timestamping problem effectively, all said the more difficult part was commercializing it. “I couldn’t work out how the business case worked … but the technology was easy to work into other applications,” Grigg said.

He was also concerned at Bitcoin’s proof-of-work algorithm, thinking it was extremely energy-inefficient. But “what caught me by surprise was, although I hated it, a lot of people loved it.”

Despite Bitcoin’s rise to fame over the past 12 years, it’s possible to argue that ways to commercialize the technology are still difficult to find. The application of timestamping and hashing to money and payments is a compelling use case, but getting the wider world to trust and accept it has been more challenging.

“I felt from 1989 that what we’d invented was going to be huge, but it might take a while,” Stornetta said. Did he see imagine the variety of use cases we see in the blockchain world today? “No, otherwise I would’ve invented them!” he replied.

He and Haber recognized their past work in the Bitcoin white paper before they saw the citations, and thought it was “nice that you started to notice us.” Haber added that “Satoshi chose the right solution to the problem.”

Stornetta noted that he’s “less concerned about whether something is fringe or not in the beginning,” comparing it to a differential equation—”the starting point is the less interesting part, but if you’ve done the equation right, the end game is inevitable.”

Taking a rare back seat in the discussion, Dr. Wright mentioned that it was a combination of his work at (Australian ISP) OzEmail and (gaming company) Lasseters that led to him applying timestamps and hash chains to the (also long-sought) idea of digital money. Many of the concepts even pre-date the digital age, as he often notes. “Old forms of money were basically checks; signed repeatedly. The more they were signed the more secure they were.”

The panel was a fascinating insight into how research from people on opposite sides of the world formed the pieces that would someday combine to form the Bitcoin (or Bitcoins) we know today. It also highlighted how much work (and more piecing-together) still remains to be done. Bitcoin today stands on the shoulders of past giants, yet it still needs new ideas from those who weren’t even born in the 1980s/90s to eventually find its place.

Watch CoinGeek New York 2021 Day 1 here:

07-13-2025

07-13-2025