|

Getting your Trinity Audio player ready...

|

With tokenization projected to hit $19 trillion by 2033, central banks are bracing for a new digital reality that could disrupt existing regulatory frameworks. To preserve their roles within the financial ecosystem, central banks are adopting the latest technologies, and a recent pilot led by the Bank for International Settlements (BIS) demonstrated that smart contracts could be prime tools for regulators in a tokenized world.

BIS partnered with the Federal Reserve Bank of New York’s innovation center on the initiative, titled Project Pine. Other participants included the central banks of Australia, Canada, England, Mexico, Switzerland and the European Central Bank (ECB).

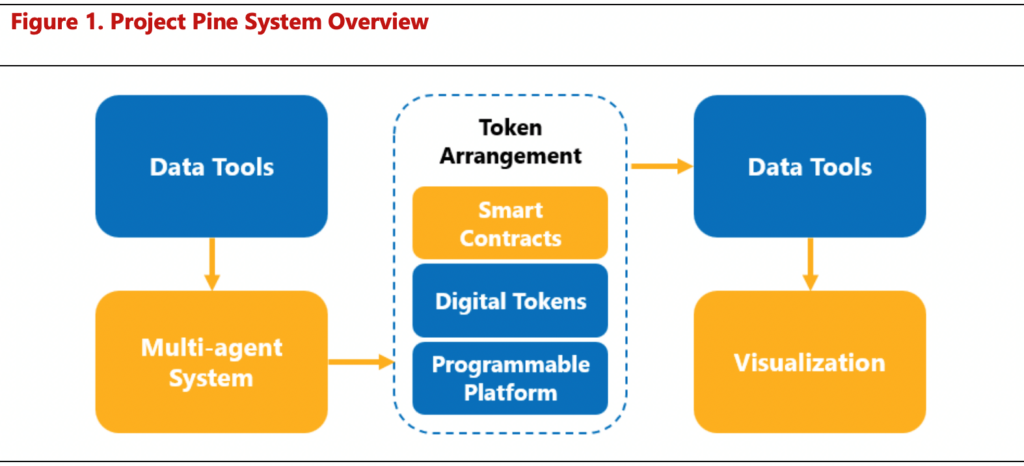

Project Pine developed a monetary policy tokenized toolkit that central banks could customize to meet their specific needs. The toolkit was built using smart contracts and tested on diverse use cases, from paying interest on reserves and swapping assets to creating facilities that temporarily exchange reserves for collateral and executing asset purchases and sales.

The project acknowledged that the role of central banks will shift drastically in a tokenized world. However, through smart contracts, they can quickly and easily adjust their existing frameworks, or create new ones, “to optimize the implementation of monetary policy in a tokenized environment.”

The new age of central banking on smart contracts

BIS acknowledged that tokenization is here to stay, and it’s set to explode in value and scope over the next few years. The Boston Consulting Group’s (BCG) recent report estimated that tokenized real-world assets could be a $23.4 trillion market in eight years, with a conservative projection of $12.5 trillion.

Beyond the figures, some of the world’s largest corporations are already running tokenization projects. $1.6 trillion asset management giant Franklin Templeton (NASDAQ: FTGTX) launched a tokenized fund a week ago in Singapore that allows investment of as little as $20, the first of its kind in the country.

Tokenization would bypass many of today’s intermediaries. For instance, an investor can purchase a tokenized security directly from another investor, and the transfer of ownership would be done on-chain without the involvement of a third party.

This bold new system requires a rethink of the regulatory tools that central banks have relied on for decades, and this is what Project Pine has been working on.

The system was based on smart contracts that functioned as a central bank toolkit prototype, housed in a programmable platform that supported tokenized money and securities.

The project then tested the toolkit in a setup that housed a multi-agent system with simulated diverse scenarios. The participants then used visualization tools to display and analyze each activity and outcome.

The entire project consisted of hierarchical layers, with the settlement layer at the base. Just above it was the asset layer, which hosted the tokenized securities and wholesale money, with the topmost protocol layer housing the smart contracts.

While Project Pine demonstrated that smart contracts could prove useful tools for central banks in a tokenized system, it noted that regulators would need privileged access to market data and higher standards of security and privacy.

The conclusion was that smart contracts and tokenization “could help central banks better manage extraordinary events.”

“The most significant benefit is that facilities can be created and deployed almost instantly with smart contracts. This speed, coupled with the ability to adjust any of the parameters at any time, gives central banks flexibility in responding to unforeseen events and fast-moving crises,” the report concluded.

Dubai’s new digital currency rulebook tightens controls

In Dubai, the city’s digital asset watchdog has updated its regulatory framework for the sector, and it’s given VASPs until June 19 to fully comply.

The Virtual Asset Regulatory Authority (VARA) announced the publication of Version 2.0 of its rulebook this week, which it says will better balance innovation with investor protection.

The updated framework strengthened controls around token distribution, margin trading and collateral wallet arrangements.

“The updates are designed to promote greater market discipline, risk transparency, and operational resilience across Dubai’s VA ecosystem,” VARA stated.

The watchdog offers more elaborate definitions of popular market products and services as it seeks to provide consistency and avoid ambiguity. It also tightened the disclosure and risk management requirements, especially in activities involving investors’ funds, such as custody, exchanges and brokerages.

Watch: Tim Draper talks tokenization with Kurt Wuckert Jr.

03-03-2026

03-03-2026