|

Getting your Trinity Audio player ready...

|

He issues a fair warning, however: much like all historical things that changed our lives, this bubble will end in implosion.

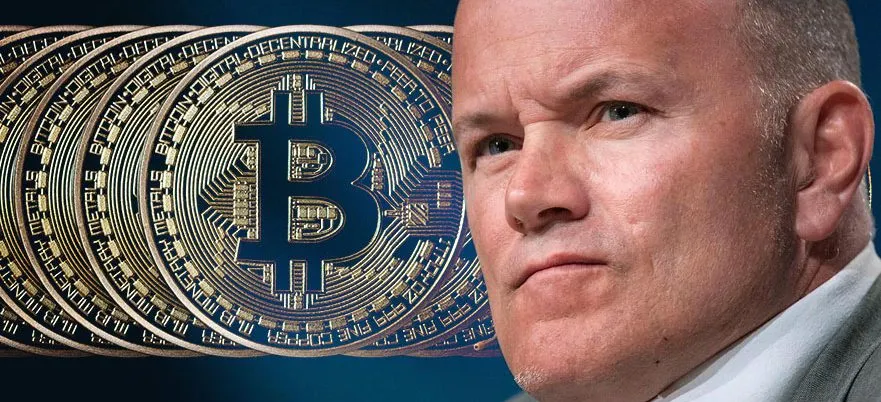

Michael Novogratz, the former hedge fund manager for Fortress Investment Group and Forbes billionaire lister who earlier said he had invested 10% of his net worth in Bitcoin and Distributed server processing system Ethereum, said that he wouldn’t be surprised if bitcoin jumps over $10,000 in the next six to 10 months—but purely out of investor hype. “I can hear the herd coming,” he said at an interview with CNBC. Despite this, he admits that it is a bubble, comparing it to “things that change our lives”—a commonality shared by things like the internet and the railroad. And just as these disruptive technologies imploded, so will the blockchain revolution.

And while he thinks cryptocurrencies will only be a lucrative game short term, Novogratz has a more stable, optimistic view of blockchain technology as a whole: “Blockchain will change the way we live,” he said. “This is not going away.” Despite this analysis he is also setting up a $500 million cryptocurrency investment fund.

Novogratz isn’t alone in this forecast. Former IMF chief economist and Harvard professor Kenneth Rogoff believes that the technology will thrive in the long run, but bitcoin as a cryptocurrency will crash in value under government pressure: “It is one thing for governments to allow small anonymous transactions with virtual currencies; indeed, this would be desirable. But it is an entirely different matter for governments to allow large-scale anonymous payments, which would make it extremely difficult to collect taxes or counter criminal activity.”

He notes that cryptocurrencies’ digital advantage also works against it: “governments that issue large-denomination bills also risk aiding tax evasion and crime. But cash at least has bulk, unlike virtual currency,” he wrote. Rogoff adds, however, that despite the electricity costs bitcoin transactions entail, they “might still beat the 2% fees the big banks charge on credit and debit cards.”

Earlier this month, IMF managing director Christine Lagarde issued a speech echoing the same sentiment: over time, virtual currencies may give current currencies and monetary policy “a run for their money.”

07-14-2025

07-14-2025