|

Getting your Trinity Audio player ready...

|

It wasn’t long ago when Bitcoin ABC claimed that big blocks could not be reliably done and would only cause insecurity and instability—at least for the Bitcoin Cash network. But with only five months after it rebirthed the original Bitcoin as envisioned by Satoshi Nakamoto, Bitcoin SV (BSV) is proving that yes, massive on-chain scaling is possible. And now that Bitcoin’s true power is finally unleashed, a more efficient digital currency network and commodity data ledger are providing possibilities the world has been waiting for.

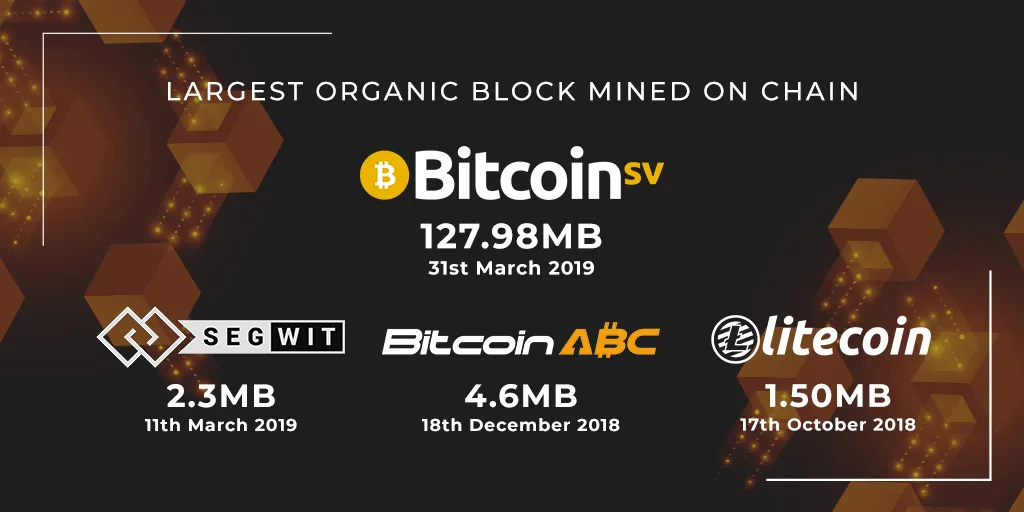

This past week marked another milestone for BSV, as the network proves that with on-chain scaling, organic growth is very much achievable. On March 31, a 128MB block was mined by CoinGeek Mining. 128MB is the current default block cap set on BSV, so this world-record setting block completely filled the current maximum. The block contained large data files (high-resolution pictures) uploaded using the “BitPaste” multi-swipe application, which makes it easy for users to upload large files with quick swipes of the Money Button.

This is the second time a block that size was mined on the BSV network. Just a day earlier, on March 30, another 128MB block was mined by nChain’s BMG Pool.

Both 128MB blocks generated transaction fees for the successful miner of 1.279 BSV, thus another 10+% of miner revenue on top of the normal 12.5 BSV block reward. This is worth noting, because it demonstrates how massive on-chain scaling allows more transactions (of differing data types and thus differing fee levels) in a block, which, in turn, results in greater total transaction fees for the miner on top of the pre-set block reward. Bitcoin block rewards halve every four years, and happens again next year as the block reward reduces from 12.5 to only 6.25 coins. Therefore, Bitcoin’s economic model requires miners to progressively earn more in transaction fees to make up for the continually-reducing block reward value, in order to mining to remain profitable and miners to continue sustaining the network. That only happens with bigger blocks and massive on-chain scaling—as now demonstrated by the BSV network—to ensure Bitcoin’s long-term success.

The Bitcoin Core (BTC) network also mined its largest block to date: a 2.3MB block on March 11, which accounted for only 199 transactions. BTC, however, continues to prove that it’s not ready for mass adoption anytime soon with upwards of 60,000 transactions sitting unconfirmed for many hours in the network’s “mempool,” resulting in daily average transaction fees to soar from $0.47 to $1.83 (and to $2.13 as of time of this writing). Fingers crossed that the fees don’t reach the 2017 level of $200,000 in transaction fees for a single block with only 2335 transactions, meaning an average fee of $85.65 per transaction in that block.

For BCHABC, the largest block mined to date was 4.6MB on December 18, 2018. The original Bitcoin Cash (BCH) chain no longer exists after the November 2018 hard fork event, so the bigger blocks on BCH that were mined prior to the fork cannot be counted. And the biggest 32MB blocks ever mined on the prior BCH chain were mined using the Bitcoin SV implementation anyway.

Rounding off the list of the three main networks that evolved from the original Bitcoin is Litecoin (LTC), which mined its largest block—a measly 1.50MB—on October 17, 2018.

So what does this tell us, other than big blocks are becoming an everyday affair for BSV?

It’s simple: with BSV staying true to Bitcoin’s original roadmap for massive, secure on-chain scaling, there has been an explosion of growth and user creativity—all organic—within the ecosystem. It’s just what nChain Chief Scientist Dr. Craig Wright has predicted, that scaling has to come first. Create the space, and application developers and users will flow in to fill it.

This is what is happening right now with BSV. BitPaste, Bitstagram, Bico.media, BitcoinFiles.org, Unwriter’s Bottle BSV blockchain browser, and the parallel swipe Money Button are all examples of developers coming to build on the BSV network. They are building on BSV because of the stability it provides, the limitless on-chain scaling it offers, and its regulation-friendly mindset. As Steve Shadders, director of solutions and engineering at nChain and the Bitcoin SV Node team’s technical director puts it:

Good ideas that have previously been shelved because they needed capacity are being dusted off. The new possibilities of a scalable Bitcoin are also starting to seep into the collective consciousness of Bitcoin app developer communities and we are seeing an explosion of creativity.

Come celebrate the renewed life of Bitcoin, and all the developments happening with Bitcoin SV, with all the world leaders in on-chain scaling at the CoinGeek Toronto conference this May. It’s easy to register. And pay with the world’s new money and you’ll receive a discount by using Bitcoin SV via Coingate.

07-13-2025

07-13-2025